We Need Escape Velocity

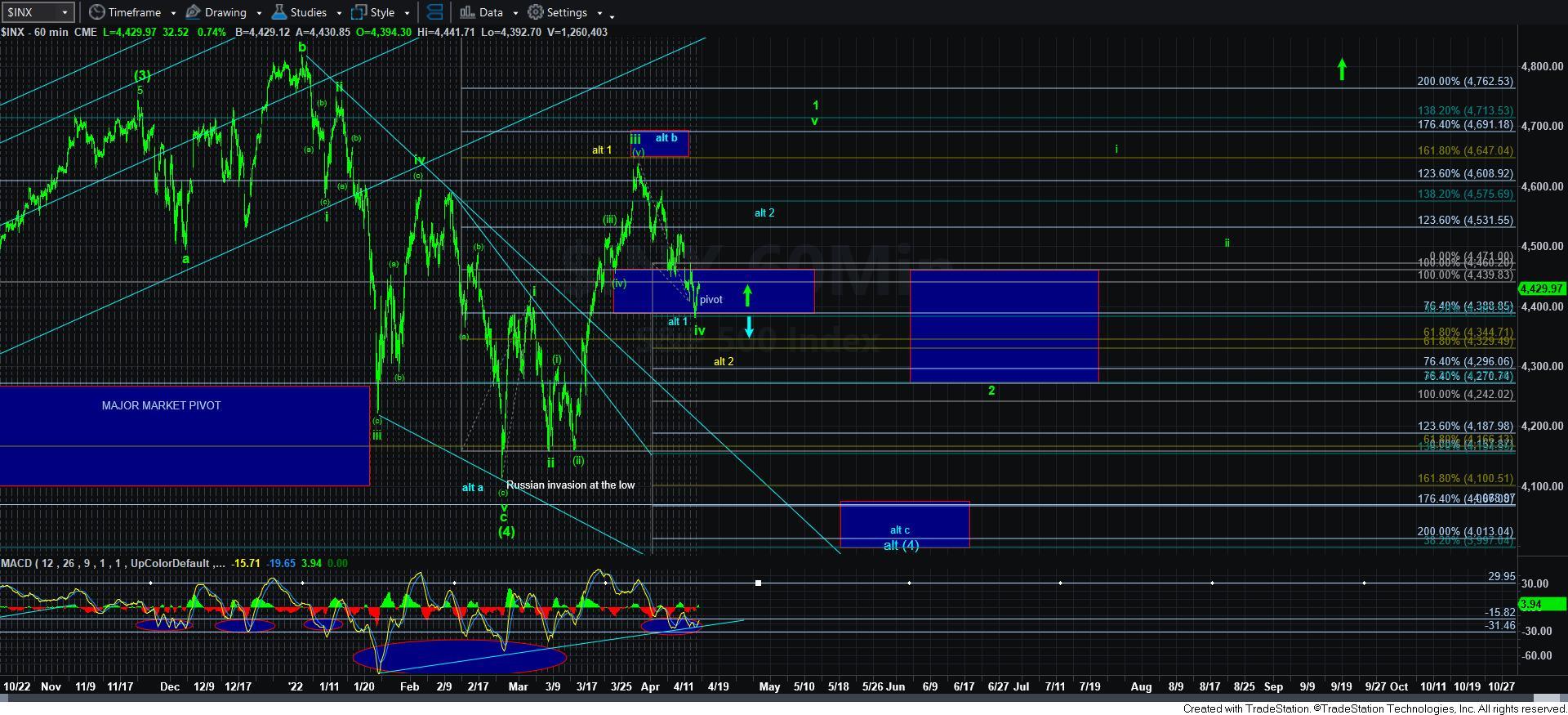

There is not a lot to add to yesterday’s analysis, as the market is still overall quite messy. While the market did spike down below the ideal 4400ES support yesterday, we have come back to rally back through it. So, I am going to keep the same analysis is in place, but will outline where that will change.

As it stands now, I am still going to maintain the green count, but, admittedly, I cannot say that I see anything in the chart that I would classify as a high probability. But, I am giving the bulls the benefit of the doubt for now, yet I cannot say that the probability of the green count is greater than more likely than not. That means it is just beyond 50%, at least in my humble opinion.

So, what would it take for me to reconsider that? Well, two things. The first is if we see a direct sustained break down below 4330SPX, then I will cautiously have to adopt the blue count, while keep an eye on the yellow count. The second is if we rally to the DANGER ZONE on the 5-minute ES chart, and then see a clear 5-wave decline from that resistance region. At that point, I will likely confidently move into the blue count.

One of the issues I am having is that the structure in the ES is much more sloppy than the one in the SPX. So, like I said, I am going to give the bulls a bit more room to run before I consider the alternatives as my new primary. In the meantime, I have turned quite cautious since we got the overlap discussed earlier this week, and will become even more protective should we rally to the DANGER ZONE overhead. Until such time, I will simply retain the protection I bought when I warned all of you about an impending decline when we were hovering just below the 4637SPX higher we recently struck. But, any further protection that I buy is simply for risk management purposes.