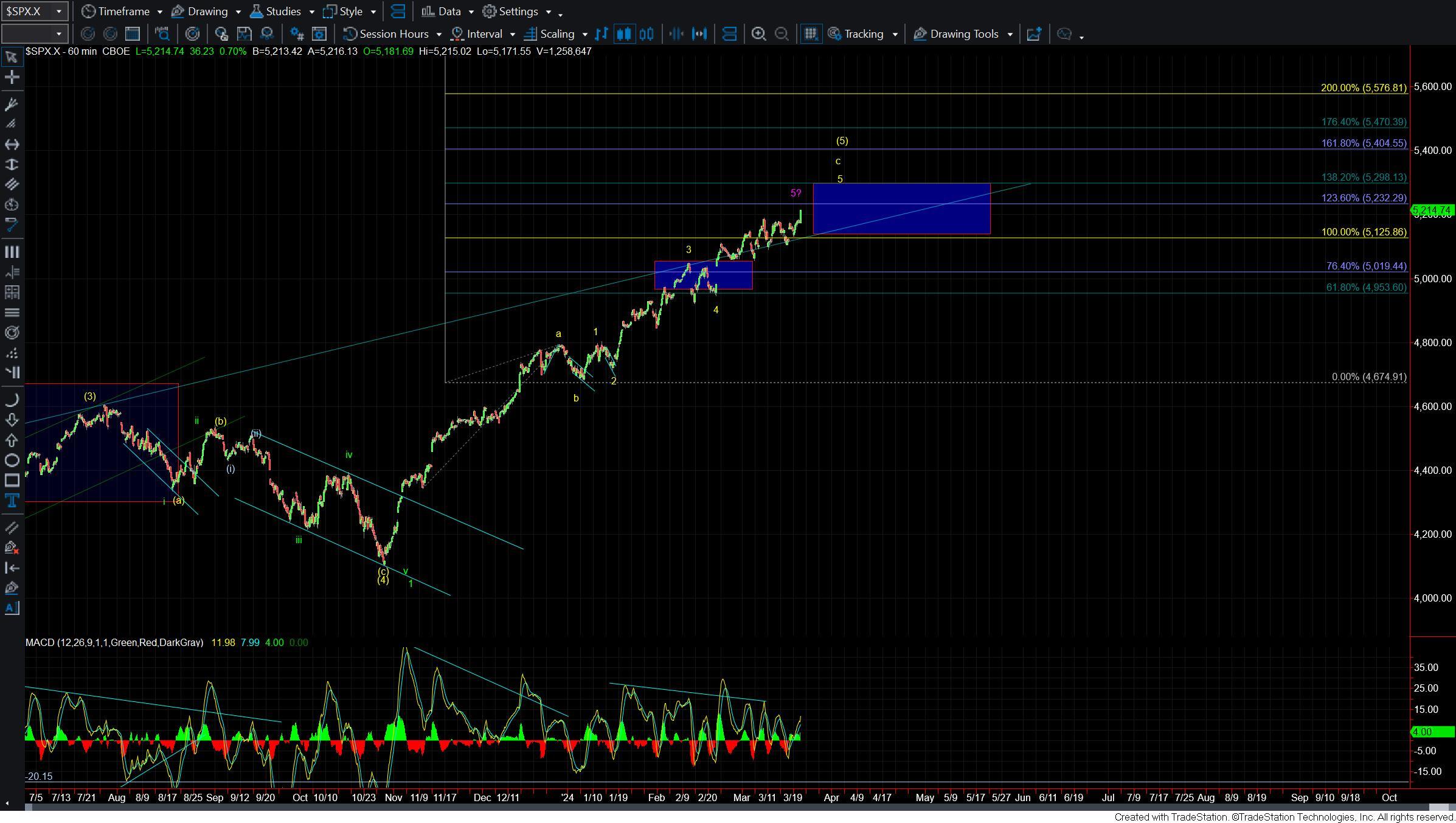

What's Next After The SPX Pushes To New Highs?

Today after the FMOC announcement we saw the SPX push to new highs. Furthermore, we broke over a smaller degree resistance level which is given us the initial signal that we may be following through per the yellow count as laid out on the charts over the past several days. With that being said so far the Nasdaq and the Russell 2000 are still holding below their respective highs so we still have yet to confirm a more sustained breakout on those indexes so far.

Should the SPX manage to hold over support and continue to push higher into the end of the week it will however give us further confirmation that we are indeed going to continue to see the market grind higher in the weeks ahead. For now, I will continue to watch the key support and resistance levels as laid out on the charts to help give us further guidance as to whether the market has a bit more gas left in the tank or if this is ready to stall out at these upper levels.

While the move up off of the February low remains quite sloppy since we are likely dealing with an ending diagonal we do have a bit more clear of a pattern off of the March 11 low. This is allowing us to lay out some fairly clear fib pinball parameters to watch as we navigate this market in the weeks ahead. With today's push higher as long as we can hold over the 5177 pivot then the near-term pressure will remain up and we should continue to see higher levels per the yellow count.

If we break under that level followed by a break under the 5131 level and then ultimately under the 5090 level then we would have initial confirmation that we have indeed put in a top as shown per the purple count. As I noted yesterday once we do top the reversal should be quite sharp to the downside based on the ED pattern. For now however and as long as we continue to hold support we still can continue to grind higher as we move into the end of this month and the early part of next month.