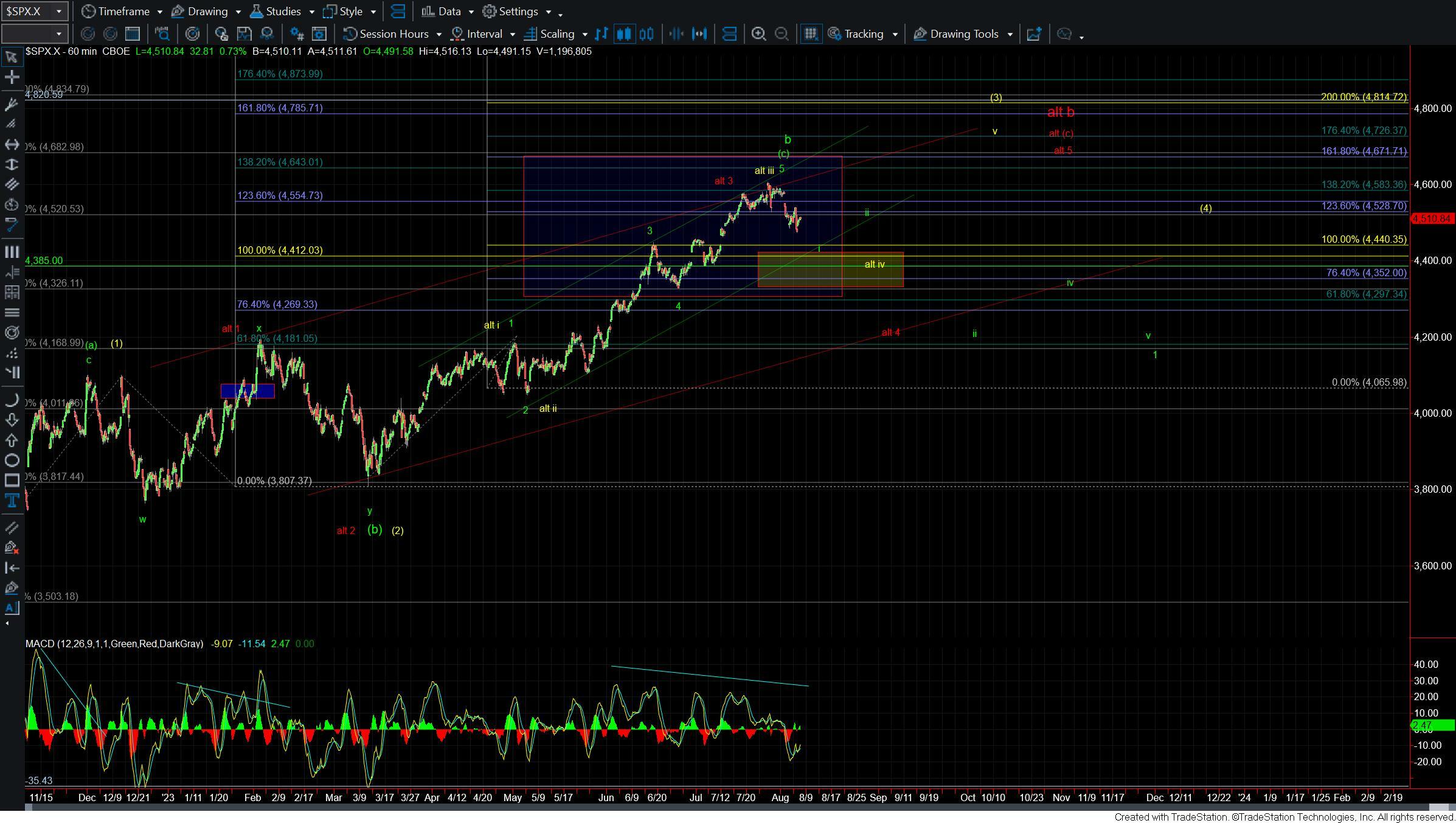

Testing Resistance - Market Analysis for Aug 7th, 2023

After moving lower last week today the market opened higher and continued to grind higher into the time of this writing. Currently, we are closing in on the upper end of the micro resistance zone which should tell us whether we are going to see this move lower to give us a lower low for a cleaner five-wave move to the downside or whether we likely have already put in a bottom in a more sloppy and less reliable five down in the form of a leading diagonal.

