Straight Up; Straight Down?

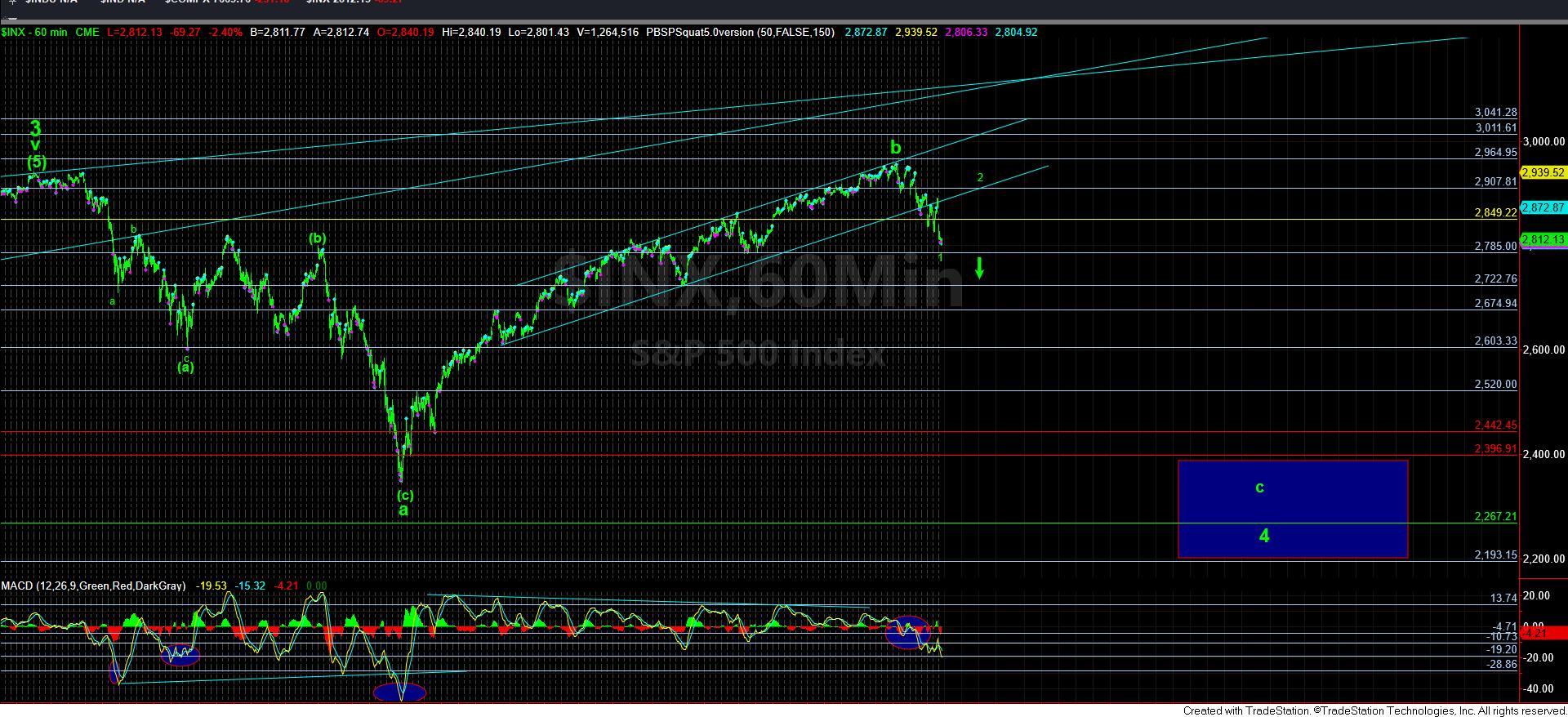

With today’s lower low, we have made it much less likely that the market is going to attempt that 5th wave higher, since we have what counts well as 5-waves down off the high. This is enough to have me view the b-wave as being completed, despite its lack of a solid topping structure.

Now, we move onto the next issue, and that is how the market drops to much lower levels that we expect.

Ideally, I am counting this as the completion of 5 waves down off the recent highs, which I am counting as wave 1 down. That means that as long as the market holds over the 2785SPX region, I am going to maintain an expectation for a corrective wave 2 rally. Based upon the size of the decline thus far, I would expect wave 2 to take us back to at least the 2880SPX region, with the 2920SPX region being the upper end of resistance, as shown on my 5-minute chart.

But, I must provide some warnings to those who may attempt to play the long side on this potential bounce. You see, the daily MACD is pointing down in the same manner in which we have seen larger declines simply continue from these oversold conditions on the smaller time frame charts. Most specifically, I warned that if we see an immediate and sustained break down below 2785SPX, that could open that downside door in a big way, and suggest we could be in the heart of a 3rd wave decline earlier than expected. That is shown in the dark green count on the same 5-minute chart.

What is most interesting of this alternative scenario is that, just as the market moved higher without any pullbacks off the December lows, we may see the same type of move to the downside. This would likely be the most painful to all market participants, as it would probably trap everyone on both sides of the market action, so please keep it on your radar for now.

For now, I would prefer to see a wave 2 retracement back up towards the 2880-2920SPX region. But, we will need to see a strong move back over 2830SPX to suggest this is in progress.

With the market breaking back below 2880 again last week, and just as it did in the fall, it was a warning to the long side of the market that risk has risen. At this point in time, I am expecting a much bigger decline to take hold, and potentially take us back down towards the December lows. The question with which we are now dealing is the specific path.

But, again, I am going to make sure everyone remains focused on the greater likelihood that this decline will set up that rally to 3500+ we expect in the coming years. Please make sure you focus on the bigger perspective, since the downside can provide us with 600 or so points lower, the upside is still 700+. Stay focused during the decline.