Today Provided More Clarity

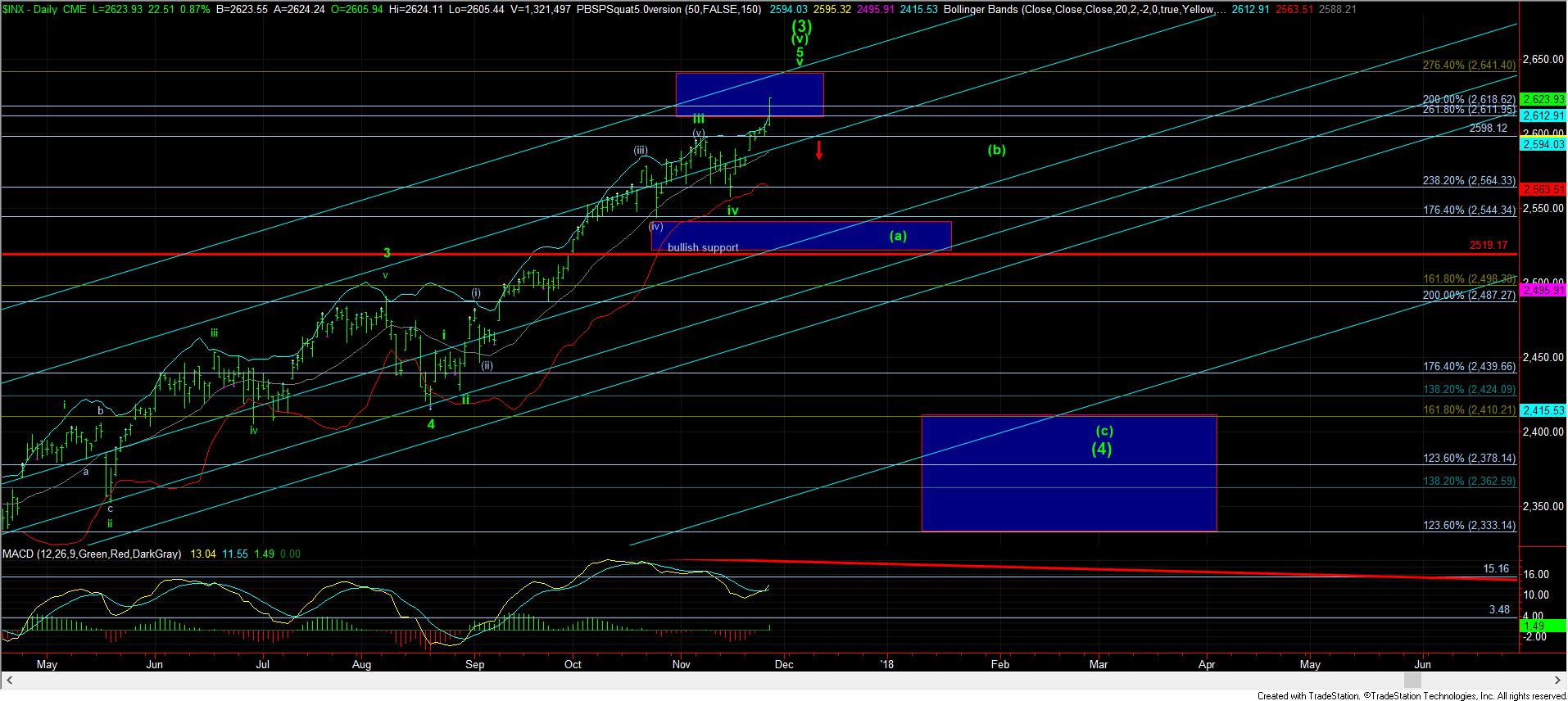

While we have been steadily looking higher in the IWM to complete this 5-wave structure off the 144.50 lows before wave (3) off the February lows will complete, I had been questioning if the SPX is going to see another full 5 wave structure into our target box. With the strong break through the 2611SPX resistance today, the SPX told us that it also wants to complete the more extended 5th wave higher along with the IWM.

And, along with the move higher in the SPX, it has now provided us guideposts which we can follow for any downside resolution. So, I have matched up the wave count within the SPX relative to the IWM.

As you can see in the attached 5-minute chart on the SPX, as long as we hold over the 2605SPX level, we can continue to the top of the box on our daily chart in the 2640SPX region. It will take a break down below the 2605SPX level, with strong follow through below 2598SPX to provide us with an early indication that wave (3) off the February 2016 lows has completed.

In the IWM, we know that the 150 level has been the relevant support, and as long as we remain over that level, we have an open door to the 155/56 region. So, currently, I am still looking up to complete wave (5) of iii in the more bullish count, especially since we have not broken below the 150 level.

So, the relevant levels to watch for the IWM is at 150, with the SPX being 2605. Those are now the guideposts which will maintain pressure to the upside, whereas a break of those levels is a warning that wave (3) off the February 2016 lows has completed.