Support Holding SO FAR

Yes, take note of the “so far” in the title, as that is important. Yet, unfortunately, the market has not taken us out of its precarious spot yet.

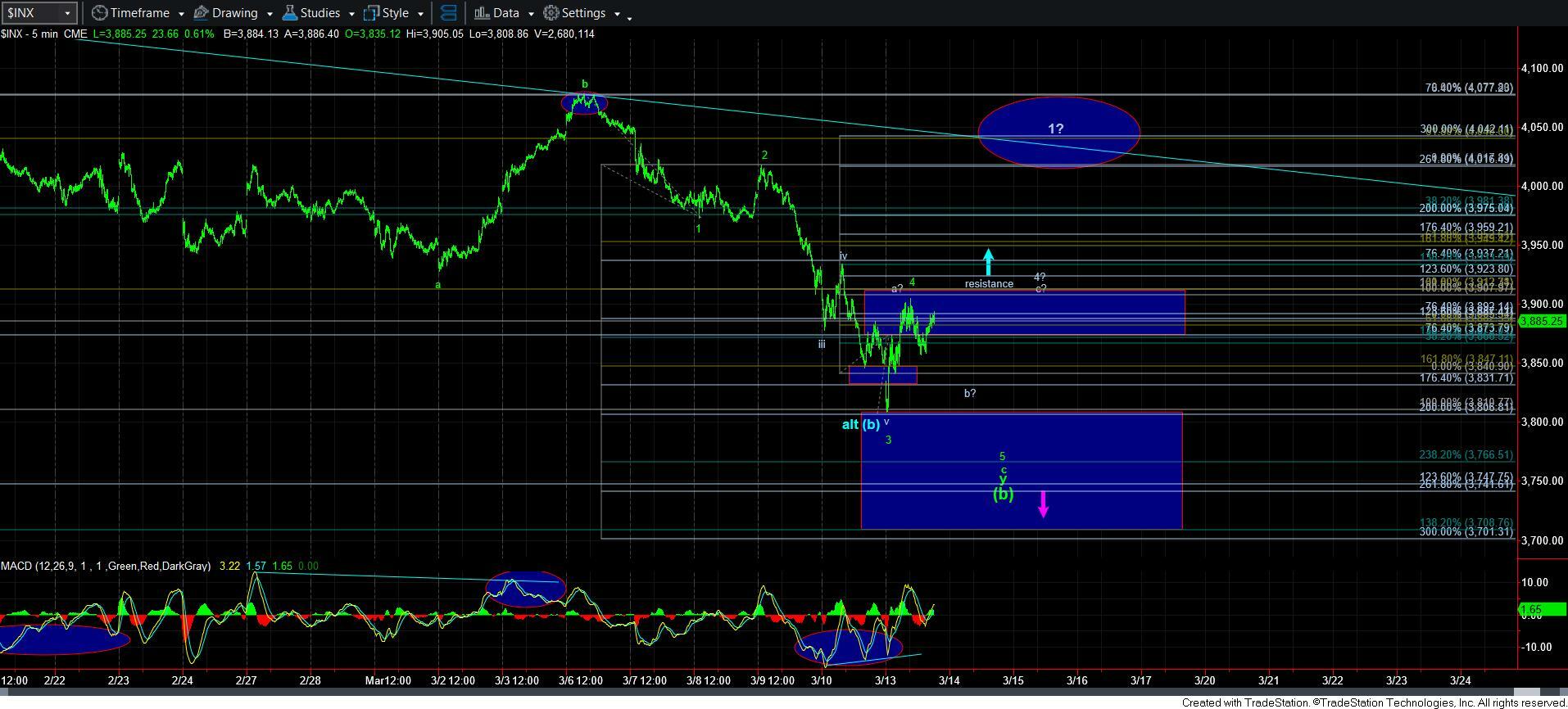

As I outlined in the weekend update and reiterated this morning, the fact that we went down directly to the 3810SPX support region has some very important ramifications. It can represent wave iii of 3 in the purple wave 3 count. And, that is why it is so important for us to be able to take out the pivot/resistance in order to make this potential much less likely.

So, as it stands right now, we remain below resistance. But, even if we do drop again, it can still be counted as a 5th wave in the c-wave of the y-wave of the [b] wave (yes, I know that is a mouthful and quite confusing, so please review the chart to see what I am speaking of).

And, should we drop again, then it is really important that we hold the 3740SPX region for me to be confident of the [b] wave bottoming. A sustained break of that region opens the door to the stronger potential we are in the purple count. Also, I have provided a bit more outline to the purple count on the 60-minute chart. As you can see, it would mean we would likely drop back towards the October low to complete wave i of a larger c-wave decline pointing us potentially to the 2700-2900SPX region. But, again, this remains an alternative for me at this time. Yet, we all now know how to recognize this potential in the coming days.

For now, I am still leaning on the more bullish outcome, which is pointing us back to the 4300+ region. Yet, I have no reason to be trading that aggressively until I see a clear 5-wave rally to the ellipse target we have set for wave 1 of the [c] wave rally to 4300+. Should we see that, then we can consider buying long positions during the wave 2 pullback.

Until the market makes its decision, we have our parameters clearly laid out. And, as long as we remain below resistance, I will likely remain somewhat protective.