Still Grinding To Completion

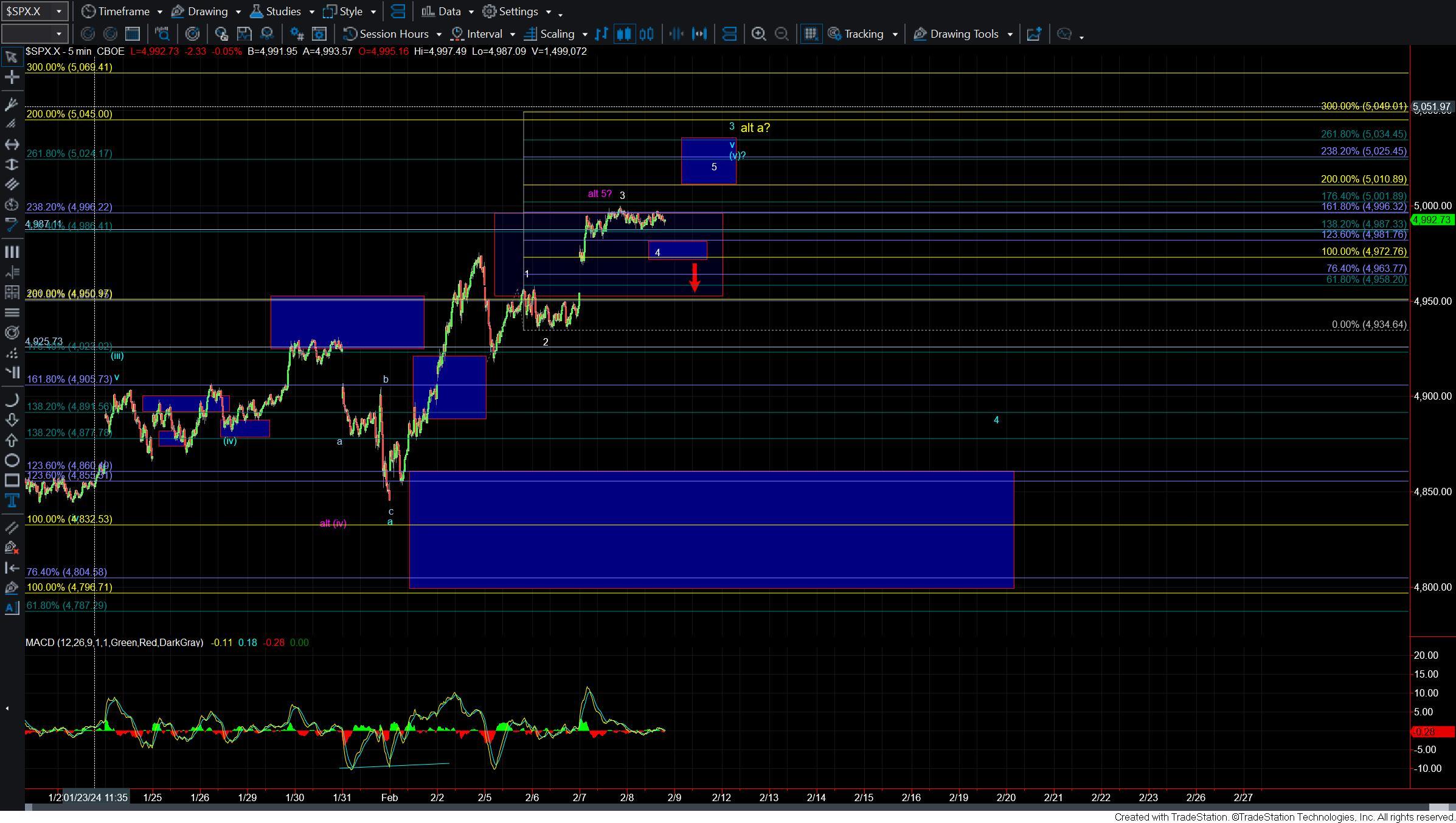

Today the market opened flat and has remained flat all day. This is a fairly typical fourth-wave consolidation action which is supportive of where we currently look to be in the micro count. With that I have very little to add to the previous analysis and the bottom line remains that we likely will see another little micor push higher to finish off our wave 3 before seeing a local top.

