This Should Be Clearing Up Soon

There are going to be times when we will be unsure about a clear path the market will take. In this case, I am unsure about the smaller degree structure within which this pullback is taking shape. But, the bigger picture still remains clear, and I conclude this update with that presentation.

But, for now, I want to remind you of something that is said in Frost & Prechter’s seminal book The Elliott Wave Principle:

“Of course, there are often times when, despite a rigorous analysis, there is no clearly preferred interpretation. At such times, you must wait until the count resolves itself. When after a while the apparent jumble gets into a clearer picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%.”

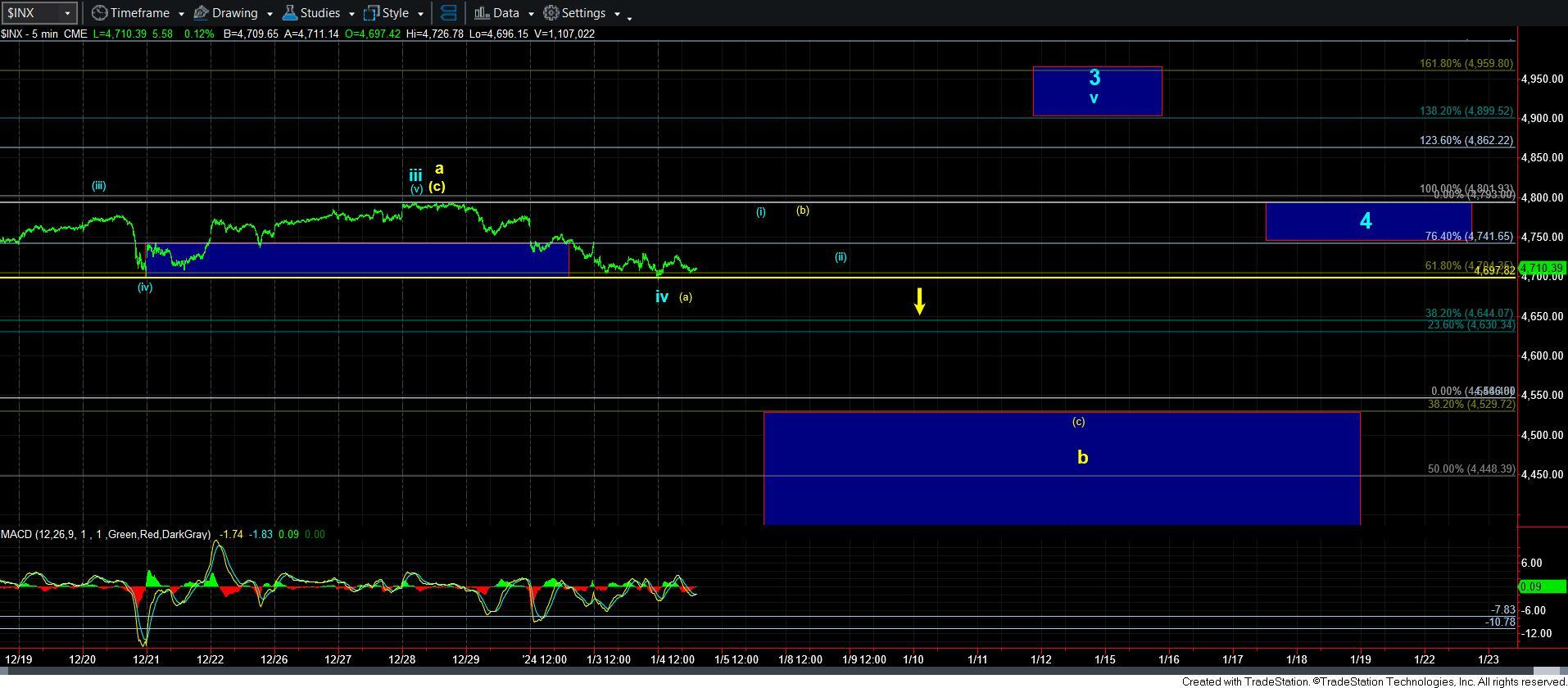

As I have been outlining in my posts in the room of late, I am seeing less indications now for the blue count in the SPX, as we are starting to see more indications pointing towards yellow. But, I am not yet at the point where I would say yellow is a HIGH probability. Allow me to explain what I am seeing.

