The Market Is Setting Us Up – The “New Paradigm” Is Almost Here

For the last 5 days, I have been in a hotel room in Idaho Falls waiting for my wife to get clearance from the doctors to fly home. During that time, while my wife has been sleeping, I have been contemplating the overall nature of the stock market within its greater context. So, I wanted to take a moment to put pen to paper (so to speak), and just present to you what I have been thinking.

The bearish price action of 2008 did a lot of damage to the investor psyche. In fact, it chased many investors away with the belief that the stock market can destroy your wealth in a very short time and gave many investors the impression that it was too volatile and dangerous to trust with their long-term money. In summary, trust in our financial system was destroyed.

However, the price action we have seen since the bottom in 2009 has been doing just the opposite. In fact, the downside moves have been relatively short and V-type bottoms have triggered relentless rallies. The stock market action has indeed turned investors from fearful of the market (2009) to fearing to be short the market (2019). And, I think that is something very important for any true student of the market to recognize and understand well.

But, this change in the nature of the market will likely build towards a euphoric market top in the next several years. So, the main point I want to highlight is that we have clearly moved from a period where the sentiment of market participants was a fear of the long side to now a fear of the short side.

In fact, I recently saw a post that epitomizes how well the market has now changed the thinking of investors:

“BTFD is THE place to be, till the bull market tops out.. and who knows when that will be”

To me, this says that investors have clearly been trained to buy every dip. The manner in which the market has trained investors is truly remarkable, and was necessary in order to set up the next long-term top. And, without understanding the larger context of the market and where a longer-term market top can strike, it means they will certainly be buying the dip well after the market has struck a long-term top.

Moreover, it seems that the common investor gives credit for this relentless rally to the supposed “Fed put.” Most now believe that it has been the Fed’s brilliant engineering of the market that has caused this rally of the 2009 lows. Along with that belief comes the developed belief in the omnipotence of the Fed. This has led to the erroneous belief that, since the Fed controls the market so well, the Fed can continue to prevent any bear markets. But, that misguided belief in the Fed will likely lead to most investors’ undoing.

