Wave 3 May Not Be Over

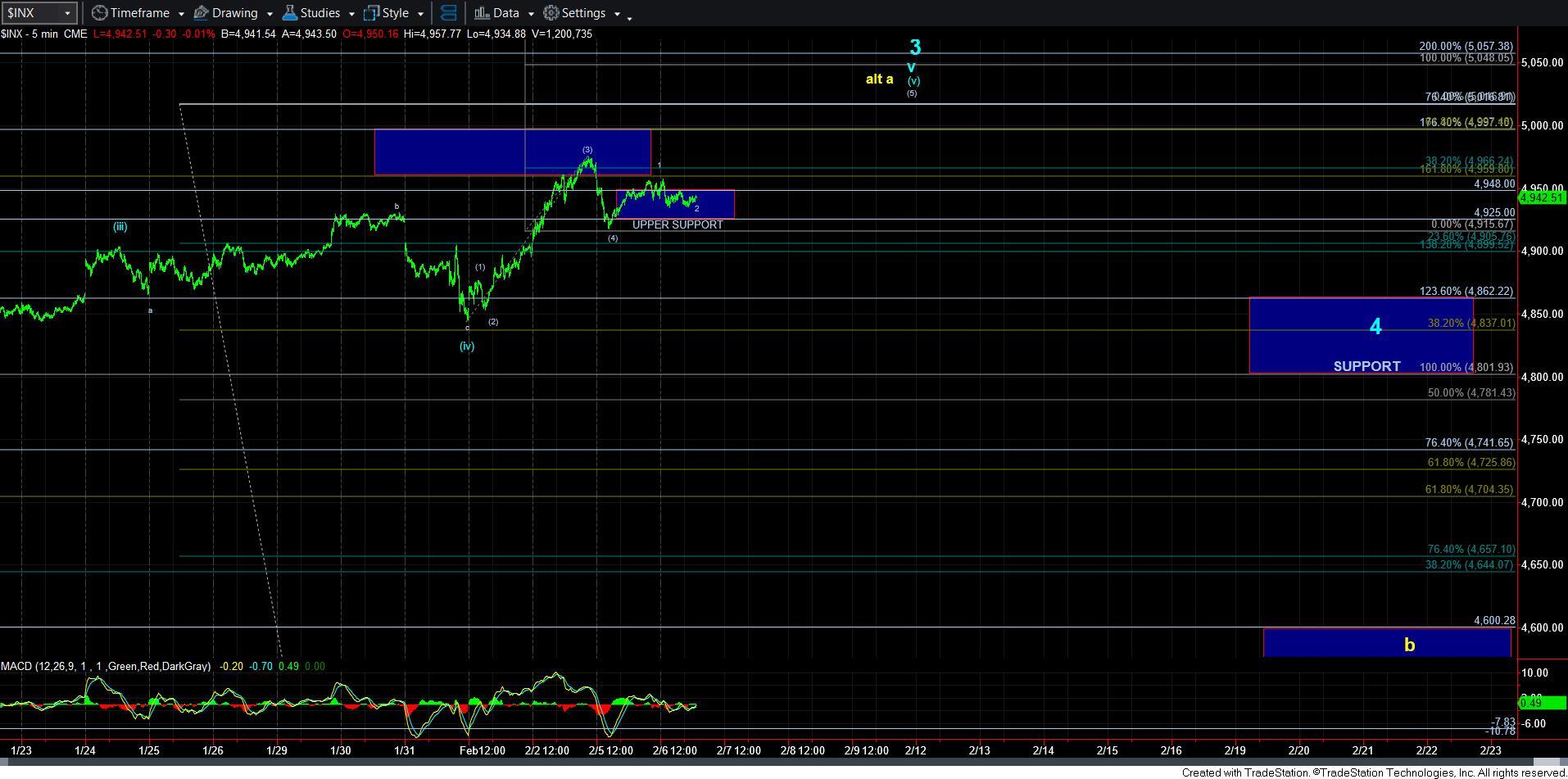

Along the lines of our discussion yesterday, it would seem that the market has been holding the upper support region noted over the weekend, and we can make the argument for a 5-wave rally yesterday off that low.

So, it makes our analysis rather simple right now. As long as we do not break back below yesterday’s low, we have a 1-2 set up in wave [5] of [v] of v of 3, which can be seen on the 5-minute SPX chart.

As far as targets are concerned, initially I was looking for the market to extend to the 4997SPX region if we were not yet done with wave 3. However, based upon the micro-structure over the last few days, I am considering that we may actually extend to the 5017SPX region, wherein wave [5] would be equal to .764 of the size of waves [1]-[3].

Assuming we do see such an extension in the coming days, then I have moved up our wave 4 support box as well. Moreover, a top at 5017 would provide us with a .382 retracement of wave 3 in the 4835-4840SPX region, which is also the region of the 4th wave of one lesser degree, another general guideline for a 4th wave target, which falls right in the middle of our support zone for wave 4.

Of course, should the market instead break down below yesterday’s low before we begin to rally, then I will have to move back into the prior wave 4 count, with the prior wave 4 support box.