Time To Be A Bit More Cautious

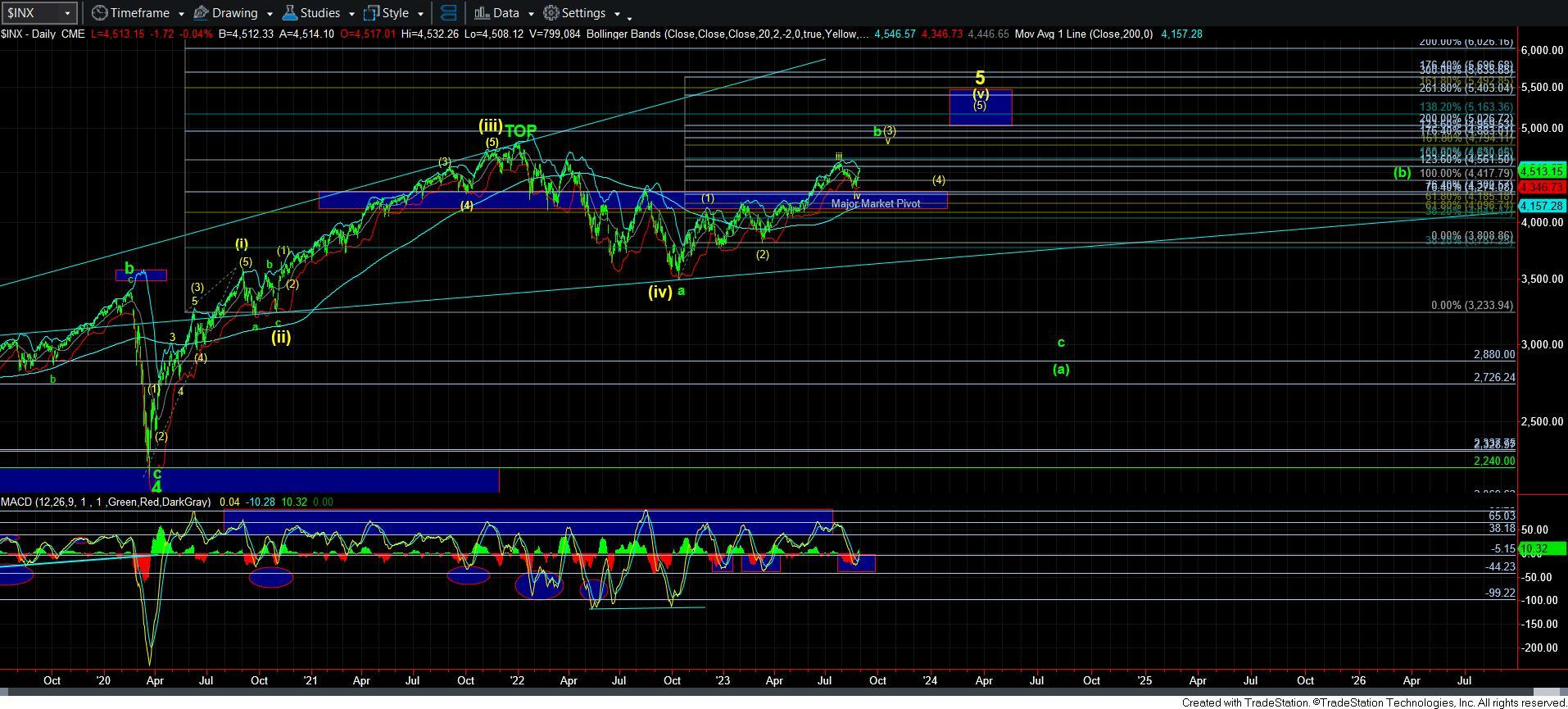

As you know, the action this week makes me strongly consider that we are heading to 4800SPX in the bigger rally structure we have been tracking. Yet, I have to note that there is still some question about the path.

As I have said many times, if the market can complete a full 5-wave structure to complete wave 1, as outlined in yellow on the 5-minute SPX chart, then we can look to buy a low-risk, high probability pullback in a wave 2.

Yet, until that time, we simply have a 3-wave rally. And, that 3-wave rally can still be a higher b-wave, as I have explained in alerts and in my live video on Wednesday. So, if we are unable to complete all 5 waves up towards the 4570+ region, and, instead, we see an impulsive break down below the pivot, we will have to move towards the blue count, and view this a wave [4] as presented on the 60-minute SPX chart. It would mean that a break down below the pivot in impulsive fashion is the c-wave of wave [4], likely taking us back down to what would seem to now project to the 4230-4260SPX region.

What has me a bit concerned at this time, which is why I am writing this update early, is that we are losing some of the good structure we have seen in this rally over the last week. The manner in which we are overlapping near the highs up here does have me a bit concerned as we are losing some of the standard impulsive structure.

So, I think it is wise to have a healthy dose of caution until the market gives us a stronger entry for a rally to 4800SPX.

Again, I want to reiterate that I still think the greater probabilities suggest that the market has its sights on the 4800SPX region. I am still looking to see if the market will provide us with a low-risk, high probability entry for those that are a bit more conservative. The yellow 1-2 would provide that entry. But, to be honest, so would a 5-wave c-wave decline in blue. So, I simply want to maintain a bit more patience for the appropriate set up.

Lastly, I want to point your attention to the fact that the daily MACD on the SPX has now turned up for 3 days, and would support the yellow path at this time. Of course, should we see an impulsive break down below the pivot, then I would have to side with price action. But, for now, as long as we remain over the pivot, I am going to attempt to continue tracking the yellow count as my primary based upon the weight of evidence. Therefore, I am still focusing on individual stocks until the SPX gives me a low-risk, high probability entry opportunity.