We Are Very Stretched To The Downside

As you may know from reading the weekend update, I am still in the blue wave count, which would suggest the market can still take us back up to the 4800SPX region. Yet, our alternative presents us with the potential that a major top has already been struck in the early part of the summer. And, I set the parameters in the weekend update to outline the difference between the two paths.

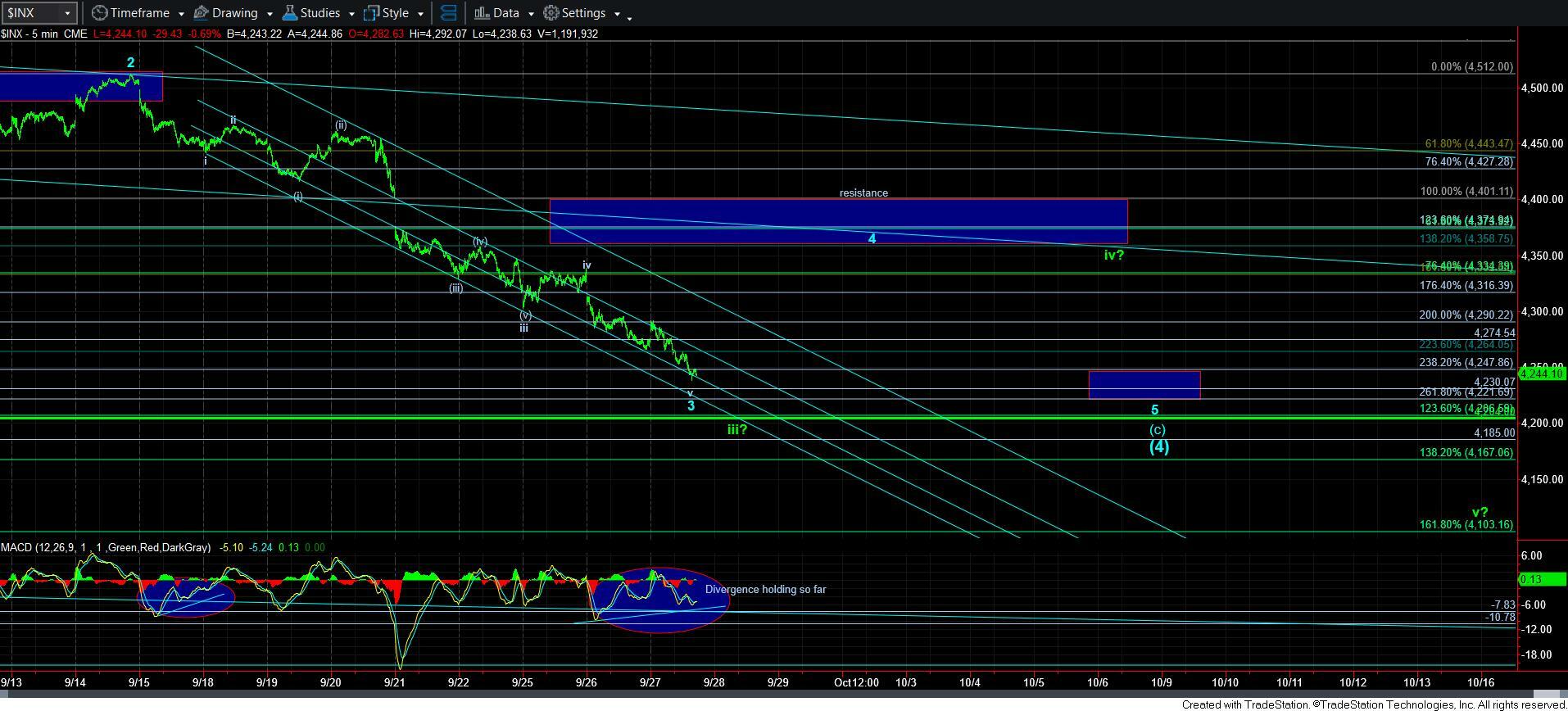

As I also noted in today’s live video, as long as we do not continue in a direct fashion down to the 4205SPX region, I can still strongly maintain the wave count in blue, which points us towards 4800SPX in the coming months. However, if the market takes a more direct path down towards the 4205SPX region, then it would begin to increase the probability that we are in the green wave count, which suggests that a long-term top is in place.

A few months ago, as we were approaching my target during the rally into the early summer, I urged you to raise cash because there was no way to know at that point if the market was going to strike a long-term top, or if we were simply going to see a corrective pullback, thereafter setting us up for another rally to 4800SPX. Thus far, I can still maintain the perspective that the high that was struck was not THE top for 2023. But, the market is certainly pushing us to the limit on this.

Over the coming several weeks, the market is going to make an important decision: Will it give us a strong indication that a major top has been struck by drop to the 4205SPX region directly (or even lower for green wave iii), or will we hold in this region we now find ourselves, and begin a sizeable wave 4 bounce to keep the blue count well in its place?

Of course, I cannot answer this question in any definitive manner. I am resigned to follow the price action to let me know which path we will take. But, I will add to something I noted in yesterday’s update (which I strongly suggest you read – along with the weekend update), and that is the Bayesian probability for the blue count even ticked up a few points today.

I will also add that the market is extremely stretched to the downside. In fact, we have now exceeded the 2.382 extension of waves 1-2 to the downside in the blue count. And, that is a VERY extended 3rd wave, considering that the standard extension we often see is the 1.382-1.764 region for a 3rd wave. Therefore, based upon these standards, I would say we are overdue for a sizeable bounce. And, that remains my expectation.

And, of course, as I outlined in the weekend update, should the market begin to take the green path, and break down below 4165SPX, then I will have to adjust and move towards the top being in place, and that a structure is developing to take us down below the October 2022 low. Again, for now, this is only my alternative, and the market will have to prove this to me by completing 5 waves down off the summer high.

Lastly, I want to reiterate something I said in yesterday’s update about those who are considering buying long positions in this region:

“Now, the question many of you are asking is whether this is a good time to re-deploy the money I suggested you raise several months ago as we were approaching the summer high. And, it is not an easy answer.

You see, much of the answer is based upon your own risk tolerance. Normally, I would begin buying at the bottom of what I view as the 3rd wave of a [c] wave. That is generally where we reside right now. However, due to the unusual nature of the market structure over the last year and half, I would personally want more assurance. Therefore, I would prefer to wait for the 4-5 to complete, or for the market to take us back over the 4401SPX resistance region.

Yet, there are many of you that are much more risk-tolerant than I. Therefore, you can always choose to begin layering into positions. But, please keep in mind your risk management throughout your entire plan. I really would not want to see the market breaking down below the 4165SPX region, as I outlined in the weekend update.”

In summary, we are VERY oversold, and have struck larger than standard extensions thus far. Yet, we are seeing positive divergences holding on many time frames. Therefore, if we are going to remain in the blue count strongly, then I would want to see us begin to rally rather soon in wave 4. Otherwise, should the market continue lower towards the 4200SPX region, it would increase the potential for the green count in my eyes.