Waiting for the Downside Structure

Today the market bounced higher after completing a fairly clear a-b-c move down into the overnight lows. This was not terribly unexpected, as the full pattern into the overnight session suggested we would see a bounce today. The big question at hand now is whether this current move up will ultimately lead to new highs or if it’s simply a corrective move higher that still has another downside leg to complete.

Because we have likely been dealing with a larger diagonal pattern in this region, making all of the price action corrective in both directions, we really won’t have an answer to that question until we see what the structure of the next move down looks like.

If we see a corrective move lower, then the market likely still has some unfinished business to the upside. However, if we see a five-wave move lower, that would open the door for continued downside, at which point we will once again focus on the lower pivot levels to help determine whether a larger-degree top has indeed been struck.

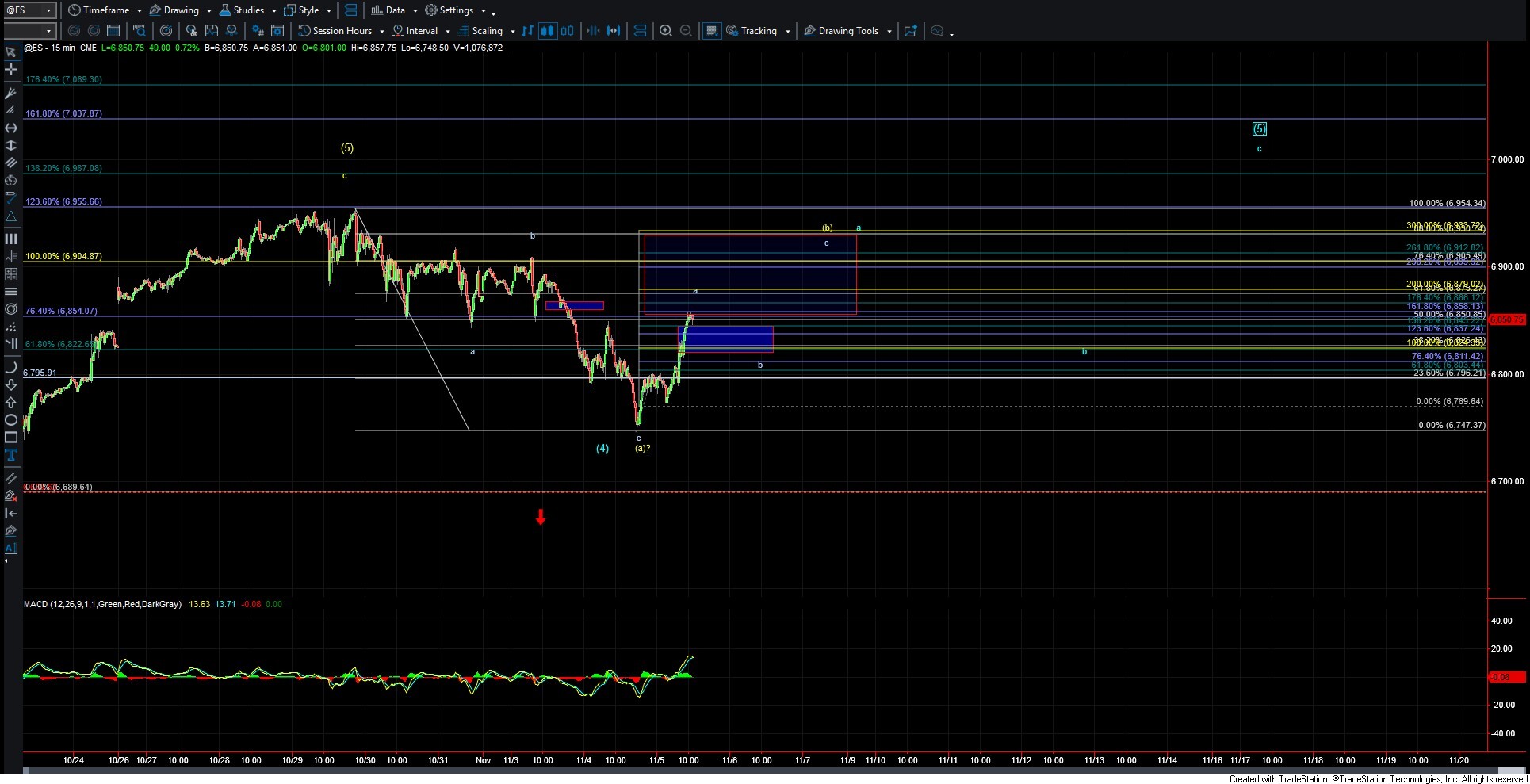

Drilling down to the 15-minute ES chart, we currently have three waves up off the low. This can still develop into a five-wave move—even as part of a larger a-b-c corrective move to new highs, but it certainly does not have to, nor would I say that this is a high-probability outcome at this point in time. The initial wave a off the lows could top at any point. A move back under the 6824 level would be the first indication that we have topped in that initial wave a up. As long as the action back lower remains corrective in nature, a move higher for at least a wave c of a larger wave (b), per the yellow count, is likely in the cards.

If and when that occurs, the structure of the next move lower will give us the next set of clues as to whether we are going to push to new highs per the blue count, or move lower once again per the yellow count. Should we see a three-wave move lower, then we likely push higher for a wave c of a larger wave (5) toward the 7000–7069 region. However, if we see a five-wave move lower followed by a corrective retrace higher, then the door would open for a potential top in the yellow wave (b).

For now, we still need a bit more price action to fill out before we’ll have a clearer idea of what the market’s intentions are in the days and weeks ahead.