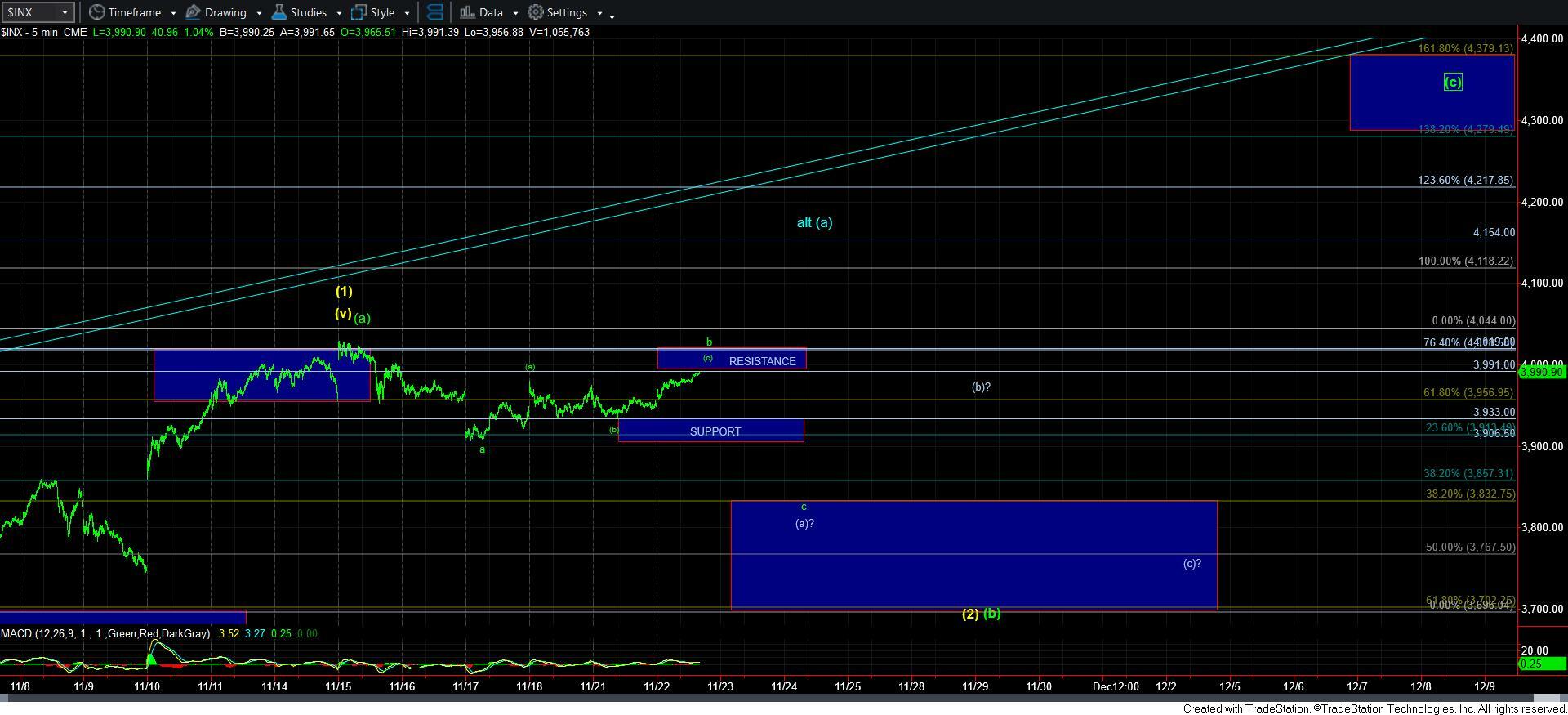

Still Going Nowhere - Market Analysis for Nov 22nd, 2022

Since we topped a week ago, the market has been going nowhere. It seems like we are just stuck. But, I guess that is what consolidations do.

Today, I had to take a step back and outline the overall resistance and support regions. I think that may make things a bit easier to trade.

Overhead, resistance is between 3991-4019SPX. And, if we are indeed tracing out a b-wave, as outlined by the [a][b][c] micro structure outlined on the 5-minute SPX chart, then I don’t think we have enough room for extensions pointing us as high as 4019SPX. But, nonetheless, that is our resistance, at least based upon the high struck in the futures last week, as it represents the .618-.764 retracement of the initial decline off last week’s high.

As long as the market remains contained by that resistance, I am viewing this as a b-wave. Whether that is a b-wave within a larger [a] wave is yet to be seen. But, I discussed this last night, as well as in today’s live video, and it is outlined on the 5-minute SPX chart.

I also have support noted, which is between 3906-3933SPX. Once support breaks, we should be in a confirmed c-wave down to the larger degree support box below.

Since I still need an alternative, the only reasonable one I can consider is the bigger blue [a] wave again. So, I have brought it back on the chart. But, as long as the market maintains below 4019SPX, I view that as a much lower probability.

For now, I am waiting until the market provides us with an initial 5-wave decline to provide a first signal that the c-wave down is in progress. Until then, we seem to be extending into and hitting our head on resistance as I write this update.