The Set-up Continues To Develop

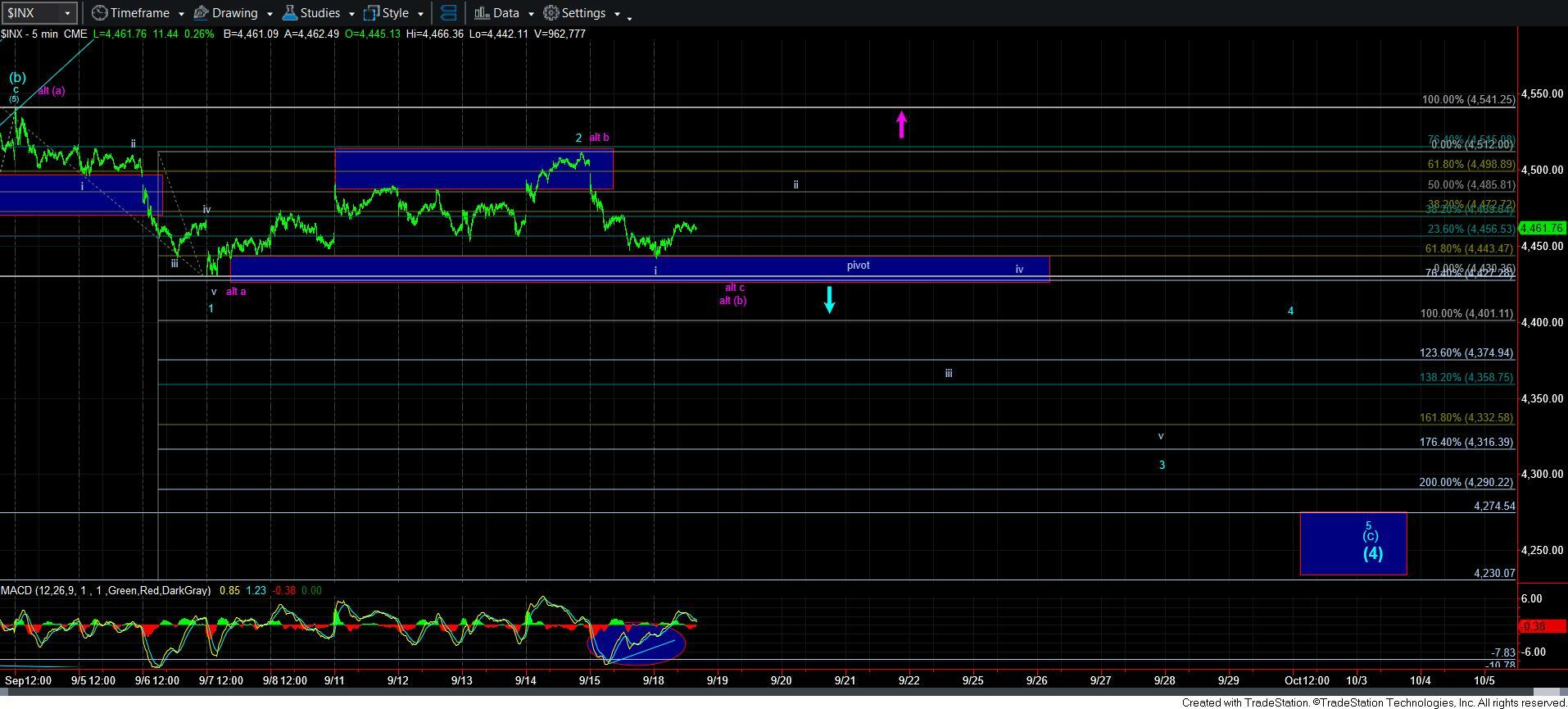

Let’s take a moment to review our Fibonacci Pinball structure. It all starts with having a 1-2 in place. While what we are calling a wave 2 is a bit larger than I would normally expect, as I said last week, I am still keeping the primary count the blue count.

Now, once waves 1-2 are in place, we set up our projections based upon that structure. Therefore, it is quite common to see wave i of 3 target the .618 extension of waves 1-2. Today, the SPX dropped 1 point below the .618 extension of the current 1-2 structure, and began to bounce. This would suggest that wave i of 3 is now likely complete, and we are in the process of a wave ii bounce.

The wave ii bounce usually sees the a-wave of wave ii target the .382 retracement of wave i, followed by a b-wave pullback/consolidation. The c-wave then rallies to the box, which is usually the .500-.764 retracement of wave i. Moreover, we often see a ration such as an a=c between the a and c waves, which often overlaps one of the retracement levels within the box. Since we still do not have the b-wave completed, this may be something we work on tomorrow.

We will then be looking for a break down below the .764 extension (4427SPX region) to signal that wave iii of 3 is likely in progress. And, then the pivot represented by the .618-.764 extension will become our resistance for wave iv of 3.

I noted last week that I really do not have a path upon which I can present a reasonable alternative for the purple count. But, with the market now dropping down towards the pivot, I have added an alternative for purple. To be honest, it really would need a drop down to the .764 extension over the coming hours to make it more likely, followed by an impulsive rally off that low. That would provide us with a c=.764*a ratio within the purple [b] wave, which would really be the minimum extension I would accept in this scenario. So, in the meantime, I am going to re-post what I sent out earlier today as an alert:

“Due to how low we have now dropped off last week's high, there is something I am compelled to bring to your attention, and that is another iteration of the purple count. TAKE NOTE THAT THIS IS ONLY AN ALTERNATIVE AT THIS TIME.

The reason it comes up for me is that we are approaching the point where we could have an (a)(b)(c) structure, wherein (c)=.764*(a), and that could represent a corrective pullback. So, the closer we come to 4430SPX, the more we have to at least consider this potential.

But, the only way I would consider this as even possible is if the next "bounce" begins as a CLEAR 5-wave rally. If that is the case, then I will put you on alert for this potential, but it will remain an ALTERNATIVE as long as we remain below 4512SPX. It would take a break out over 4512SPX to make this a primary count.

Again, I just felt compelled to bring it to your attention with the deeper drop we are seeing this morning. And, if the market begins a rally in a clear 5-wave structure, it is something we will have to watch more closely. For now, blue remains my primary, but with defined parameters.”

So, in summary, we have our parameters for the blue primary count. This current bounce should not break out over the box (the .764 retracement being approximately 4495SPX - based upon the retracement in the ES). And, an impulsive break-down below the .764 extension at the 4427SPX region would strongly suggest that we are in wave iii of 3.