Too Much Of A Mess

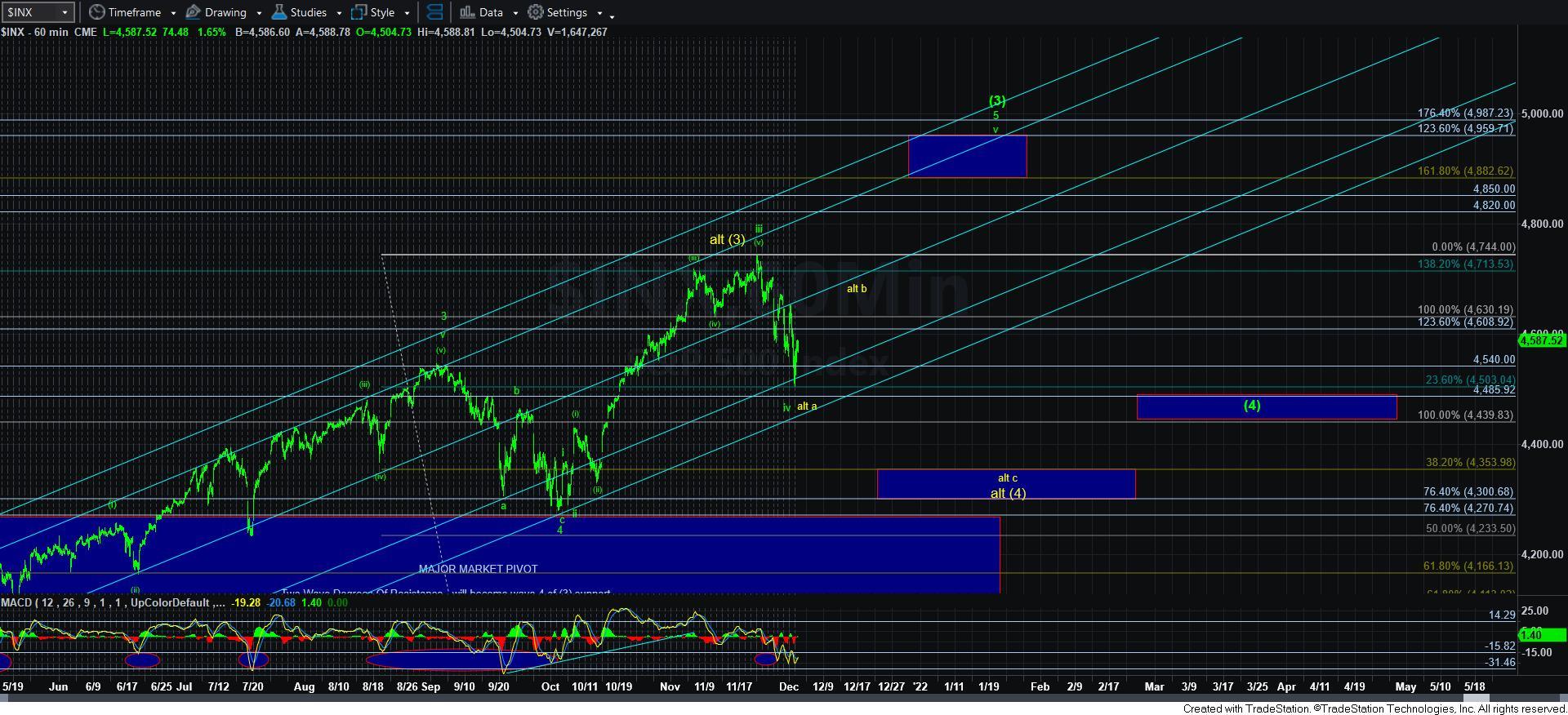

With today’s rally, the structure has not really provided any clarity to the bigger picture. In fact, there is still some potential to drop one more time. While we did hit the .236 retracement of what may have been the wave [3] top, we did not approach the [a]=[c] on the decline in the 4475-85SPX region. So, there is still even some potential for another drop.

On the rally, the structure is looking quite corrective thus far. This further adds some probability to the yellow count again. But, as I said today, I am going to be a bit more patient before I am willing to turn wholly to the yellow count for the many reasons I have been citing of late, which I outlined in detail in my live video this morning, which I opened to the membership.