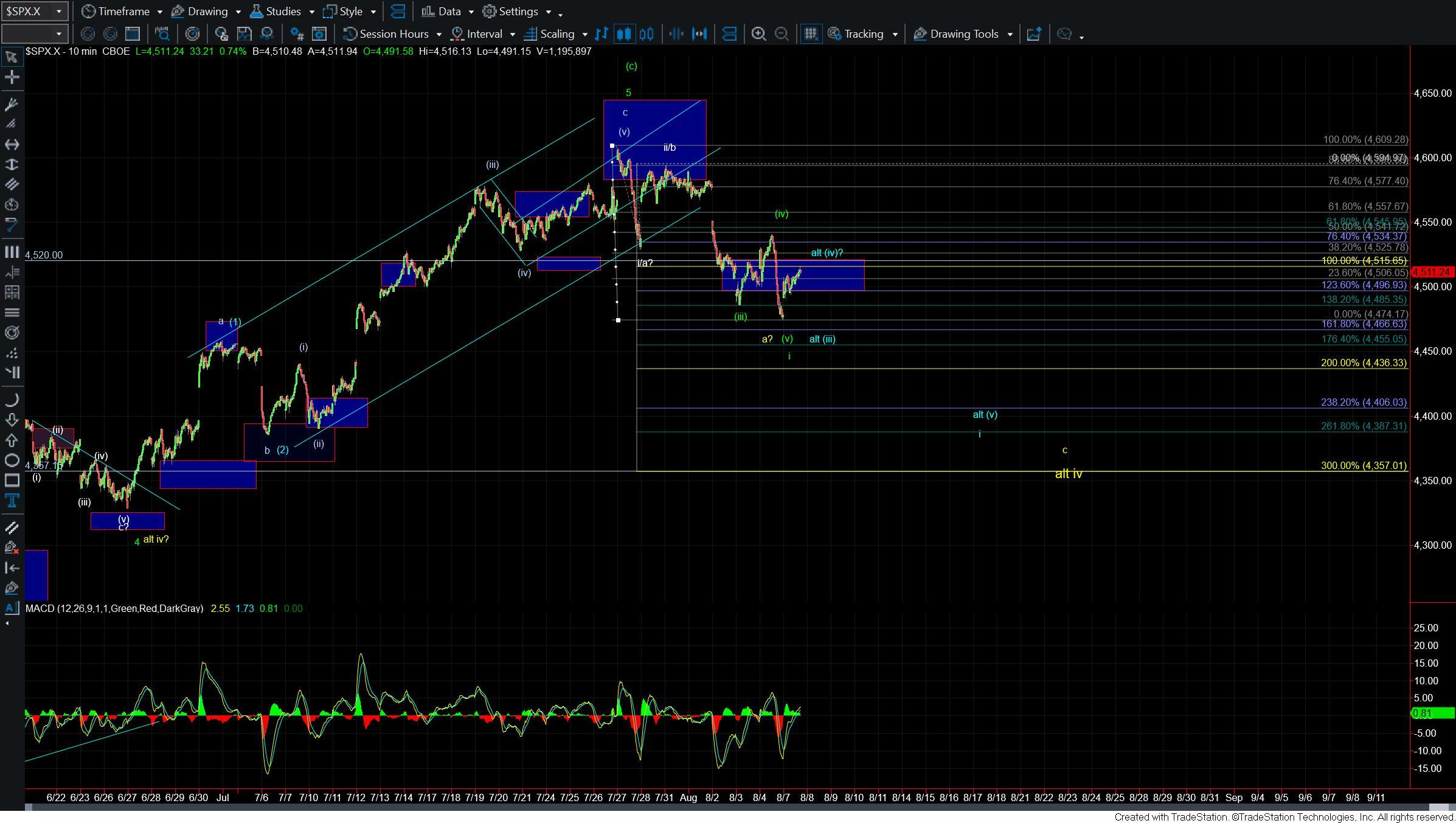

So from here, it remains fairly straightforward on the smaller timeframes and if we are able to hold under the key micro resistance zone and make another lower low then we will have a potentially more clear five wave move to the downside whereas a move over resistance would still potentially give us five down however a five down in a more complex and sloppy leading diagonal form.

As shown on the 5min chart the micro resistance zone current sits at the 4515/20 region which is a key fib pinball resistance level from the move down off of the highs. Holding that zone and turning back under the 4472 low would then open the door to see a move down into the 4436-4387 zone below to finish off an impulsive five-wave move to the downside as shown in blue on the charts.

If we break back over the 4420 level then we likely have already bottomed in either green wave i or yellow wave a. At that point, overhead resistance would come in at the 4543-4594 zone. As long as that zone were to hold then I would still be looking lower to start either the green wave iii down or yellow wave c down. How we were to follow through upon breaking the lows would determine whether we are following the green or yellow paths into the end of the year.

So while the base case remains that we have put in a top we still have a bit of work to do to give us further confirmation as to exactly which path we are going to follow. That work should be done over the course of the next several days at which point we will likely have a more clearly laid out path as we head into the latter part of this year.