Topping Is A Process

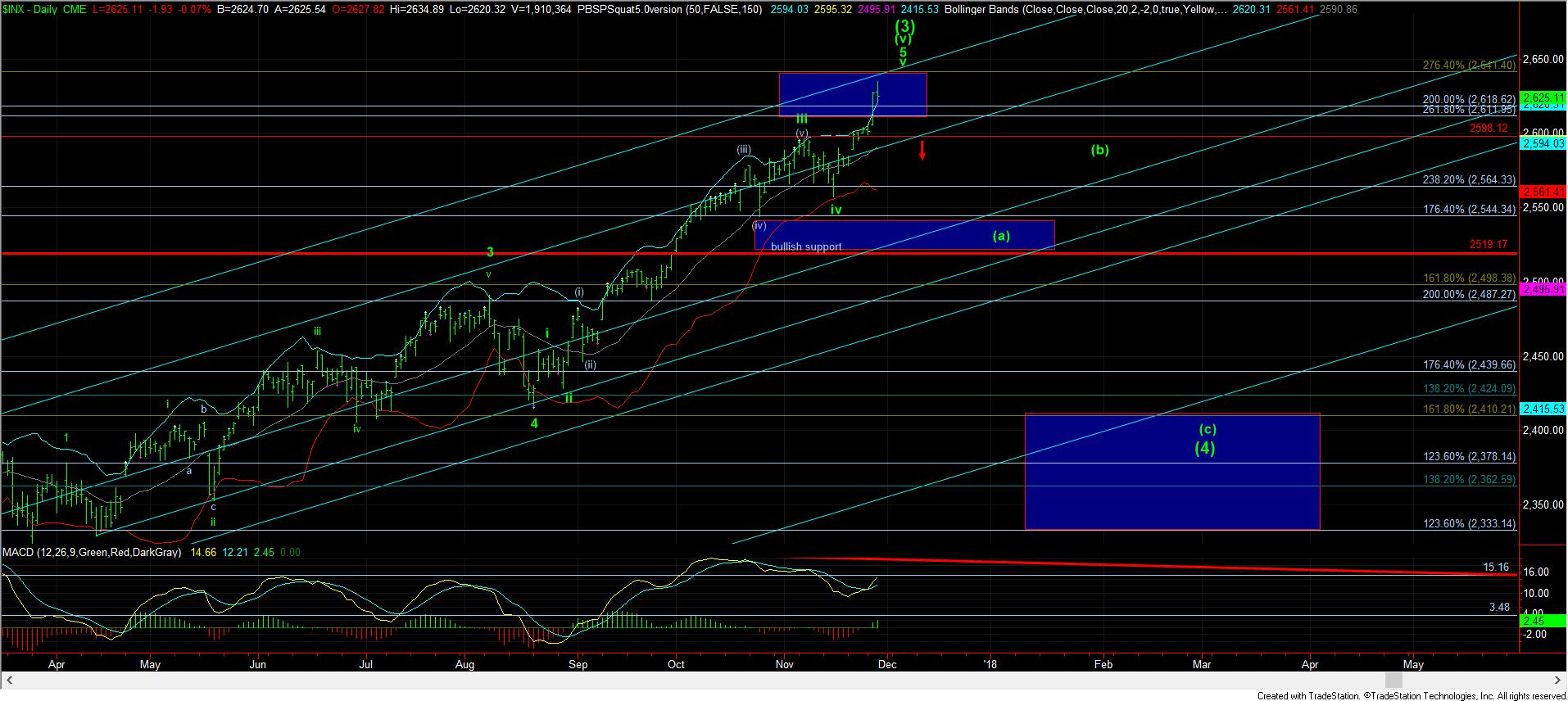

This morning, I sent out an update that suggested you maintain an eye toward the bigger perspective as to where we believe we stand in the market. And, yes, we are looking for the final “squiggles” in this rally off the August lows, which should also complete a major segment of the rally off the February 2016 lows.

But, there is an old saying that “topping is a process.” And, often it is a frustrating process. Yet, consider why people view it as such. If you understand that a topping process is basically the market completing a series of 4th and 5th waves in Elliott Wave parlance, it would make sense regarding it being a “process.” It simply means that you are seeing a lot of up/down volatility as the market creates its topping structure. And, that is likely where we now reside at this time. And, Elliott Wave analysis places the market within a context for us to understand what is going on in this “process.”

As far as the smaller degree structure within this topping process, as you can see from the attached charts, we have likely just about completed the last 3rd wave in this move up off the mid-November lows.

In looking at the 3-minute IWM chart, you will see that as long as we hold the upper support box over 152.40, the market can push higher one more time before it completes its wave (5) of iii. But, should we break that support, then it becomes likely we have moved into wave iv.

The same applies in the SPX. Based upon the current structure, I think both the IWM and the SPX can see a consolidation in the coming week, which will set us up for one last rally to complete these final squiggles we have been tracking of late. Now, I cannot be certain if this 4th wave will take a week, or even as long as two weeks. All I can tell you is that as long as the IWM remains over 150 and the SPX remains over 2605 on the next larger pullback, we will likely see one more higher high to complete several wave degrees, and completing all of wave (3) off the February 2016 lows.

And, as I noted earlier today, it would take a strong break of the relevant support levels (150 in IWM, with follow through below 149.50, and a break of 2605, with follow through below 2597SPX) to give us our first indications that a top may certainly have already been struck. But, we will need to break below the lows struck in mid-November to make it much more likely that the larger degree wave (4) on the daily charts have begun.

So, we will need a bit more patience, as the market may still attempt to extend a bit more before we begin wave (4). While we certainly can count enough waves in place if the market chooses to break down sooner rather than later, I think patience is going to be the key right now, as we allow the market to signal to us that it has exhausted itself to the upside, and has its sight set on our larger degree wave (4) targets below.