Time to Discuss Timing

I rarely get into the perspective of specific “timing” within the market because, based upon my research and experience, I still have not found anything that would work better than 50% when it comes to “cycles,” with many underperforming that benchmark. In fact, I have seen cycles analysts blow up more people’s accounts than I have cared to see, and it truly makes me sick. But, I digress.

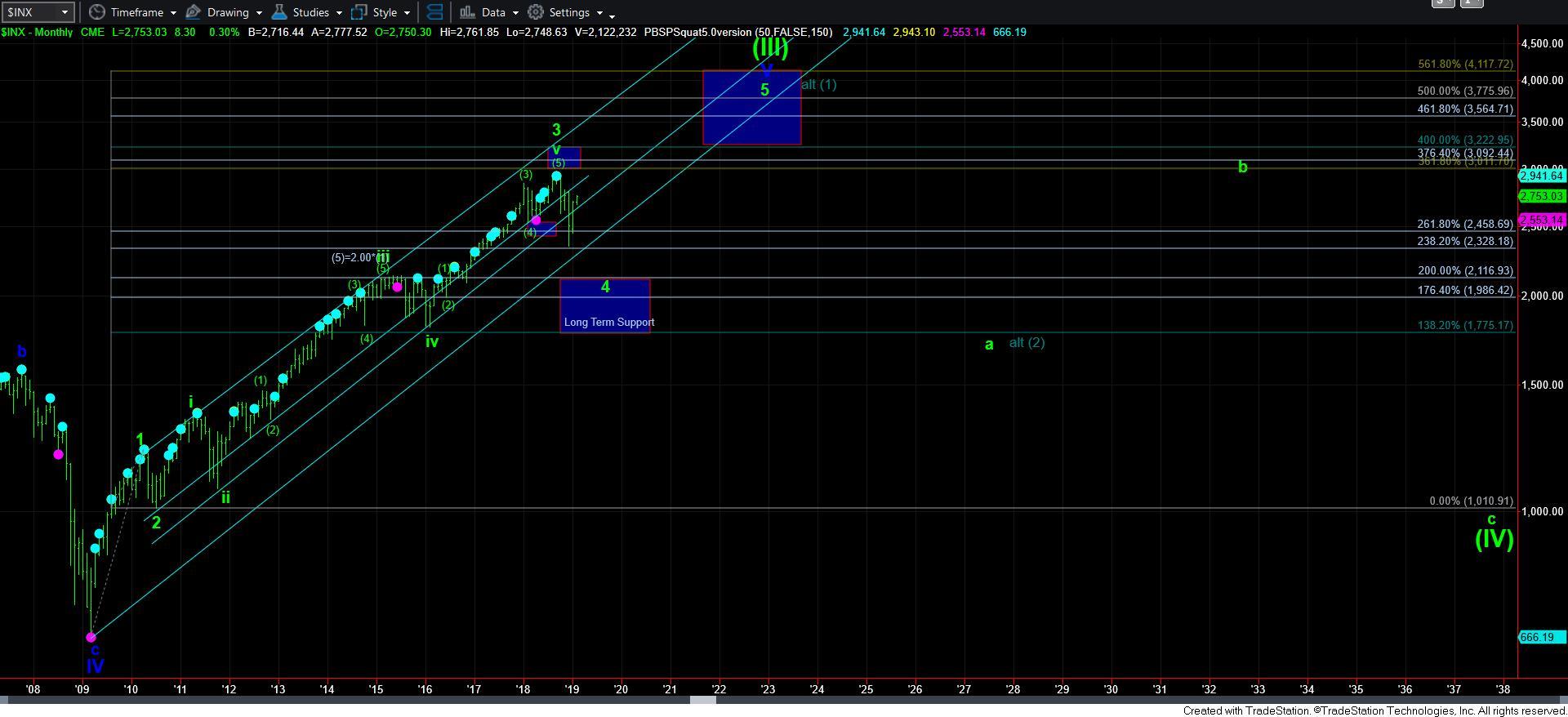

I wanted to explain a bit into my thinking about why I was looking for a top in the 2022 time frame. You see, we can see Fibonacci relationships within a timing perspective. While it is not something I would ever trade upon, I will say that it does happen. And, since the market bottomed in 2009, I was considering a Fibonacci 13 year time frame from the bottom struck in 2009 as the potential target time frame for a top to this 5 wave structure off the 2009 lows.

Now, since then, I have had a nice discussion with one of our more astute members at Elliottwavetrader.net – Bill Albert, who many of you know as El Hombre Espantoso. Bill provided some very interesting observations with a similar time frame in the market. Bill noted that the year 2021 is 34 years from bottom of the correction in 1987 and 89 years from 1932 bottom in the market.

Now, when you consider that these Fibonacci timing cycles often have a margin of error of 1-2 years, we have some very interesting confluence for a market top between the years 2021-23, with the 13 year Fibonacci cycle off the 2009 lows landing right in the middle at 2022.

Just something interesting I thought I would share.