We May Get To Our Higher Targets

Last week, I was pointing to the IWM being able to rally to at least the 151 region, with the outside chance we can push towards the 156 region. While we now have enough waves in place to count 5 up off the 144.50 low we struck last week, the market has opened that higher target region to us today with a greater probability.

As I have said so many times before, markets are non-linear, which means we must always be adjusting our perspective as new information comes to our attention. While I expected that we will soon be topping in wave iii off the recent lows, today’s strong action in the IWM suggests that we may have developed a much more bullish i-ii, (1)(2) structure off the lows. And, as long as we maintain cited support on any pullbacks we see in the coming week, then the market could now be pointing us up towards the 154-156 region in the IWM.

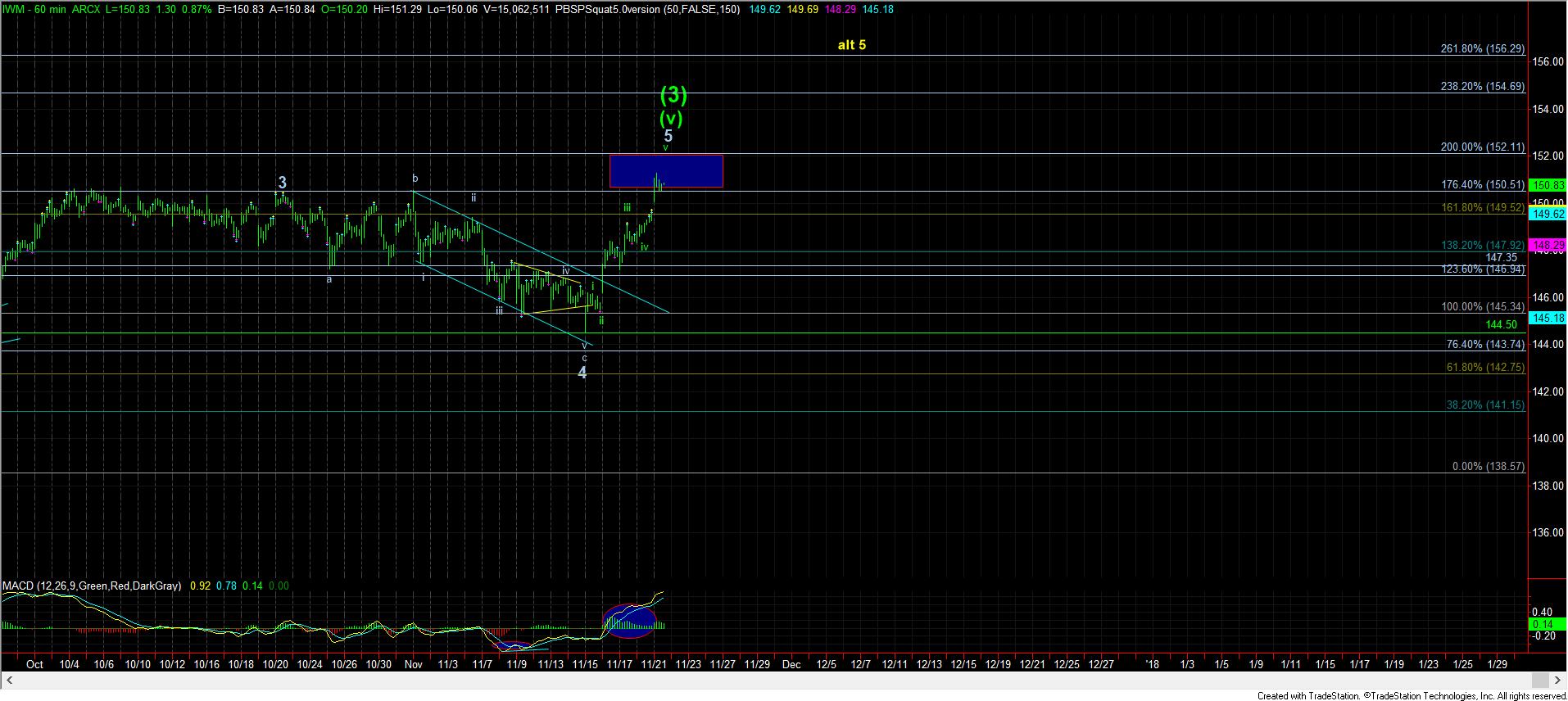

Currently, as I noted before, we have almost completed the minimum number of waves in place to consider all of wave 5 in the IWM as completed, as shown in the attached 60-minute chart. Moreover, we have now moved just beyond the point at which wave 1 would be equal to wave 5, which is the most common target for a 5th wave. Lastly, we are now in the initial target zone we set for ourselves as we were looking for the bottom to wave 4 last week.

However, there is a more bullish internal structure, as now noted on the attached 3-minute chart, which can point us to the 155-56 region in the IWM in the coming week or two. And, the more bullish scenario centers around the 149.40 region. As long as we do not see a drop below 149.40 within the next few days, we will likely continue to subdivide higher, as presented on the 3-minute chart, and strike the higher target we noted last week within the 155-56 region in the IWM.

