We Came Up Woefully Short

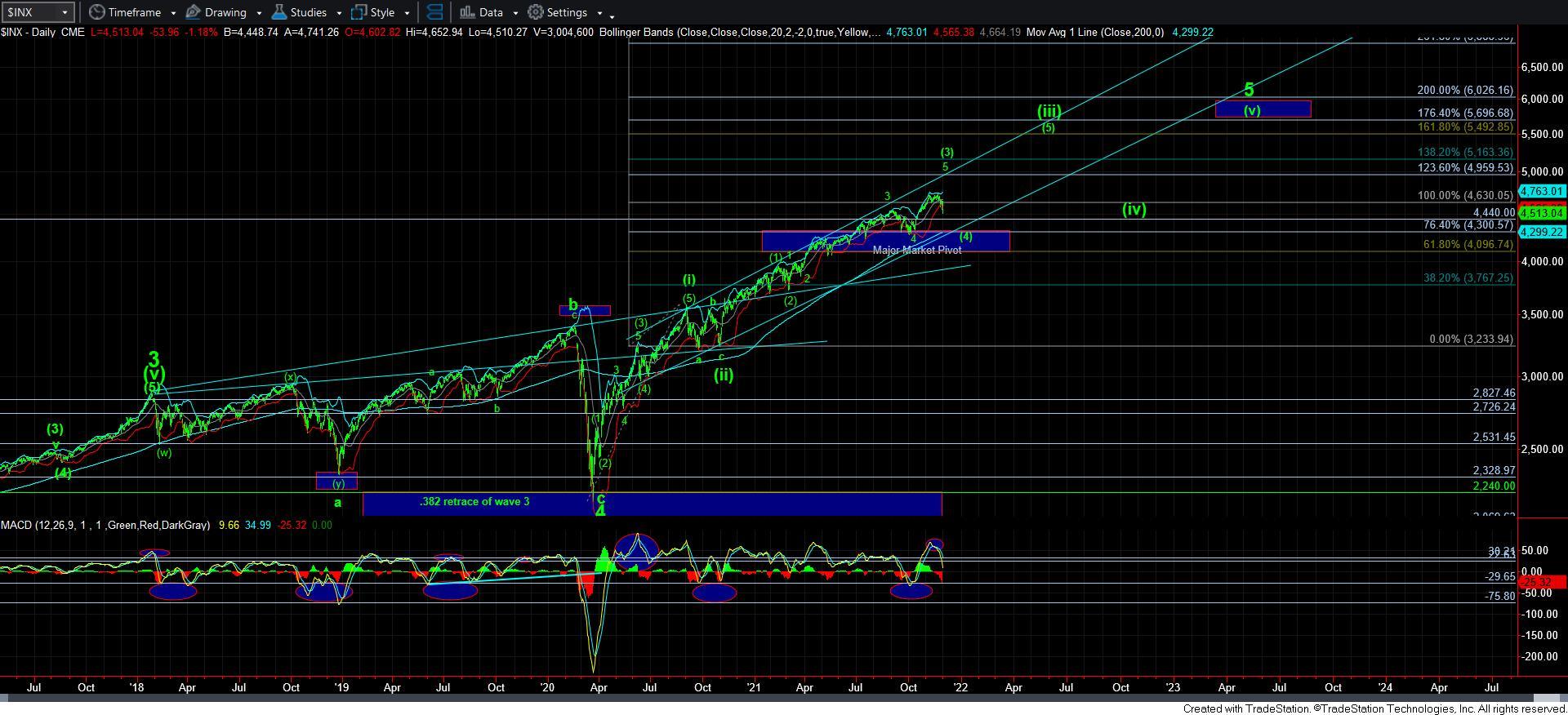

With the break down below 4540SPX today, I have to give much more credence to the potential that wave [3] came up woefully short of its ideal target. While I am still going to leave the green count as it is presented on the chart, the next rally will likely be moving me into the yellow count, assuming that it is corrective in nature.

Currently, the support below us is pointing towards the 4475/85SPX region, which is the .236 retracement of wave [3], assuming it has completed. And, that is the typical target for the a-wave of [4]. Thereafter, I am still expecting a rally. If that rally is corrective in nature, then I will be moving into the yellow count, raising cash, and looking for further downside into the 4350/4400SPX region, which is where the .382 retracement of wave [3] resides, and is the typical target for wave [4].

With the larger degree structure still leaving us short of the ideal target for wave [3], I am still leaving the door open for the market to show us a potential impulsive 5 wave rally off a low in this region. Should that occur, then I will remain in the green count, but quite cautiously, and raising supports each step of the way up.

The bigger issue comes in the form of the IWM. I did not view this potential as a high probability due to the size of this correction. You see, the high we struck a few weeks ago was CLEARLY on a 3 wave rally, which still has me expecting we will exceed those highs. But, after consolidating sine February, I did not think it was the higher probability view to expect this pullback/consolidation in the IWM to take almost a full year. It just seems way too large.

But, with the break of the structure I was tracking, I have no choice but to view this drop in the continuation of a VERY large corrective structure in the IWM. The question I still grapple with is the same I have with the SPX, and that is if this wave 4 or [4]. And, the next rally is what will settle that issue.

As far as the oversold nature of this chart, I want to again point out that each and every time we have hit the oversold region on the 60-minute chart since we bottomed in MArch of 2020, a large and strong rally has ensued. This is the first time since we bottomed in March of 2020 that this did not occur. This is the point in time we have to remind ourselves that we deal in probabilities, and the great majority of the time you get a set up like that in a bullish chart, you have to assume the standard bullish resolution. This time, we did not get that, and have found ourselves on the power probability of resolutions.

Ultimately, I am still expecting the market to pullback to the 4400SPX region in wave [4]. And, the next rally will tell me if that rally will be the b-wave in wave [4], if it is corrective, or if we still have a shot at getting up to the 4880SPX region. Due to the larger degree structure, I am not yet giving up on that potential, but there is no question that the break of 4540SPX has increased the probability that we are already in wave [4].

As far as targets go long term, I still think the 5500SPX region is a reasonable target for wave [5] of [iii], as you can see on the daily chart. And, I still think we can get there within calendar year 2022, but that is a guestimate right now. Overall, this is still a bull market, as the structure is not even close to even completing the larger degree wave [iii] off the March 2020 low. And, despite many that will certainly be claiming that the bull market is over, I see nothing that suggests that we are even close. I guess this is no different as when we were down in the 2200SPX region in March of 2020, and I was fighting everyone about us still needing a 5th wave off 2200 to complete the bull market off the 2009 lows. I still am in that camp and think there is much more bullish action to be seen in the coming year.

In the meantime, if the next rally is going to be clearly corrective in nature, then I will be raising cash before the impending c-wave down to the 4350/4400SPX region.