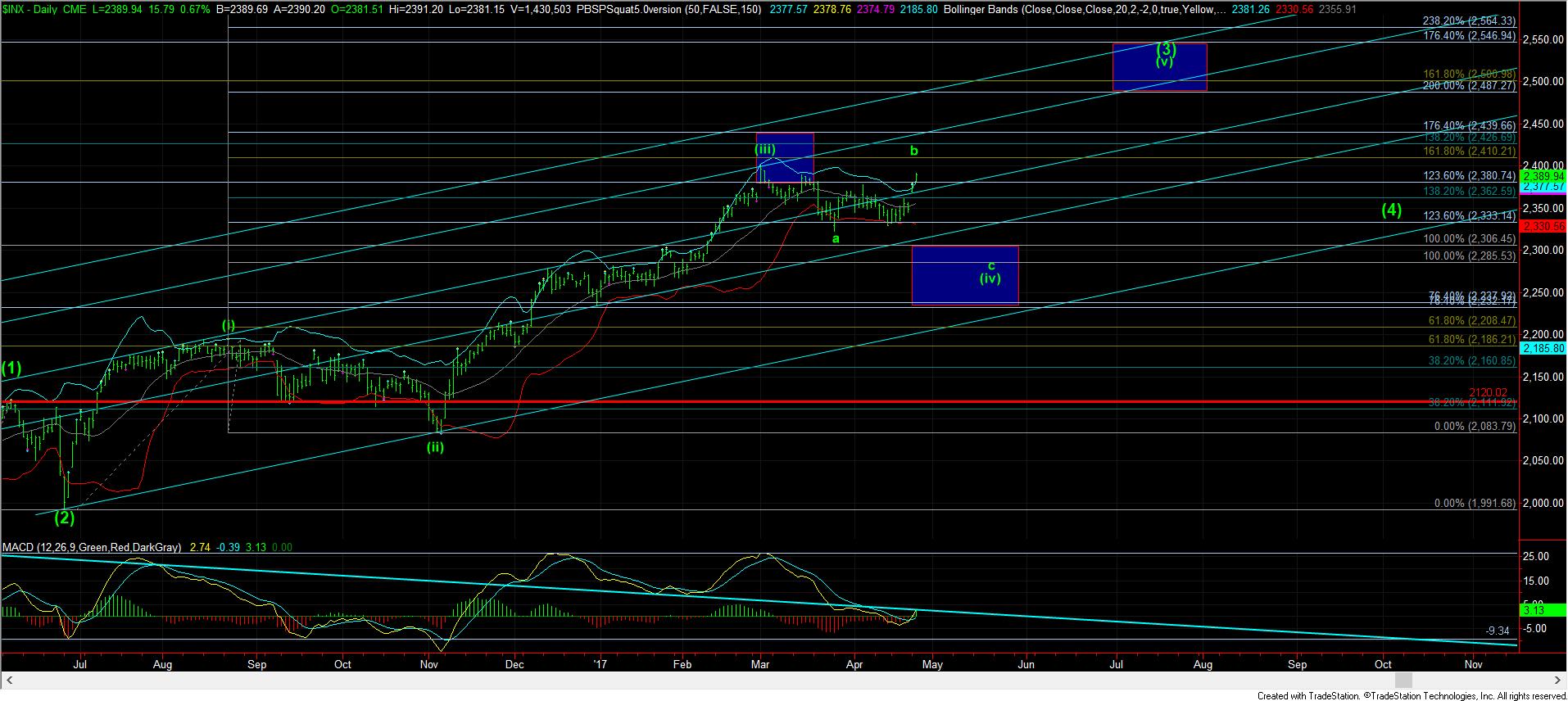

Why I Still Think This Is A b-Wave

As the SPX heads back towards the all-time highs, while other markets make new all-time highs, I want to explain why I still think the SPX is in a b-wave rally.

First, for those that remember when I noted on March 1 that we should prepare for a pullback, as it became clear that the market was not going to strike the ideal 1.618 extension for wave (iii) at 2410SPX, I continually noted that b-waves will often come back to strike the ideal Fib level that the 3rd wave was not able to strike. So, since we began this pullback, I have been reiterating that it is reasonable to expect that this b-wave can come back to strike the “open” Fibonacci Pinball level not struck in the main count, as it happens quite often.

Moreover, I have no solid and clear way to count the bottom of wave (iv) in the SPX as having completed. While it is certainly “possible,” and is now my alternative count, I believe the potential for wave (iv) in SPX as having completed is a lower probability - especially when you consider that the proportions really are not clean, and it would have to be considered as a truncated pattern as well. I rarely will consider a truncated pattern as a primary, unless I have good reason, and this does not provide me any good reason to do so.

Additionally, the current 5 wave structure off the lows does not seem to project beyond the 2420SPX region, which does not line up with the larger Fibonacci Pinball structure which suggests that wave (v) should be targeting the 2500SPX region. To me, this presents additional evidence as to why this is likely a (c) wave of a b-wave of wave (iv). Alternatively, if wave (iv) has ended in a very unorthodox manner, then this rally would have to be wave 1 of wave (v), and we will likely see a pullback into May, as I now note in my alternative count.

So, ultimately, without a clearly completed wave (iv), along with the b-wave approaching the level we had initially believed we could see it strike, the market is playing out pretty much as we had noted back in early March. Therefore, I have no reason to believe this is going to play out otherwise.

In the micro count, it seems we are only completing wave iii of 3 in the (c) wave of b. That means we should see a pullback for wave iv, followed by a completion to wave 3, followed by another 4-5 before this pattern completes. That suggests that we may not see this pattern complete until next week. However, if we see an impulsive drop below 2360SPX, then I would assume that we completed a w-x-y for this b-wave, and we have begun the drop in the c-wave of (iv).