Still Over Support for Now, but the Air Is Thin Up Here

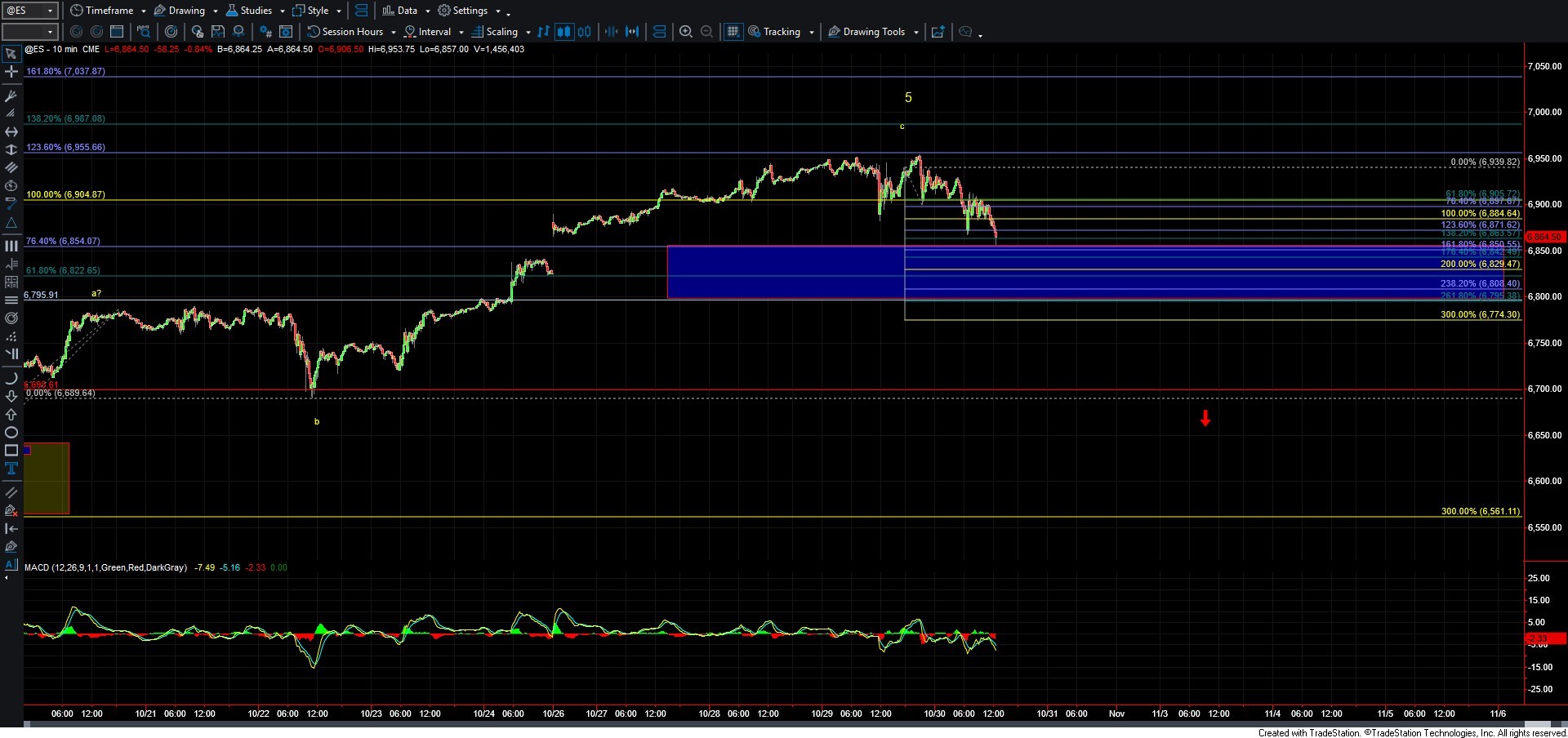

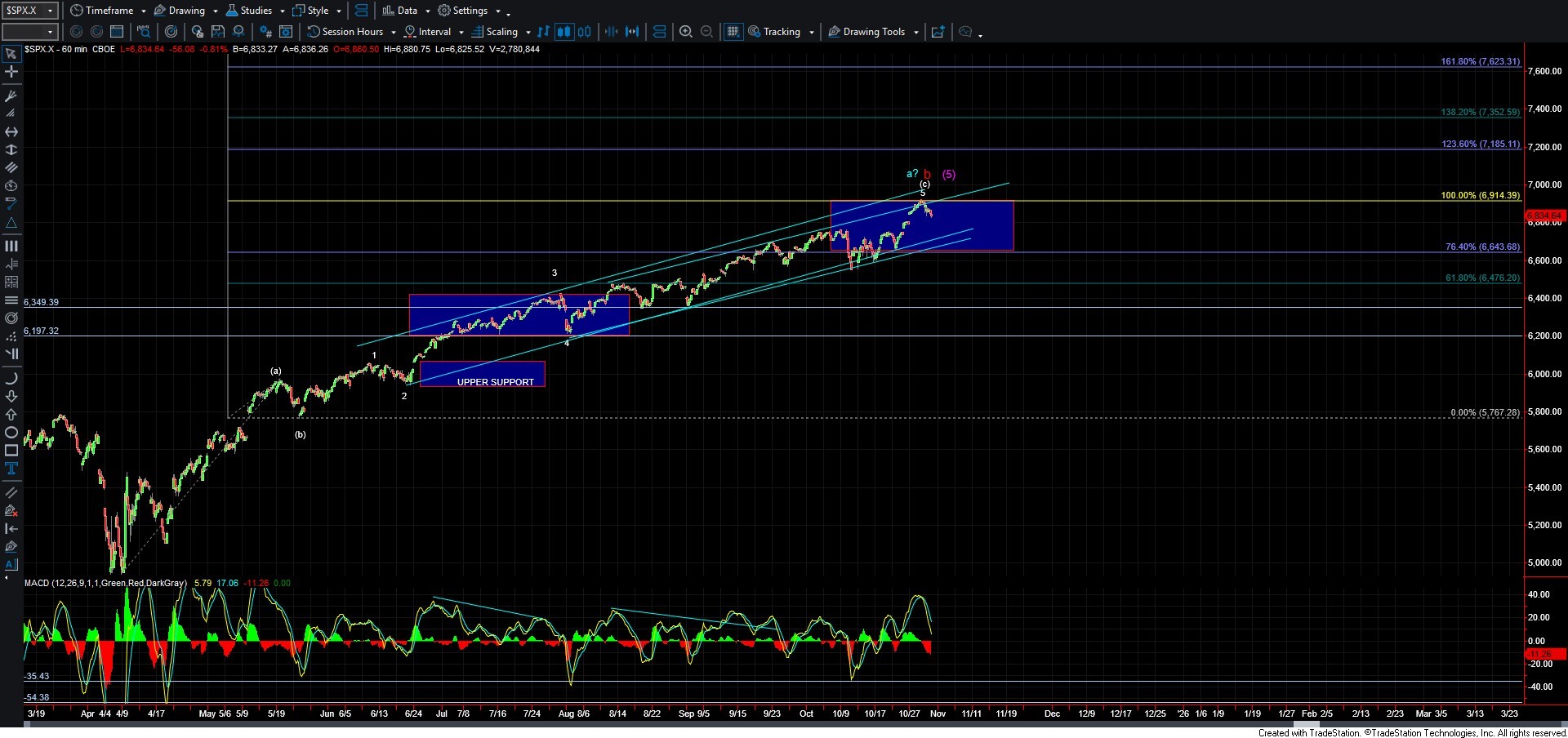

Today, we saw the market move slightly lower in what continues to be overlapping action to the downside. While I can make a case for a potential leading diagonal with this most recent micro lower low, it’s far from a reliable pattern at this stage. I would need to see further confirmation before putting much weight on that interpretation.

For now, my focus remains on our key price support levels to guide us in determining whether a top has been struck. As previously noted, this market remains very stretched from both an Elliott Wave and Fibonacci perspective, making the air quite thin at these elevated levels. That said, without a clear five-wave move to the downside and with support still intact, the market retains room to push higher before any significant top is confirmed.

Overall, there isn’t much to add to the prior analysis. Today’s move took us into the upper portion of the support zone, which I currently have in the 6,850-6,795 region. I’ll be closely watching the structure of the next move higher to determine whether it presents as corrective or impulsive, as that will provide valuable clues about whether a top may already be in place.

Given that much of the recent price action has been corrective in both directions, consistent with the likely diagonal structure we’ve been tracking, a clean break of support will remain the better indicator that a top has potentially been struck.

For now, patience remains key. We’ll continue to let the market tip its hand while keeping in mind that conditions remain quite stretched at these current levels.