We Have A Downside Set-up

Yes, I know this is a bull market. And, yes, I know we have extended quite a bit. And, yes, I know we just got some great economic news with the passage of the tax reform act. And, yes, I know the market is not “supposed” to go down this week with Santa coming to town. But, I cannot ignore a set up we are seeing on the charts, as we have not seen a true downside set up in quite some time. While I do not know if it will trigger, it is certainly present on the charts after today.

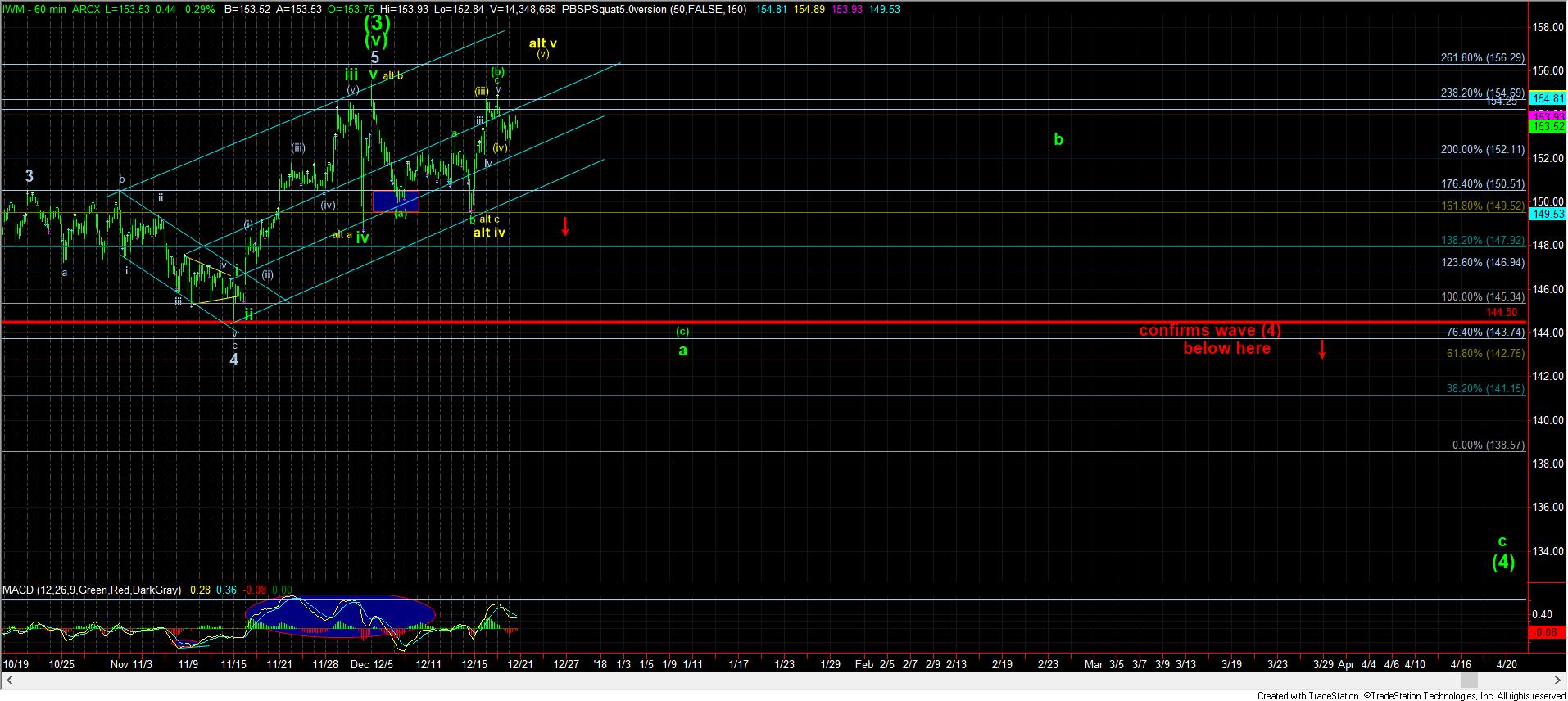

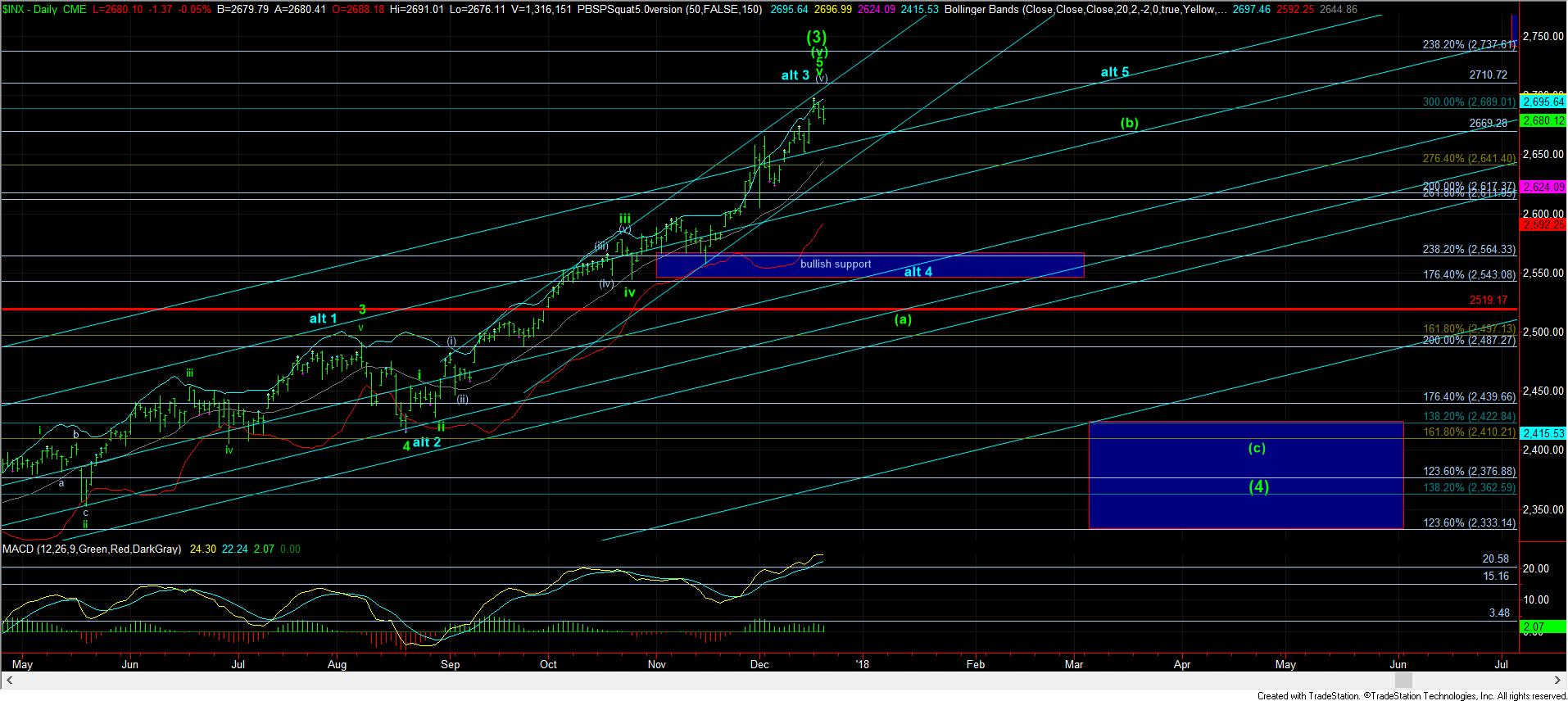

I think it is rather simple after today’s action. We had 5 waves down off today’s high in the ES. That means we MAY have a c-wave decline in the making. The key is today’s low. As long as we remain over today’s low, then we can still push to a higher high in ES/SPX, and potentially a double top in the IWM.

However, should we see a break down below today’s lows in RTY/IWM and ES/SPX, that opens the door to an initial indication of a top being in place, with a target for the market ideally pointing us towards the November lows.

Again, I want to caution anyone who is looking to the short side to remember that you should be more focused on finding long opportunities in this market for the next year rather than finding aggressive shorting opportunities. And, even if we do see a break down in this immediate set up, we still need to break below the 149.50 IWM level and the 27.63 level in the XLF to give me a stronger confirmation that we are going to drop towards the November lows.

So, going into this evening, the market is clinging to a set up to take us a bit higher into the end of the week. However, if the morning lows should break, we may see a trap door open up for the market.