The Market Refuses To Let Go

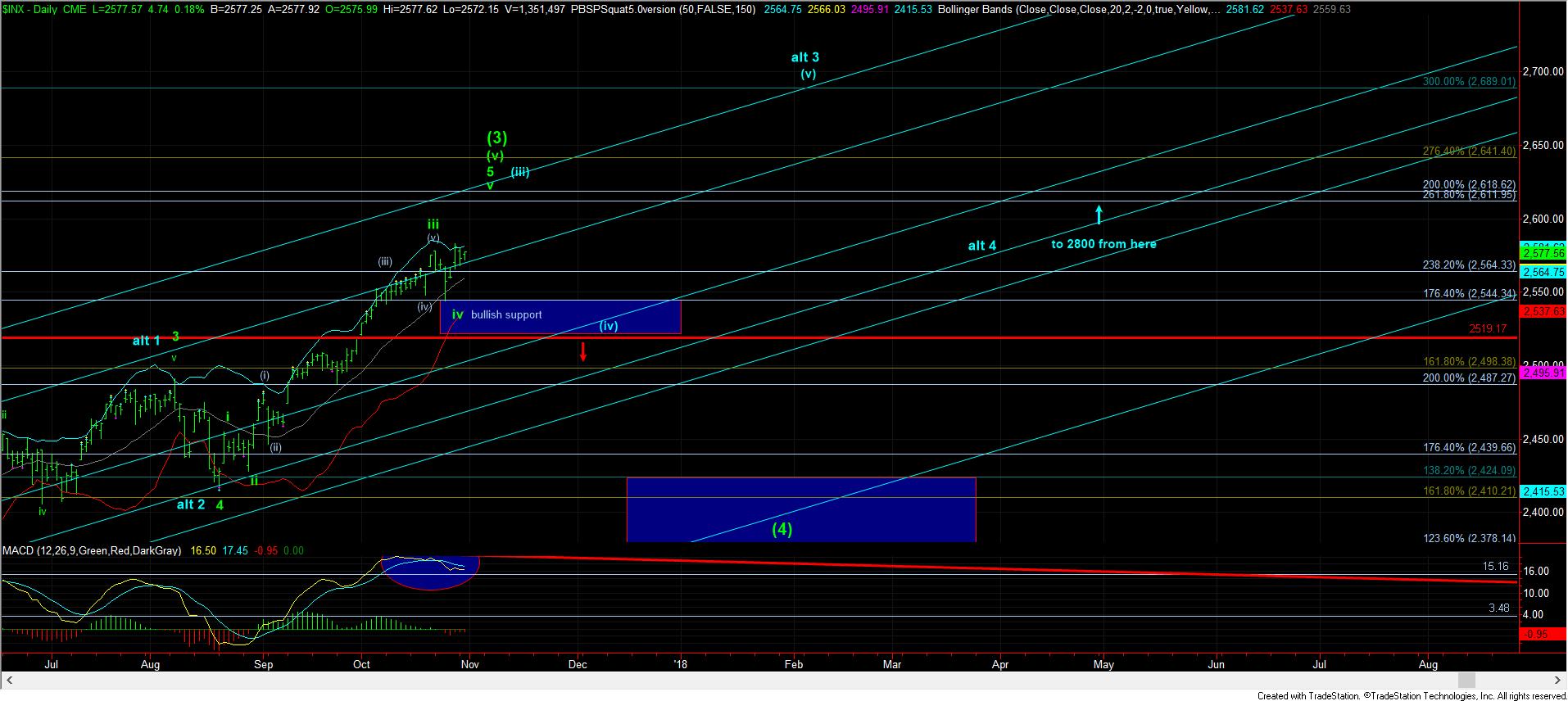

So, as we have seen many times before, the market has a downside set up in place, but has not taken the opportunity to take advantage of it for another pullback. Rather, it has now meandered in the current region with an overlapping pattern so as to not provide a strong immediate directional signal as it remains between 2568-2583SPX.

Moreover, it seems the market may want to wait for a catalyst, and we have yet another Fed day on tap tomorrow. For those that have followed my work for some time, you would know that while I recognize that news may act as a catalyst for a market move, the substance of the news will not provide you with the directional bias for that move.

So, this afternoon, I am going to take you through my thought process as an analyst, and you will then understand why I am still torn as to a strong immediate directional bias.

Let’s discuss what we know. We know that the market provided us a very shallow wave iv (.236 retracement of wave iii), whereas standard 4th waves usually see only the a-wave of the 4th wave bottoming at the .236 retracement level. We know that the market rallied directly to the 1.00 extension off the low we struck last week, wherein we have a perfect (a)=(c) corrective rally count. We know that the market invalidated a standard impulsive structure off the low we struck last week when we broke below 2570SPX yesterday. We know that c-waves in an a-b-c corrective pattern are most often standard impulsive 5 wave structures. We also know that the market only provided us with a 3 wave drop off last week’s high.

So, the market provided us with a shallow drop off its October 23rd wave iii high, and did not provide us with a standard impulsive rally off that low. Normally, coupled with a perfect (a)=(c) rally off the low, this will signal a b-wave high with a c-wave down still to come within wave iv.

However, we also know that this bull market has been quite strong and the market has not been providing us with standard sized pullbacks. And the fact that we did not drop in a standard 5 wave move off the high seen at the end of last week does not provide us with a strong indication that the market is going to want to follow through in a c-wave back down to our support region below.

Based upon all we know, I hope it is clear that the market is not providing us any strong directional cue from an Elliott Wave structure perspective. This leaves the potential open for both a diagonal pointing higher, and a diagonal pointing lower. And, for this reason, as long as we remain between 2568-2583SPX, I “lean” slightly towards us still being in wave iv, but have no conviction as I have no clear set up. That is the conclusion to which I must come based upon the facts that we know, as I have listed them above.

PLEASE also remember that there is nothing that is suggesting this rally off the August lows has yet completed, as we need AT LEAST one more push higher before we can even consider an ending diagonal is completed for this wave v off the 10/25 lows.

If you feel you have further clues to point out, feel free to post them as a response to this update.