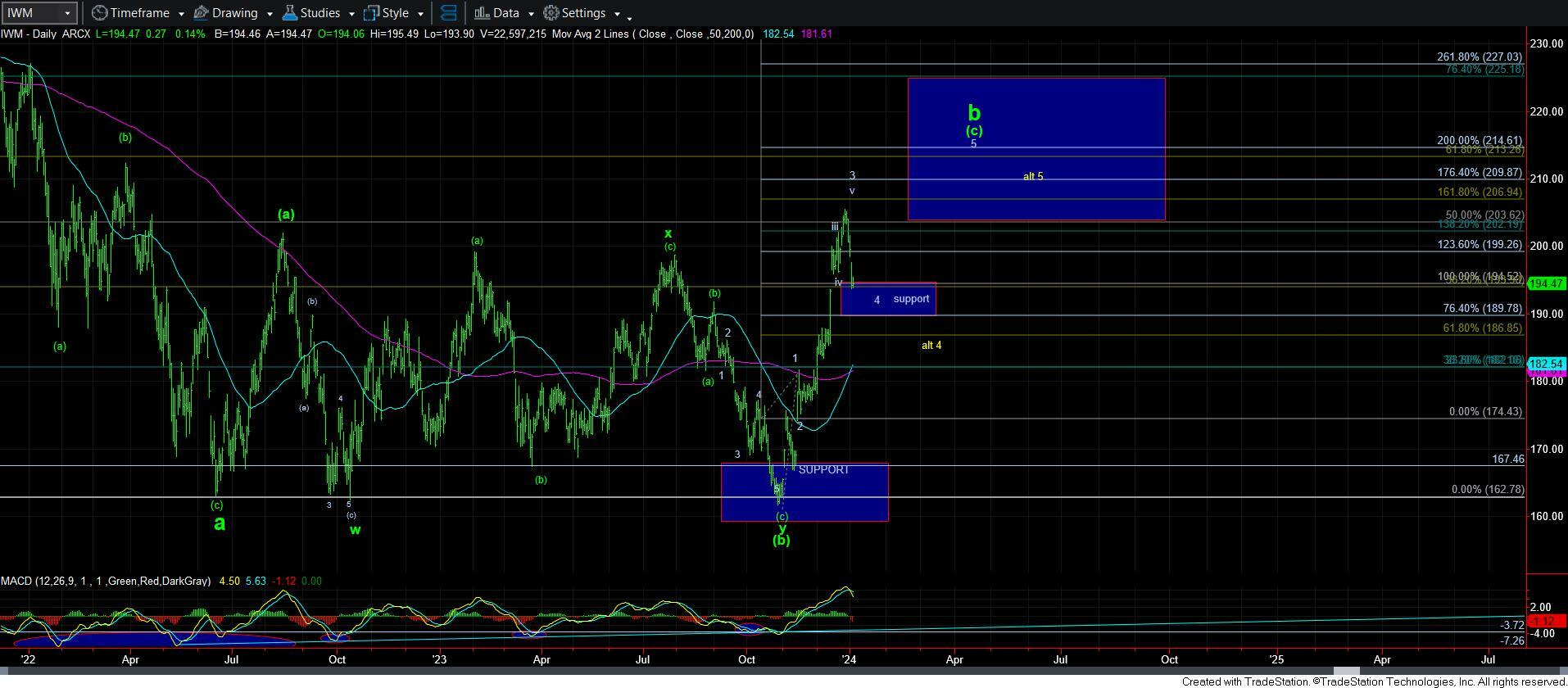

First, in starting with the IWM, as you can see from the daily chart, we are already in the wave 4 target I set some time ago. The question now is if we continue to chop around before wave 4 is done. I am leaning towards the potential that we could chop around more, with a [b] wave rally still to be seen, followed by a [c] wave decline.

The issue I have with the IWM right now is that we came up short of its ideal wave 3 target. Oftentimes when this occurs, we see the [b] wave of the wave 4 correction try to come back and strike that target before the [c] wave decline takes us back to the wave 4 support region. So, I am considering that path at this time.

Therefore, it is possible that we are completing the [a] wave in both the IWM, as well as the yellow [a] wave in the SPX, with a [b] wave rally to follow. So, if the next “bounce” in the market is clearly corrective, then it will likely solidify this expectation over the coming week or two.

