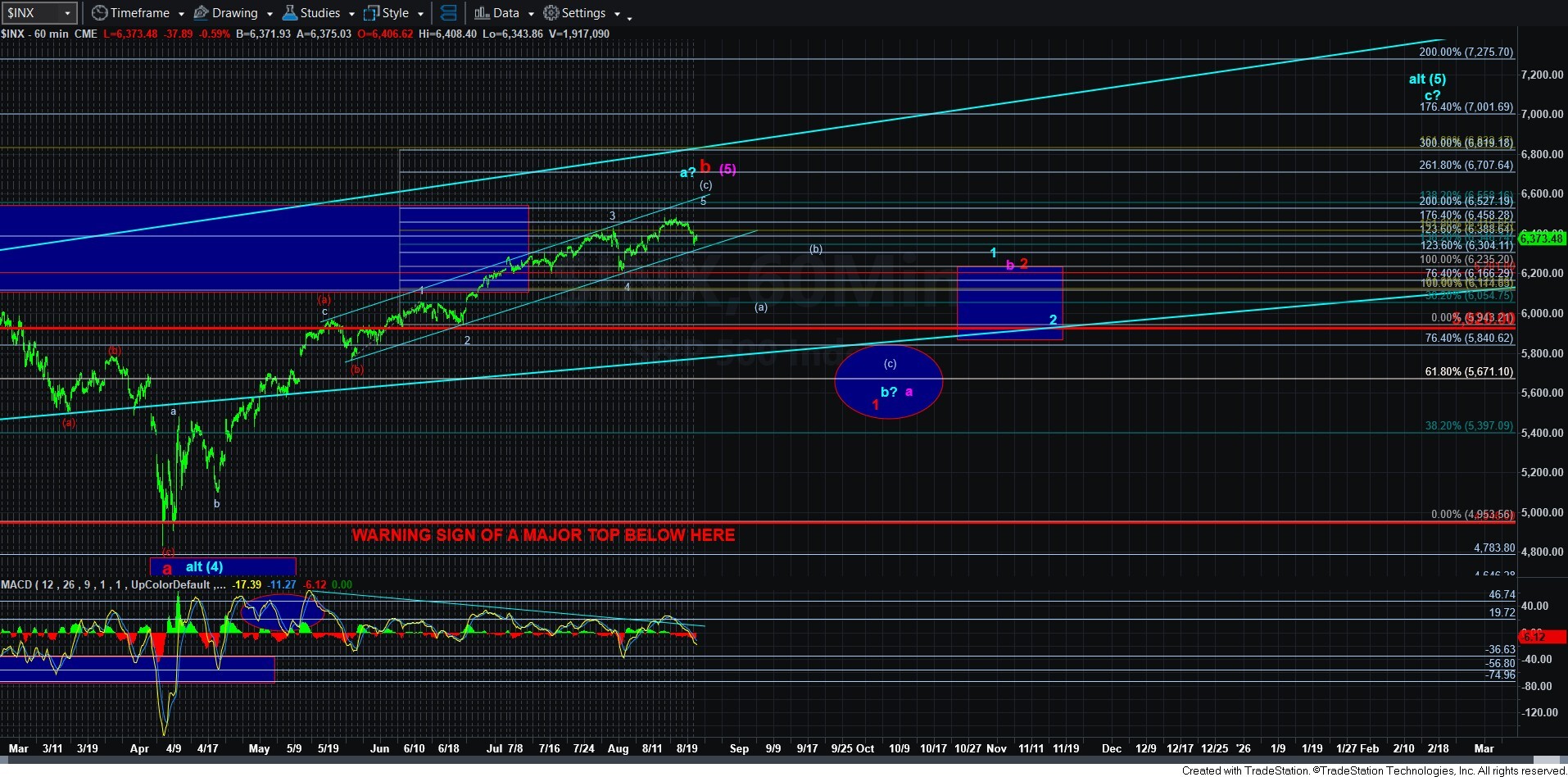

Testing Support - Market Analysis for Aug 20th, 2025

With the follow-through this morning, into the support box, the market has now struck the ideal target for a 4th wave in an ending diagonal. You see, in the great majority of ending diagonal structures, we see overlap within waves (1) and (4). And, this morning, the market provided that overlap before it began its bounce back up into the afternoon.

However, being a purist, I can count for one more lower low as long as the pivot box on the 15-minute ES chart holds as resistance. But, clearly, we have enough waves in place now and have struck the ideal target to consider all of wave (4) as complete.

In order to invalidate a potential 5th wave higher, we would need to see a break-down below the wave (2) low, which is the 6287SPX level I have noted on the 5-minute SPX chart. Until such time, I am going to look for one more rally higher, even if we go a bit below the support box on the SPX 5-minute chart.

But, as an aside, I have a hard time seeing that potential in the NQ, so it may not see a higher high even though the SPX can.

In the bigger picture, while I am certainly expecting a larger pullback, if not a major top being struck, we still have no confirmation that anything has been broken or that the upside is done. So, please do not get too bearish until the market confirms that some form of top has been struck by at least a break-down below 6278SPX. Follow-through below 6212SPX will make it a much higher probability.