Still Set Up For Higher

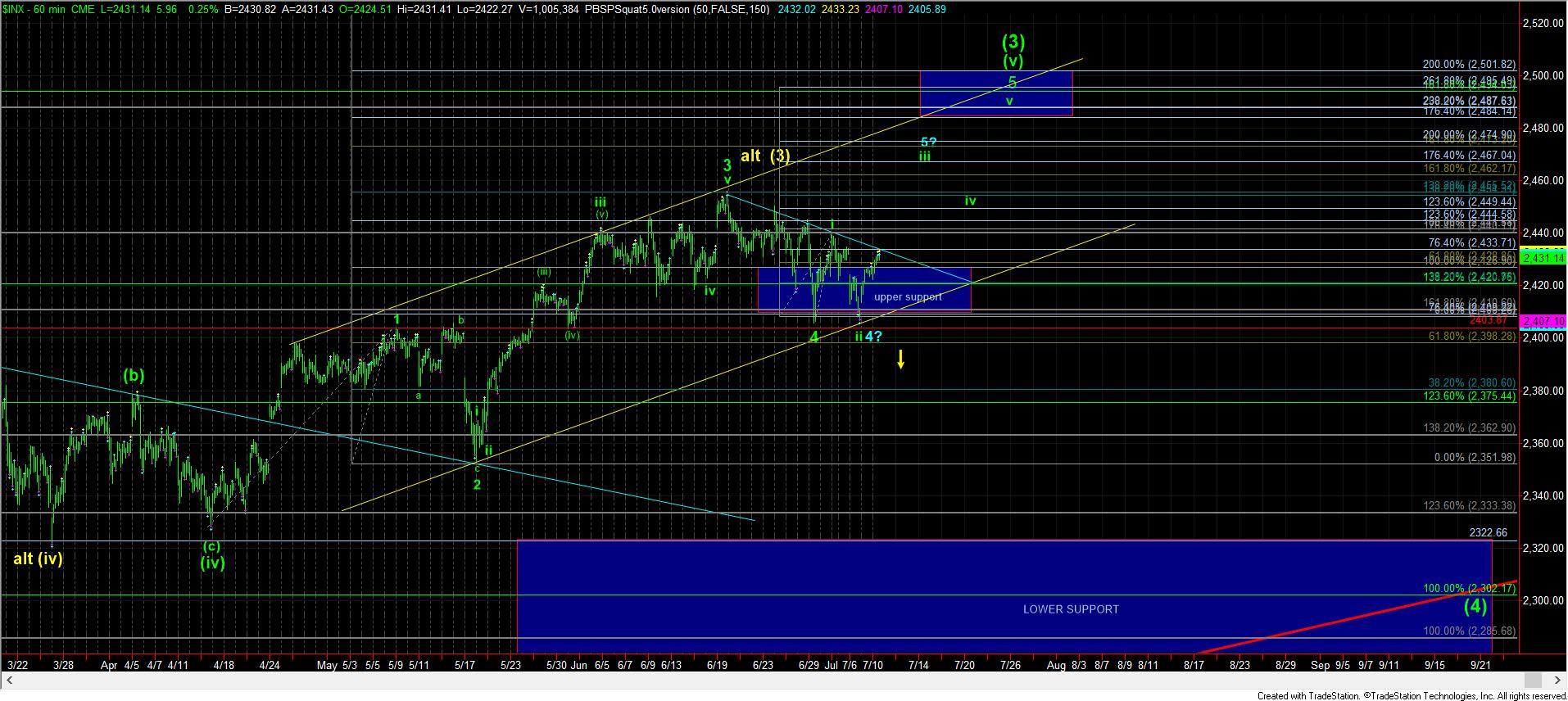

Yes, I know I sound like a broken record, but as long as we do not see a strong break down below 2400SPX, the market still seems to be setting up to hit our higher target region.

But, the smaller degree issue I have with the last pullback is that we have a double bottom. That second bottom can either be a wave ii of a bigger impulsive structure or a truncated 5th wave in an ending diagonal for the 4th wave, as presented in blue.

To be honest, I have been going back and forth as to what I would classify as the “primary” count, and have finally decided upon the green count as presented since it targets a higher level. But, if the blue count is actually operative, then it suggests that we could be looking for “one more higher high” in a week or two that will not show up. So, while my primary count is going to be the green count, I think the risks would be quite high trying to aggressively trade for that final iv-v in green.

To reiterate my overall perspective, as long as last week’s low is not breached, pressure will remain up in the green count. And, once we are able to move strongly through the downtrend channel, I believe we will be on our way to the target region we have been seeking for quite some time now.

Alternatively, should we break below last week’s low, and strongly follow through below 2400SPX, I would have to view us as being in wave (4) already. But, again, my primary perspective is still focusing on the upper target to complete wave (3).