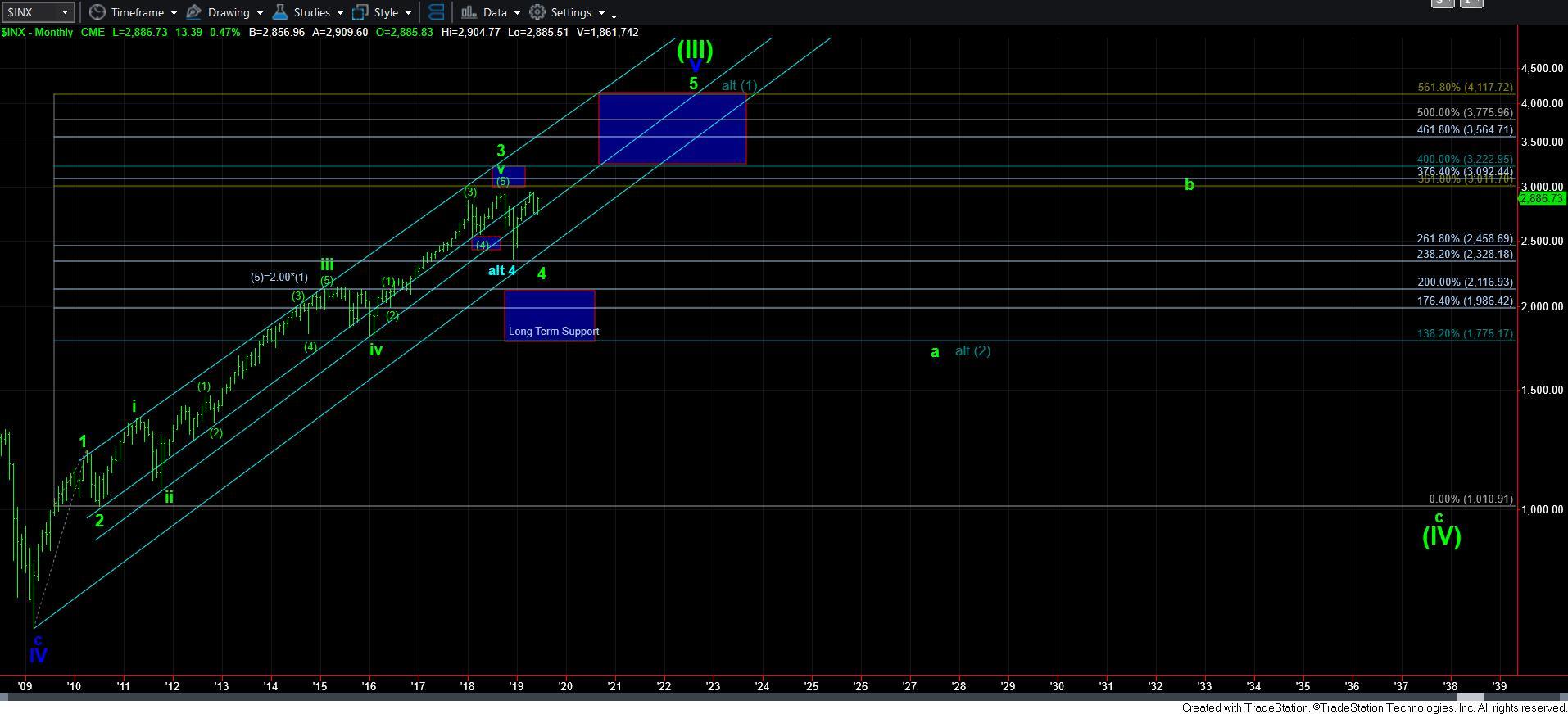

This is why the context provided to us about markets by Ralph Nelson Elliott 80 years ago is so vitally important. We understand that larger degree 3rd waves convince people to move from a bearish perspective to a bullish one. And, since we concluded the 3rd wave off the 2009 low back in 2018, it makes sense to see comments by market participants similar to the statement quoted above. The market has done a fine job in convincing participants to only buy the dip.

In fact, it is within the 4th wave consolidation that we see this sentiment become pervasive among the retail world, which is simply how the sentiment of the crowd develops during a 5-wave structure. And, it is the retail investor world that is often the main segment of the market that drives it up to its final high in a 5th wave. I don’t think this time will be any different.

The shortness of the corrections we have experienced since 2009 have trained investors quite well to believe that any downside will certainly be bought, and it will not take the market much time until it recovers to new highs. This shortness in the timing of corrections is what has amazed me the most about the market character since 2009. And, I am now surmising that this was the only way the market could convince the retail world that “BTFD is THE place to be” after its trust was seriously damaged by the action in 2008.

I am always fascinated by the herding principle and how markets are driven by sentiment. And, I must say that the price action we have seen since 2009 has quite remarkably convinced the herd once again that “BTFD is THE place to be.” Yet, this seems to be setting us up for a major topping out in the coming 3 or so years.

So, while I still think we have several years left to complete the 5th wave to higher levels, I wanted to at least make you aware of how the overall market sentiment has seemingly changed from a fear of the market to one where “BTFD is THE place to be.”

In fact, I think we will likely see even more bullish extreme views of the market within the next several years. Therefore, it would be wise for you to take note as we move from “BTFD is THE place to be” to the point where investors are going to believe that the Fed has done a masterful job with regard to maintaining a floor under the market, and no real correction will ever be seen in our lifetime. Yes, my friends, we are about to enter the “new paradigm” mode.

For those of you that know market history, you may recognize this quote:

"We will not have any more crashes in our time."

This was said John Maynard Keynes in 1927, two years before the stock market crash which lead to the Great Depression.

In fact, Janet Yellen has recently told us something similar when she proclaimed a little over a year ago that because of the measures the Fed has taken, another financial crisis is unlikely "in our lifetime."

As George Santayana wisely noted, “[t]hose who cannot remember the past are condemned to repeat it,” and it seems as though many have forgotten the past. Despite Ms. Yellen’s proclamation, I fully expect to live to see it go down in history as further evidence of the hubris of those supposedly “in charge.”

History is about to repeat itself in the coming years, and if my primary wave analysis is correct, this could be the hardest lesson investors learn since the Great Depression. So, as we get set in the coming months to move into our 5th wave which I think will last from 2020 to 2022/23, please be mindful of the past as we look to the future.