So, again, while we have now struck our initial minimum target for this rally off the 144.50 region for the IWM, the structure is such that, as long as we remain over the 149.40 level, we can continue to extend up to the higher target we had in mind for this 5th wave off the August lows. Therefore, I will continue to look higher, as long as the IWM can maintain over the 149.40 region over the next few days.

This is a good time to remind those that follow our analysis that one must always listen to the signals provided by the market, and not maintain any perspective as set in stone. While we have now reached our initial target set last week, if the market is unable to break down below 149.40 within the next few days, it is providing us with clues as to how it can continue to stretch to the 155/56 region in the IWM within the next week or two.

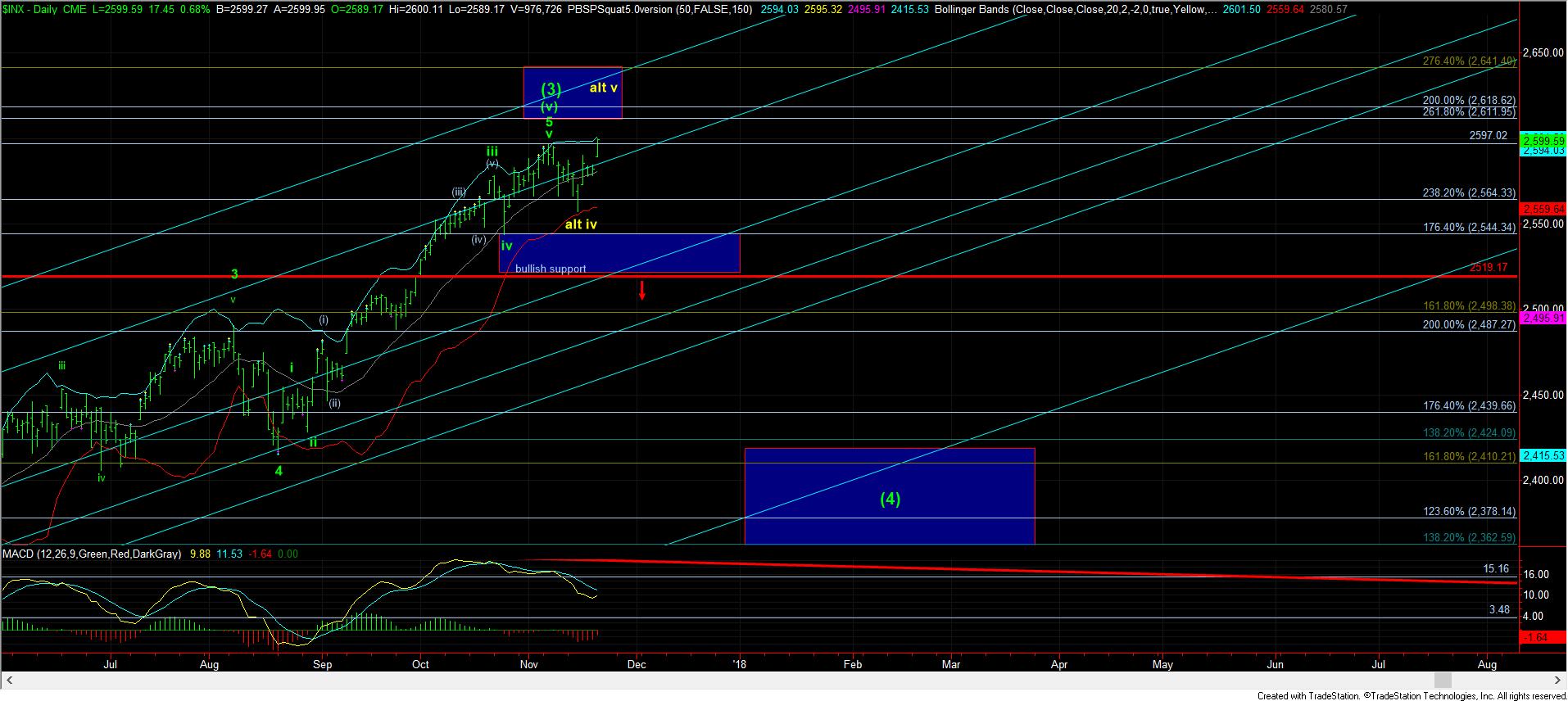

As far as the SPX is concerned, I think the market provided us with clues that the IWM was likely going to outperform the SPX in this rally. Moreover, I am still uncertain if the SPX can attain our target box. However, I would imagine that if the IWM can hold its more bullish wave structure, it will likely keep pressure higher in the equity market, and will likely allow the SPX to reach its target box overhead as well. But, as I said before, I was not as confident of the SPX to attain its target as I was the IWM to attain its target. And, thus far, the IWM has certainly been the correct horse to ride.