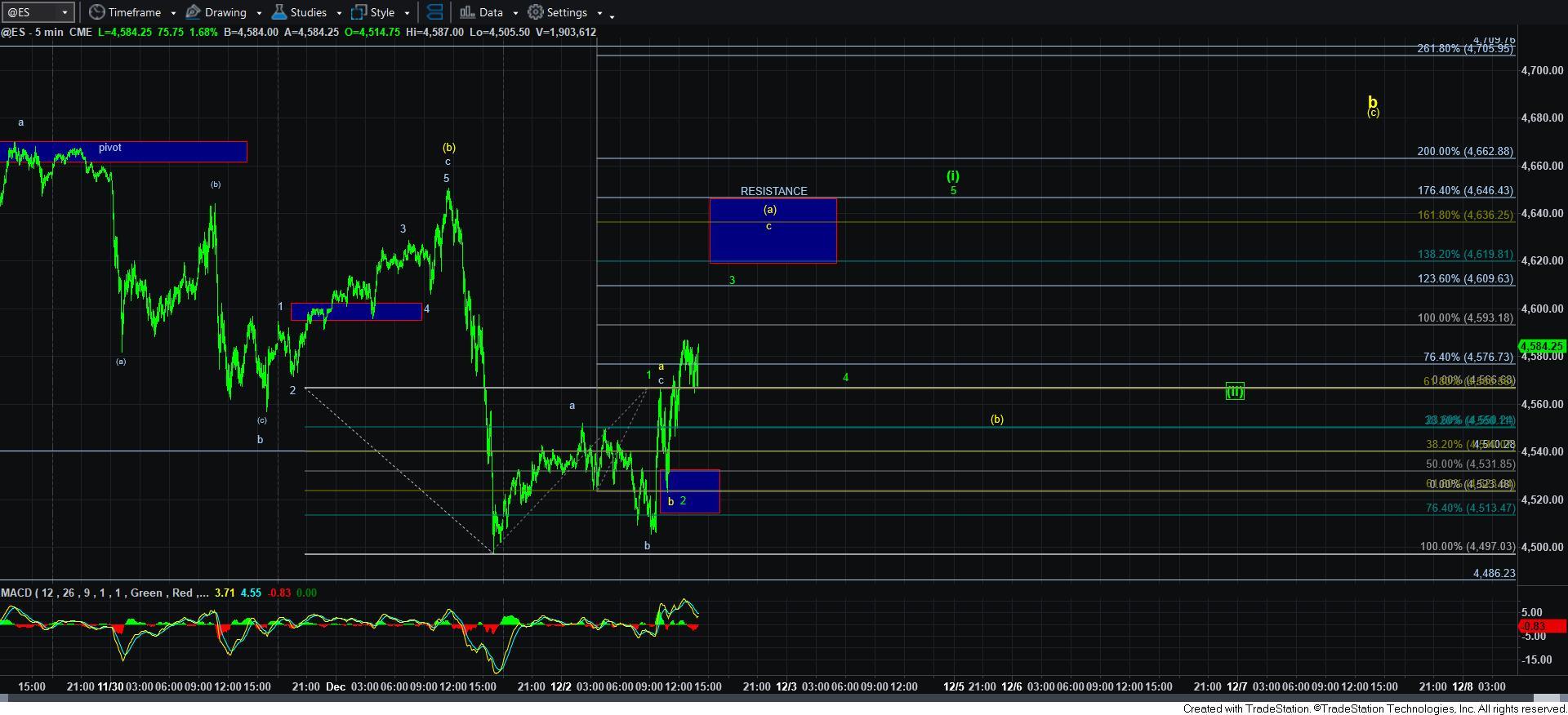

So, in addition to potential for a lower low, I have several paths laid out on the 5-minute ES chart. I would imagine that the market will begin to distinguish between these paths over the coming days, and we can narrow down our plan over the coming weeks.

But, for now, I think it is best for me to remain patient, and allow the market to differentiate between the patterns before I can provide more accurate near term guidance.

In the meantime, I am going to add some of the intra-day alerts I posted over the last 15 hours:

Posted last night:

“I have been doing a lot more work on the micro structure this evening, and I cannot ignore several things on the chart right now with this break down:

1 - The initial move down off the highs was a clear 3-wave move - which I am classifying as an (a) wave.

2 - The structure after the (a) wave counts best as an expanded (b) wave. In fact, the low we struck yesterday was a clear a-b-c for the b-wave within that (b) wave, and today's 5-wave rally was a c-wave that completed that (b) wave.

3 - The (a)=(c) region is within 4490SPX region is within a few points of the .236 retracement of wave (3) that I outlined this evening in the 4485SPX region.

For these 3 reasons, I am assuming this is a (c) wave down today. And, I want to reiterate that the wave iv in green is not completely dead, but it is certainly on life support. And, if the next rally is not CLEARLY an impulsive 5-wave structure, then I will be moving into the yellow count on that next rally/bounce.

And, the more and more that I scrub these charts, the more and more I am disappointed that the market topped at the 1.382 extension as opposed to the 1.618 extension as we normally would see after bottoming at the .764 extension in the 4270SPX region.”

Posted this morning:

“ I am going to be playing this VERY cautiously right now. So, while there is a potential 5 up off yesterday's low in ES, I am not going to even rely on it until I see a 5 wave structure at one bigger degree . . meaning, wave (i) complete. Until then, the decline structure does look like it needs a lower low, so as I said, I am going to play this very cautiously.

In both situations, I am still looking for a rally this month, and the question is going to be if it is corrective or impulsive. If corrective, then I will be raising cash in preparation for the c-wave down. If impulsive, then I am still going to play for a 5th wave move to 4880, but with VERY tight risk parameters.”

Posted late morning:

“Well, I just had to do it. I have added a potential bullish count for the green count . . which would be a leading diagonal as shown.

Again, this is going to require patience to see which of these patterns the market provides us. Also, if we have begun a corrective rally, keep in mind that it can certainly take twists and turns I am unable to foresee at this point in time. Remember, trying to outline a path for a corrective structure is akin to throwing jello for distance. But, in a bit of time, it will become clear that the rally is corrective (if it truly is), and then we can act appropriately as we approach the b-wave high.”

Lastly, I want to remind you that this is still a bull market, with likely much higher levels to be seen in 2022. So, I want to address a question I have been getting of late. If wave [3] ended at the 1.382 extension of waves [1][2] instead of the traditional 1.618 extension, does that lower the target for wave [5] of [iii] from 5500SPX? My simple answer is “no,” but I will clearly be watching how waves 1-2 develop in wave [5] of [iii], as the 2.00 projection will be the final data point to tell us just how far wave [5] of [iii] will take us. But, for now, I am going with the bigger picture, which still points to 5500SPX.