Still No Confirmation Of A Top

Today we saw downside follow through. However, if you zoom out on the charts, you will see that nothing has really broken yet within the uptrend off the October lows. In fact, as I noted last week, we still need to break down below 3190, and follow through below 3150 to suggest that a top has been struck.

Moreover, I am tracking the potential for this decline to be impulsive in nature. And, should it be able to fulfill that pattern – as presented in green on the ES chart – then I can at least maintain some reasonable expectation for the bigger green count presented on our larger degree charts.

However, admittedly, the initial decline off the highs really looks corrective, but if we do see a 5-wave completed structure as shown on the ES chart, then I will be tracking both potentials. And, how the market breaks down below 3150 will be our tell.

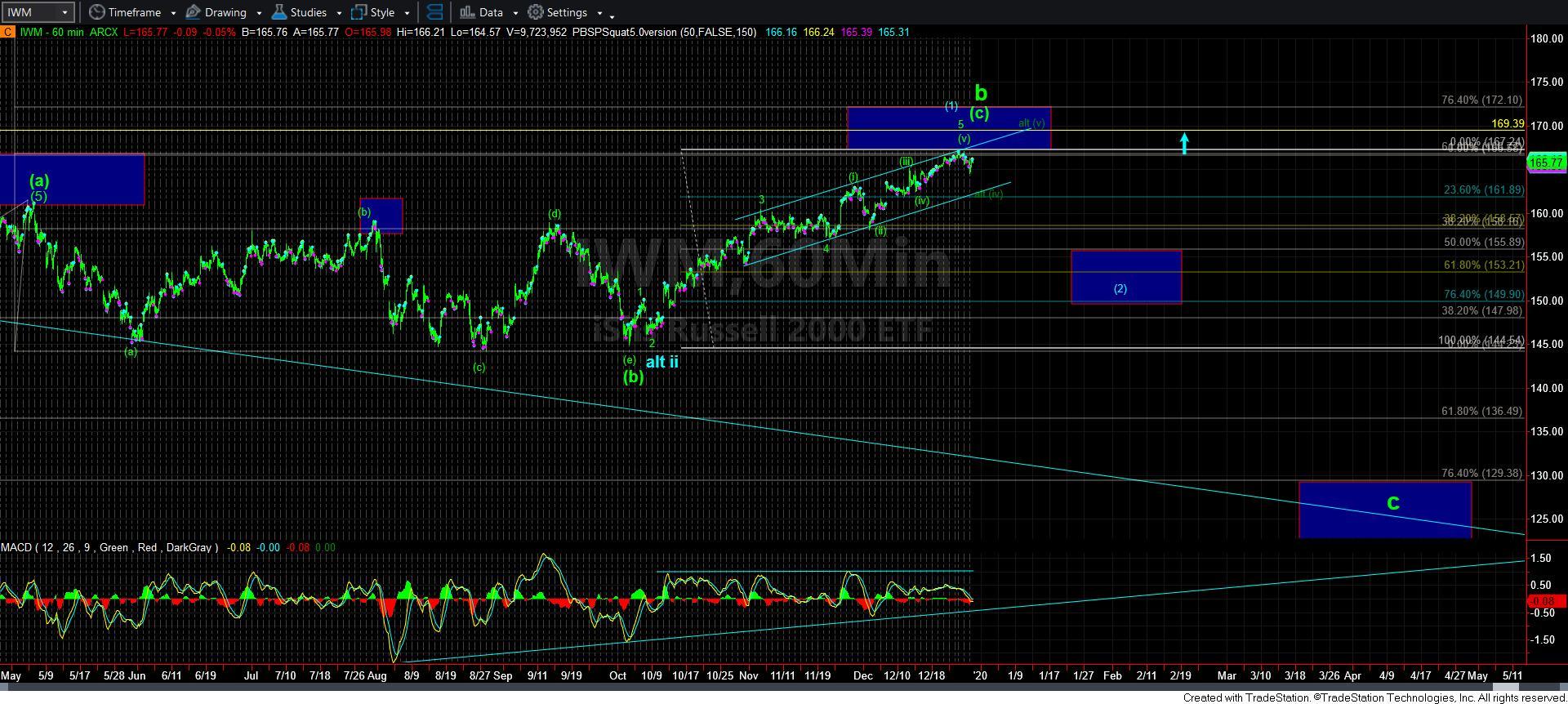

For now, we still have no indications that a top has been struck. This leaves the potential that I have had on the IWM chart with this being a wave [iv] within this rally off the 157 region, and needing a higher high to complete a bigger ending diagonal in this structure.

So, as we stand today, I am still tracking the potential for a pullback, and the nature of how we ultimately break below 3150 will tell us where our buying point will be. For now, the market has not made it clear that we are heading in that direction just yet. It will likely take several more days to have a better micro-directional bias.