Various Wave Degrees - Market Analysis for Oct 26th, 2022

One of the most difficult aspects of Elliott Wave analysis is the ability to keep track of the various wave degrees simultaneously. And, if that is not hard enough, when we have to track multiple wave structures within one wave degree, it makes it even harder.

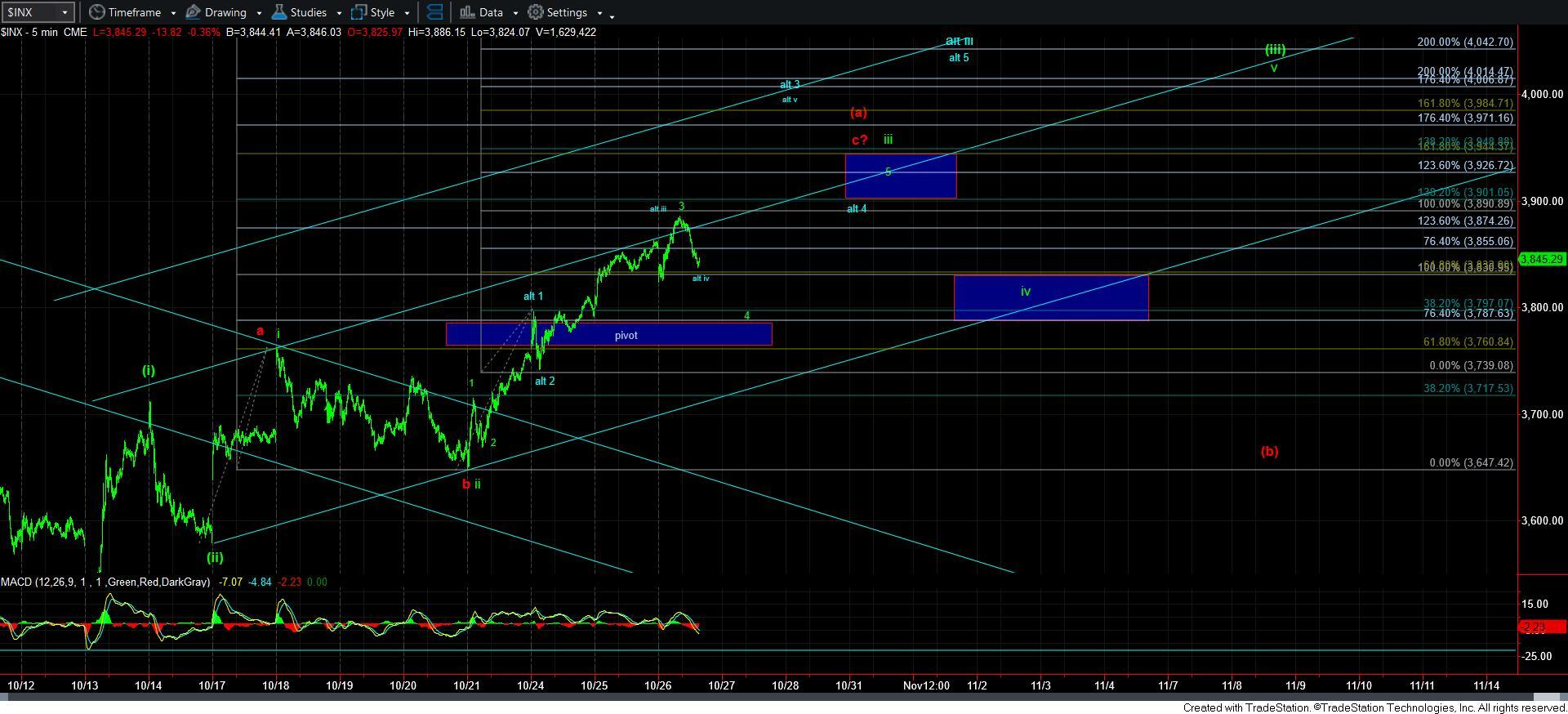

Right now, I am forced to track two different wave structures within the same wave degree of wave 3 of iii on our 5-minute SPX chart.

As far as the blue alternative goes, today, we hit the 1.00 extension of blue waves 1-2. That is usually the iii of 3. And, as I write this, we are pulling back to the .618 extension in the 3830SPX region. Therefore, with the inability of the market to give us a deeper pullback today (even though we broke below the micro support), until the market breaks down below 3825/30SPX, I cannot assume that the more accelerated count will not play out. And, if we hold that support, and take out today’s high, then I am targeting the 3950-80SPX region for alt 3.

However, the primary count suggests that today’s high is the top of wave 3, and the pullback we now see from today’s high is the a-wave of wave 4. That means that the bounce I expect to see as I am writing this should be the b-wave of wave 4, which leaves us expecting a c-wave down towards the 3787SPX region. Since the wave 3 of iii slightly exceeded the 1.236 extension of its structure, then I would expect the 4 of iii to hold the .764 extension, which is the 3787SPX region, and the top of the pivot.

To try to simplify this information, I wrote this today:

Immediate resistance is today’s high

Support right now is 3825/30, followed by 3787SPX.

Once we move to 3900, then support will rise to 3787-3830SPX.

If we break down any of these supports, then it raises the probabilities for red.

From a bigger picture perspective, you can see that we now hit the resistance I noted yesterday based upon this chart. I think we will take it out, but the question is obviously the wave structure which takes us there. Clearly, the blue structure would break us out sooner rather than later, but that really will have to prove itself by tomorrow.

So, for now, our immediate resistance is today’s high. And, as long as we remain below that, I think we are in wave 4. But, over it, and it tells us that wave 3 is extending.