This "Top" Has Been Quite The Process

There is an old Wall Street Adage that says "Tops are a process and bottoms are an event". This partial top is certainly becoming quite an ugly process to unfold which is not terribly uncommon but frustrating nevertheless.

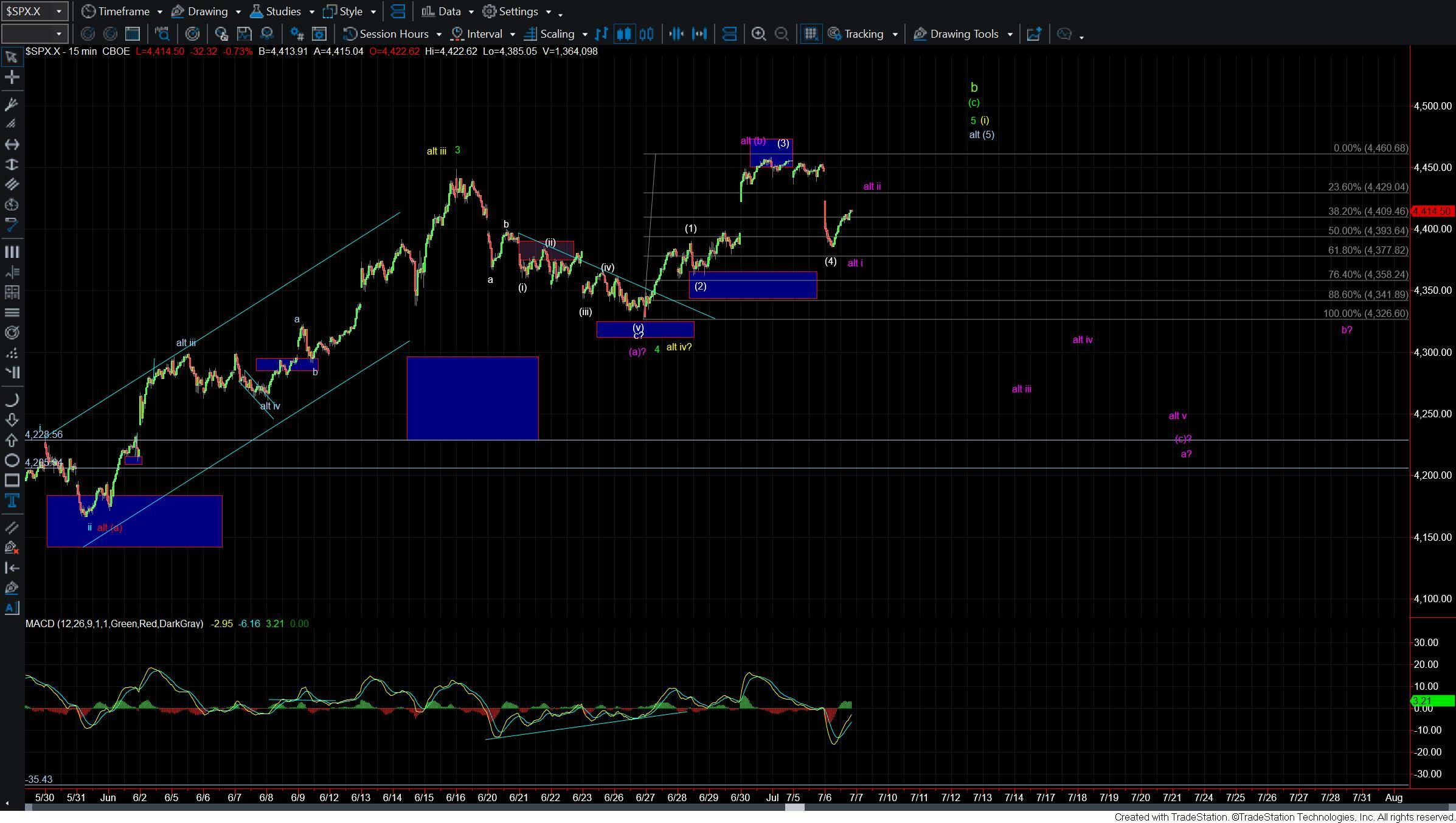

The move down today broke the ideal support level for the micro wave (4) thus opening the door that we may have put in a larger degree top. The move down however unfolded in what still counts better as only three waves which is still leaving the door open for this to see another higher high. Unfortunately for that high to take hold it would likey need to come in the form of a sloppy expanded ending diagonal. Certialy far from the ideal pattern to take us to new highs and complete this top but it is what the market left us with today.

So from here if we are able to hold today's LOD at the 4385 level on the SPX and continue to push higher over the 4460 level then we would potentially have enough waves in place to consider the wave (5) off of the 4326 low in place. From there we still woudl be looking to see what the structure of the next pullback looks like to help give us guidance as to whether we have topped in the green wave b or the yellow wave (i). That part of the analysis remains unchanged from what we had been discussing for the past couple of weeks.

If we are unable to hold the LOD at the 4385 level then it would open the door for this to be following the purple count under which case I would be looking for this to see a wave iii down followed by another wave iv and v to finish off a larger wave (c) down off of the highs. If we do fill out that initial five down off of the highs then the structure of the next leg up after bottoming would help give us further guidance as to where we are going to see further downside follow-through or whether another higher high may still be in the cards but a break of today's low would likely signal that we will at least see a break of the 4326 level and potentially a move down towards the 4250 -4200 before finding any sort of a local bottom.

While this action has certainly been frustrating on the smaller degree timeframes, we are still at a very key inflection point on the larger degree charts. So while this market is doing everything it can to delay giving us the signal as to its intentions, we are still very close to having an answer as to what the market is likely headed into 2024 and beyond.