The Bulls Are Still In Charge

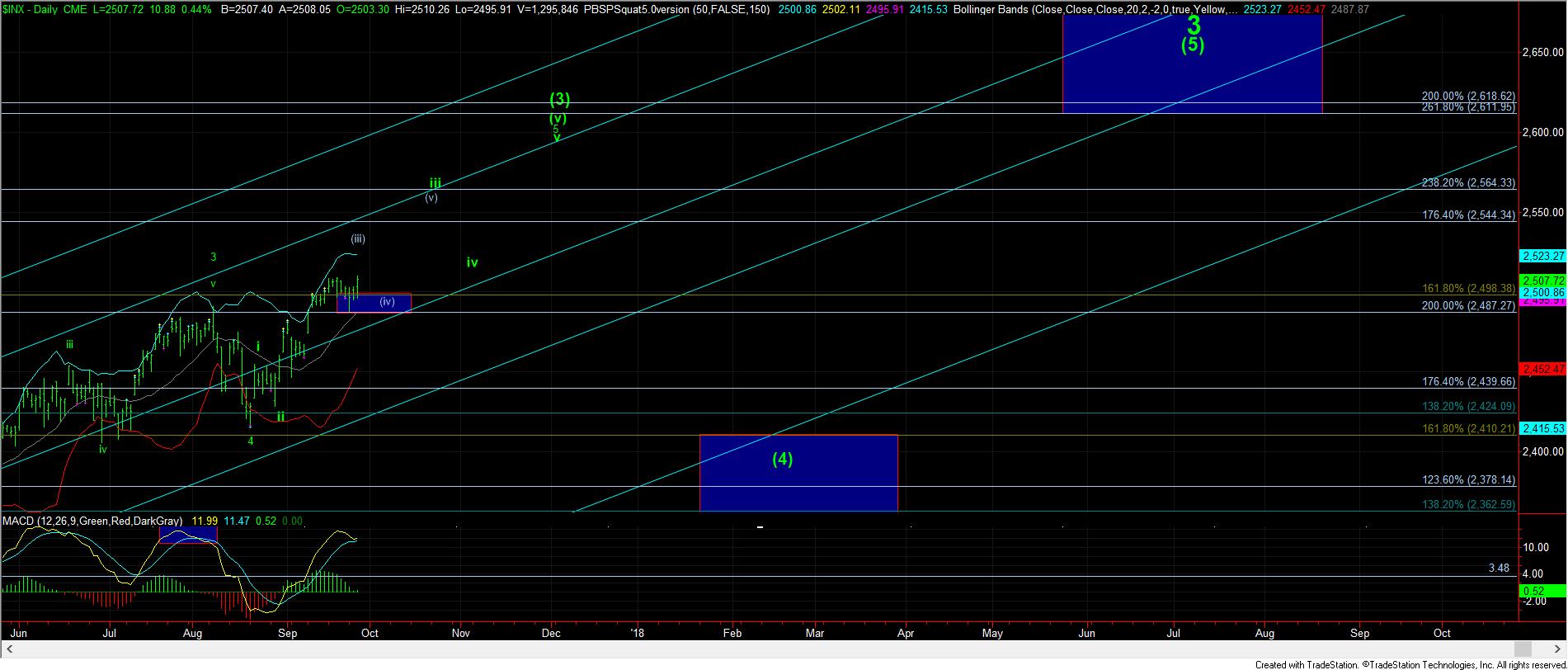

Today, the market accomplished two things. First, it completed a leading diagonal for wave i of (5) of grey (iii), and then provided us with a wave ii pullback. And, at all times, we have held that 2489SPX support on that pullback today.

Second, the IWM broke out over its resistance, and then continued higher. This is strongly suggestive of the fact that the bull market will likely continue higher. In fact, my initial target on a breakout in IWM was the 148.64 region, and it seems as though it will blow through that region should this strength be retained. The next Fibonacci extension over that is in the 152.30 region, but, due to this strength, it would not shock me to see the market extend up towards the 158 region in the coming month or two. And, at this time, the 145 region now becomes support once the market broke through that resistance. A break back below that support would have me revisit this structure.

Barring a strong reversal, the SPX is now setting up to strike the 2522-2526SPX region for wave iii of (5) of grey (iii), as you see on the 5 minute chart. It would take a reversal below 2496SPX to invalidate this pattern.

For those that are still a bit uncertain of the long side, remember, the micro count in the SPX has this only as wave (iii) of iii in the more bullish count. Of course, due to the choppy nature of the market of late, it may still provide us with another surprise. But, if it can extend up towards the 2530SPX region in this segment of the rally for wave (iii), then you will likely have an opportunity to buy a wave (iv) pullback towards the 2500-2510SPX region where we will re-test this break out region from above, which will then set up the wave (v) of iii rally to the 2550-60SPX region.

As I have been noting the past few days, as long as we hold 2489SPX, the bulls remain in charge. With the break out, we now will move support up to the 2496SPX, and we should not break back below that region again until all 5 waves in this rally complete sometime over the next month or two. Breaking back below it would suggest something else is in play. But, over it, we have to view the market as bullishly inclined.

For those that take a bigger perspective of the market, you will see that we potentially have another 75-100 points higher in this current rally, should we reach all our extensions. However, I still fully expect that, once wave (3) completes within the next month or two, we will drop back down to the 2400SPX region in wave (4), but it may take us into the first quarter of 2018 until that completes.

But, there is no question that as we move higher in this extended wave (3), the risks clearly do rise. And, one of those risks is that this may turn into a larger ending diagonal pattern. So, PLEASE make sure you know where support resides, and should anything develop in the next few days which reverses this move, it would be a first clue that we may be dealing with a much larger ending diagonal pattern, and that will increase the risks exponentially, as well as the complexity in the market. But, for now, as long as 2496SPX holds, we have to look higher.