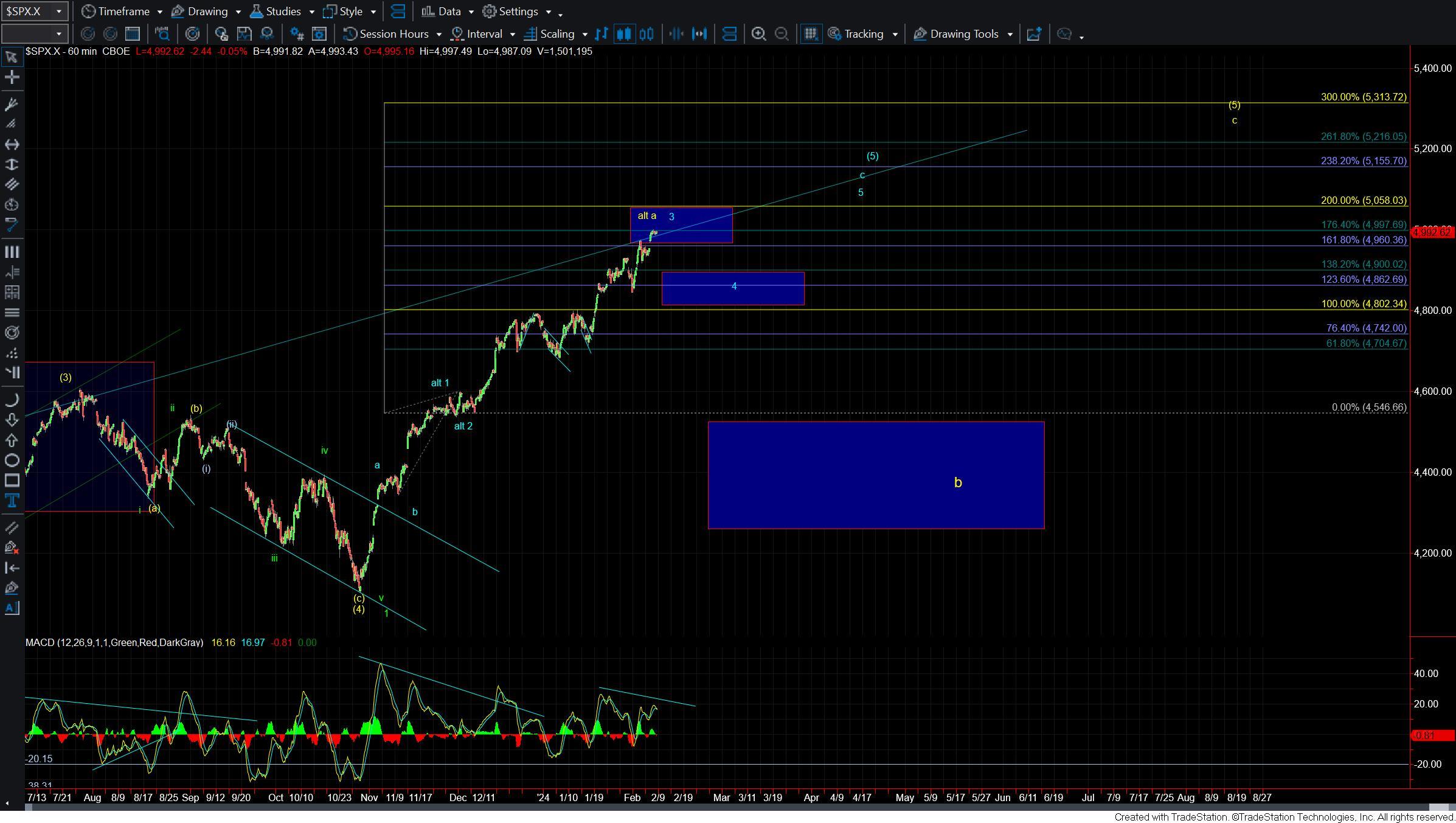

Once we do complete the wave 3 then we should pullback for the wave 4 followed by another push higher to finish off our wave 5. From there we will have a potentially full pattern in place on the larger timeframes and will need to become more cautious. For now and at least on the smaller timeframes this does look like we have a bit more work to do to the upside before that larger degree top is seen.

On the smaller timeframes, I am watching the 4987-4972 zone as support for the wave 4. As long as that zone holds I still prefer to see one more higher high to finish off this move for the wave 5 of (v). If we break under that zone then it opens the door for this to have put in a top in that wave (v) of larger wave 3.

Further confirmation of a top will come with a break under the 4934 level and at that point, I will watch 4860-4800 as key support below for the larger degree wave 4. Should we move below that zone then it would open the door for either a top in the yellow wave a to be in place. As long as we hold that zone upon the larger pullback I do however still expect to see this move higher over the next several weeks before a larger degree top is finally seen.