Will The Market Follow-Through On The Downside Setup?

Today we saw the market open up fairly flat and then moved lower into the late morning session retesting yesterday's lows only see a move higher into the afternoon session. We are currently trading near the high of the day but as long as we can remain under micro resistance we do have a smaller degree setup in place to the downside.

If we can follow through lower and develop a five-wave move of one larger degree then it would give us further confirmation that we have indeed put in a larger degree top in all of the wave b. So while we still have a bit more work to do to confirm a top we are off to a good start but we still need to exercise a bit of caution until this market does indeed confirm a top is in place.

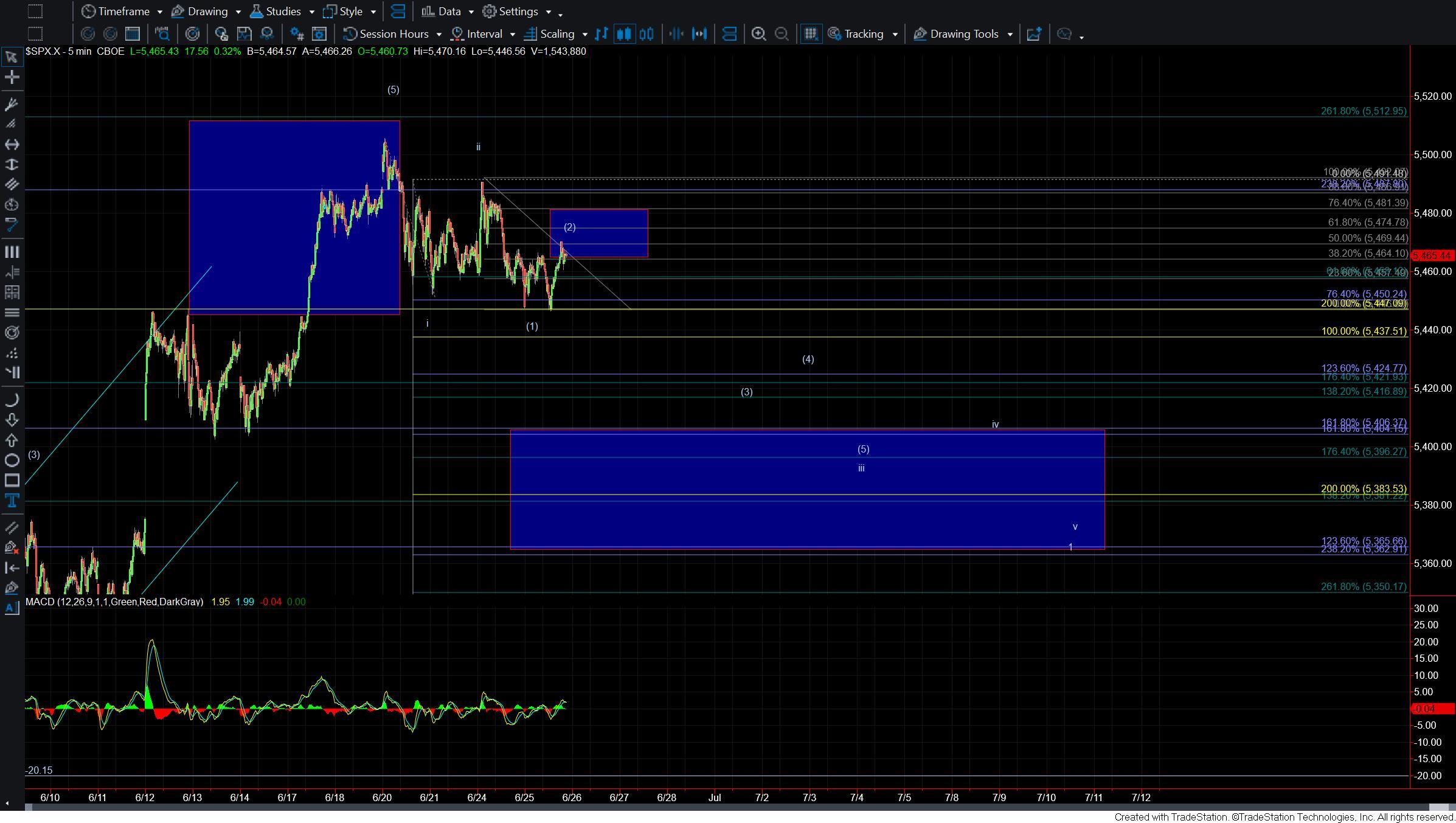

As laid out on the five-minute chart we have a potential i-ii (1)-(2) setup developing to the downside off of the highs. We still have some work to do to confirm this pattern as we need a break under today's LOD to give us initial confirmation that this pattern is playing out. If we can manage to break the LOD at the 5446 level then I will watch the 5437 level as the next key pivot level and if that breaks it would open the door for this to see a fairly direct move down toward the 5416-5365 zone below.

If we are unable to hold under the 5491 level then it would open the door for this to see yet another higher high before the wave b finally tops at which point I would be watching the 5512-5553 zone overhead as the next key fib resistance zone.

In the bigger picture not much has changed as we are still trading in a fairly tight range and we still will need to see a break of the 5362 level to give us further confirmation that we have indeed put in a larger degree top.