Support Is Rather Clear

There really is not a heck of a lot I can update today, as we still remain well within the parameters we have been working with for some time.

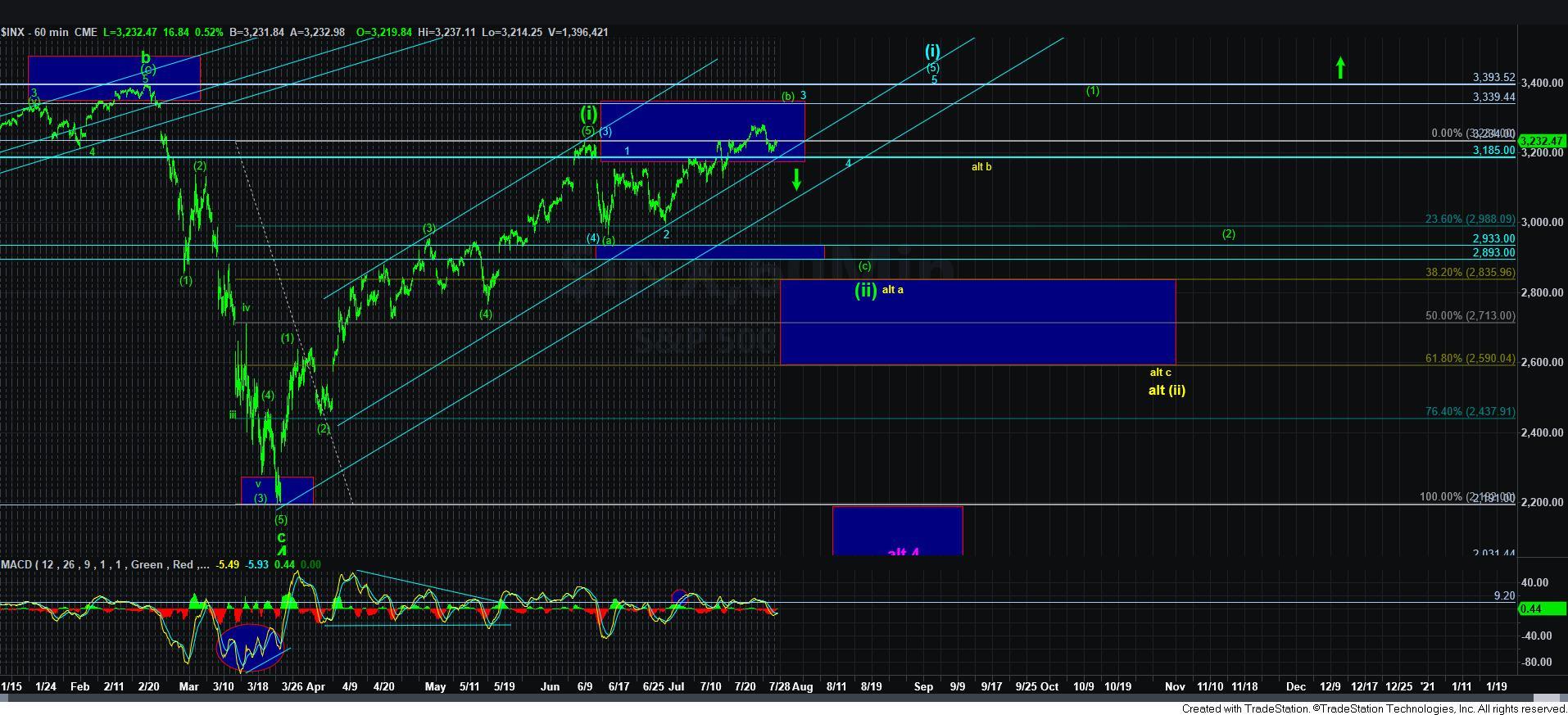

If you look at the attached 5-minute SPX chart, I think that picture says it all.

We are clearly over bullish support, so the bulls retain the ball to drive to 3320-40SPX next. But, simply because the hold the ball right now does not make this a slam dunk. The structure continues to overlap without providing any clean impulsive clues. And, the bullish structure being traded is a possible 5th wave of an ending diagonal towards that upper target.

But, when you consider that should we complete that 5th wave in the ending diagonal, the conclusion of an ending diagonal often ushers in a strong reversal, which will likely be pointing us right back down to this support region once again. So, even if we do head higher, we will likely see much more whipsaw in the coming weeks.

The bears can cause a fumble if we break below Friday’s low, and the bears can recover that fumble if we continue below 3185SPX. They will get confirmation of their drive to the 2900 region on a continuation break of 3115SPX.

So, as I said at the start of this update, nothing much has really changed, and even in the bullish case scenario, we will likely be dealing with more whipsaw in the coming weeks.