Two (And Maybe Three) Potential Paths To The Same Place

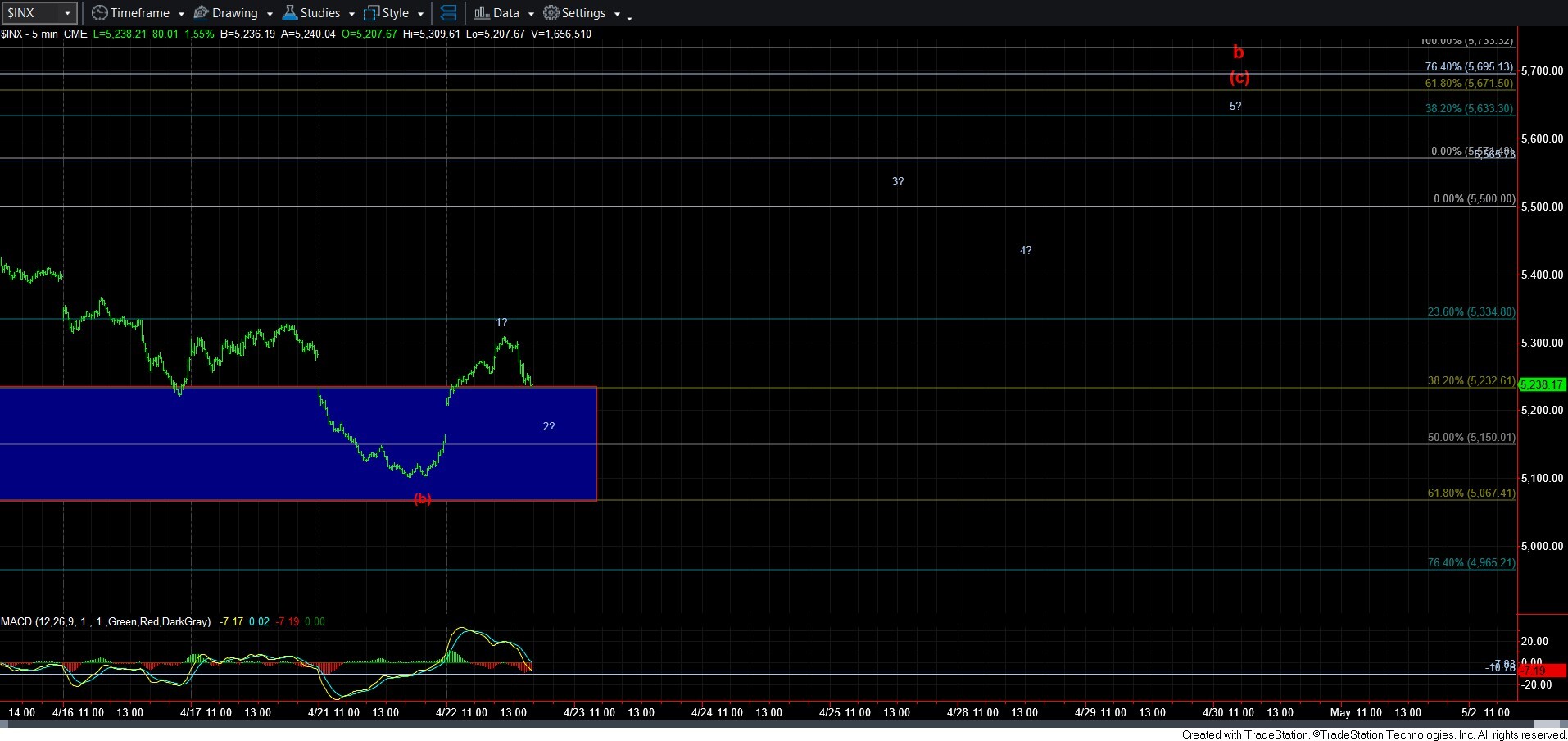

With the market seemingly putting in a bottom last week, the question that then arises is whether than completed the red [b] wave, or if the [b] wave will continue to trace out the triangle outlined on the attached 15-minute ES chart?

Well, to be honest, the SPX and ES are telling two different micro stories.

The ES suggests that the triangle will continue to fill in over the next week or so. The rally today topped at just about the point wherein we can count an (a)=(c) rally off the low struck last week. We then dropped below the micro pivot, which suggests that this move up was a 3-wave rally. That leads to the conclusion that the market may still try for a lower low below that of yesterday (lesser likely to me right now), or the rally today was an (a) wave of the d-wave in the bigger (b) wave triangle.

Yet, when you “look” at the SPX on the 5-minute chart, it does seem to have traced out a relatively nice 5-wave rally for wave 1 of the (c) wave.

What this really means is that pullbacks can be bought for those of who that want to trade for the (c) wave rally. And, stops can be placed at the low struck last week. But, it also means that we may see two more pullbacks rather than just the current one. That would be the e-wave in the (b) wave triangle. But, as noted in the title, as long as we hold over last week’s low, they are both pointing to the 5600+ region over the coming weeks.

Of course, if we do get a lower low, then we are just completing a more complex ending diagonal for the c-wave of the (b) wave, but for now I see that as the lesser likely scenario. This does seem a bit high for it to be the 4th wave of that ending diagonal. So, just keep this alternative in the back of your mind for now. And, even if this does take shape, it still would complete the (b) wave with the expectation of the (c) wave rally still to come thereafter.