However, if the next bounce is clearly impulsive, then I will have to again consider the potential for the blue count in the SPX. Thus far, I am seeing no clear indications for this at this time.

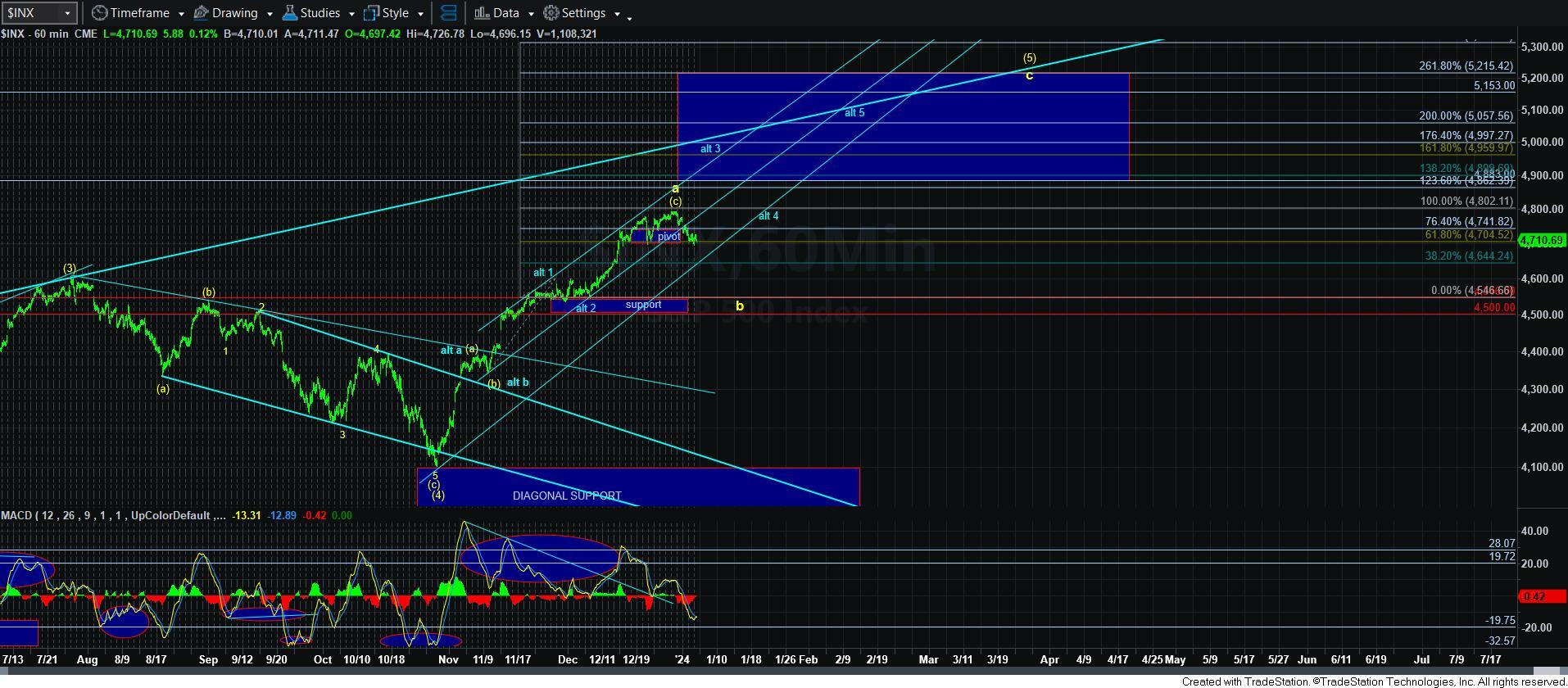

I want to conclude today’s update with something I posted in the room yesterday regarding the bigger picture, which is relatively clear:

“I want to be clear about something . . . and it is a big picture moment. I do not think we have completed this wave [5] yet in the SPX. Therefore, I think it is a reasonable expectation to be looking up to the 5000 region as long as we do not break down below 4350SPX. The only question I have is just how deep this pullback will run before we begin the next rally to 4800+. And, I am still trying to feel that out based upon the parameters we are following.

But, again, it is still not likely that a top has yet been struck, and that we will likely see higher in the coming months. So, please make sure you maintain that perspective. Again, it would take a break down below 4350SPX to suggest otherwise.”