This Ain’t Over

I want to start with the following post I made during the day today:

“There is a tremendous amount of value in understanding the environment within which you are trading. Understanding that you are likely in a 4th wave tells you to trade cautiously, and with smaller position sizes. There is no one alive that is able to catch all the turns within this type of environment, and anyone that tries WILL get chopped up.

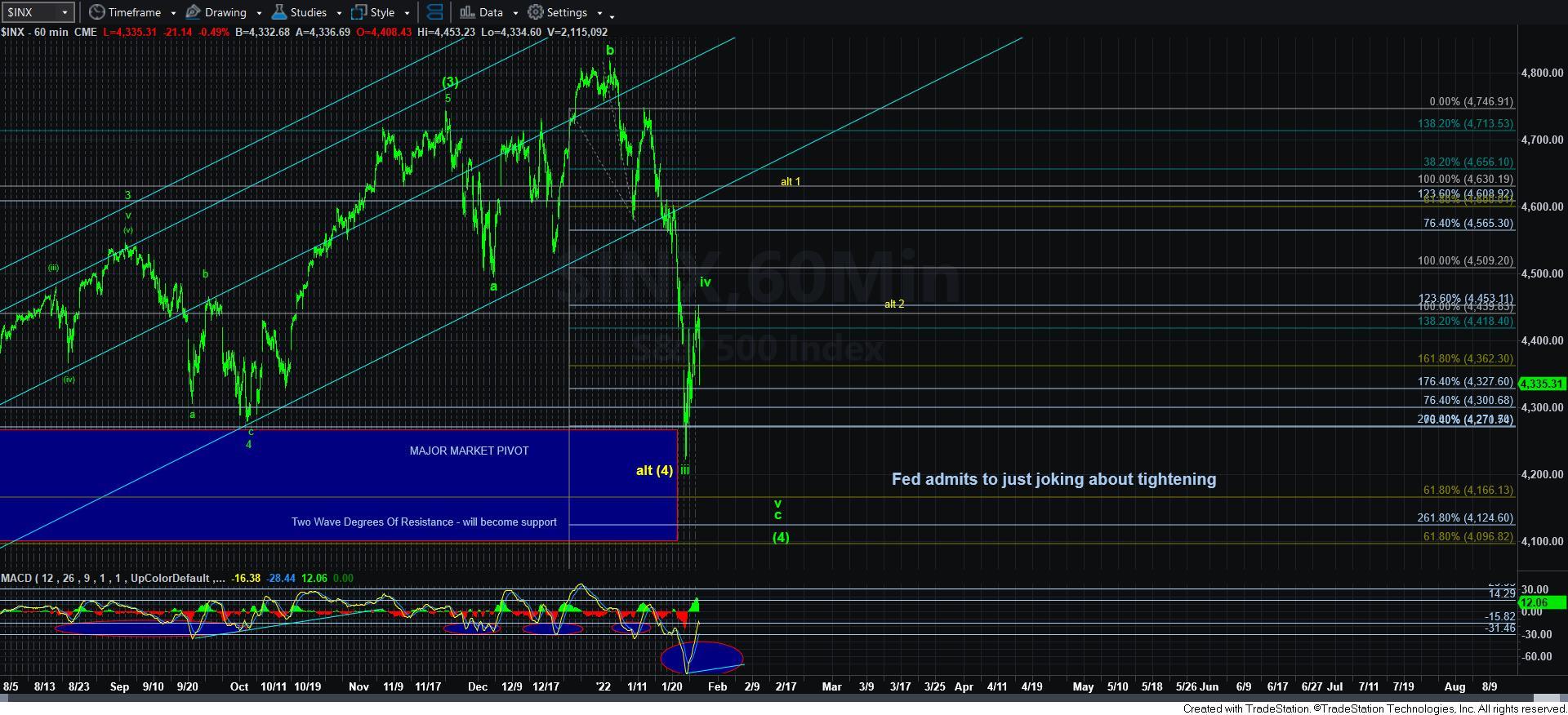

So, knowing where to pick your points is important. For example, if the market fulfills the 4-5 for the (c) wave of wave iv, one can try a short trade (small size), with a stop just over the 4480ES region. Or, if we drop in the purple (b) wave, then one can try a long position once the (b) wave completes and we have a potential 1-2 to the upside to start the (c) wave.

Again, understanding your market environment is something that most people do not have the tools to identify. That is one of the major benefits of EW.”

So, most people who are trying to trade these smaller moves are getting whipsawed, and it potentially may continue. With the market providing us a different path for the larger degree wave iv overnight, it is simply typical of these 4th wave structures, which is why I constantly warn about trading them too aggressively.

As it stands as of my writing this update, I am still viewing the iv-v as my primary analysis, which means I think it is reasonable to look for a lower low in the coming days. But that is a far cry from actually trading for that lower low, especially as the market continues to whipsaw. Rather, a lower low should be viewed by most as a buying opportunity.

At this point in time, it is certainly possible that wave iv may be done. But, I cannot say that the structure into that top was clear enough for me to be certain wave iv is over. This leaves me with the purple count, presented on the 5-minute ES chart. This can provide us with one more potential whipsaw back up before we complete wave iv.

So unfortunately, this is what 4th waves often do, as they try our patience. But, understanding the environment within which you are presented in the market, it does make it easier to protect your capital.

On the 5-minute SPX chart, I have presented the potential that wave iv has already ended. But, again, I do not have a solid 5-waves down to suggest this confidently.

The other option on this chart is the yellow count, which I really do not have any confidence in as long as we remain below 4880ES.

One thing I want to bring to your attention. The MACD on the 60minute chart has come up high enough to provide us with a nice positive divergence set up if we strike a lower low, whereas the MACD would not. That is a strong bottoming signal.

So, for now, pressure remains down and I am still seeking a lower low to complete wave [4]. But, I want you to be aware there is still potential for whipsaw before that low is struck.