Squiggles Still Left On Upside

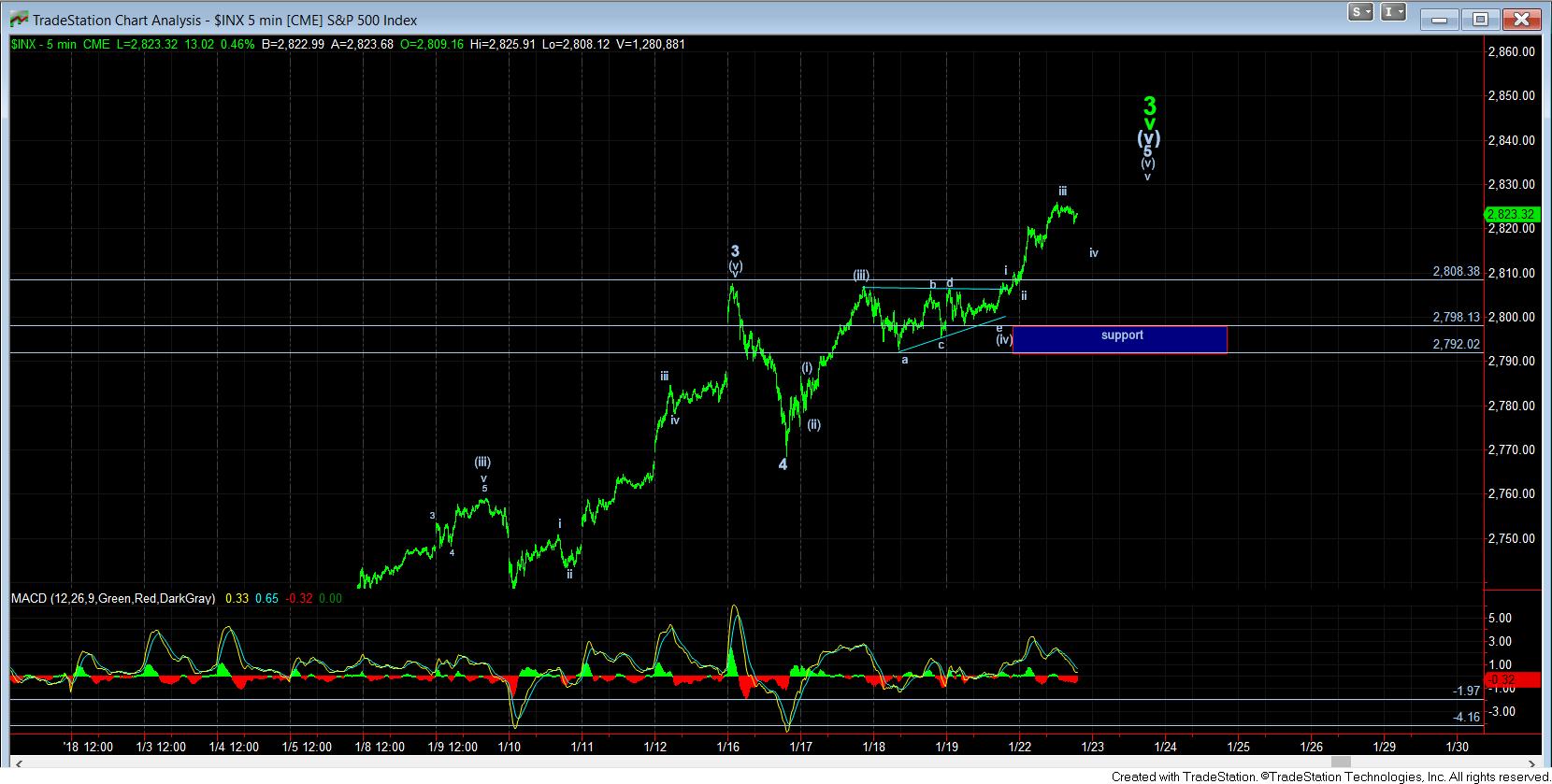

As you saw from the 5-minute chart presented over the weekend on the SPX, the market ideally still had some upside work to complete in the primary wave count for wave (v) of 5 of (v) of v of 3. As presented tonight, it would still seem we need a micro 4th and 5th wave still to complete that structure.

As you can also see from the attached 5-minute ES chart, this upside move counts best as an ending diagonal for the ES, but with the SPX still counting best as a standard impulse off the 1/16 lows. But, in either case, until the micro support noted on the two charts breaks, I cannot begin to look for the wave 4 pullback I want to see on the daily chart.

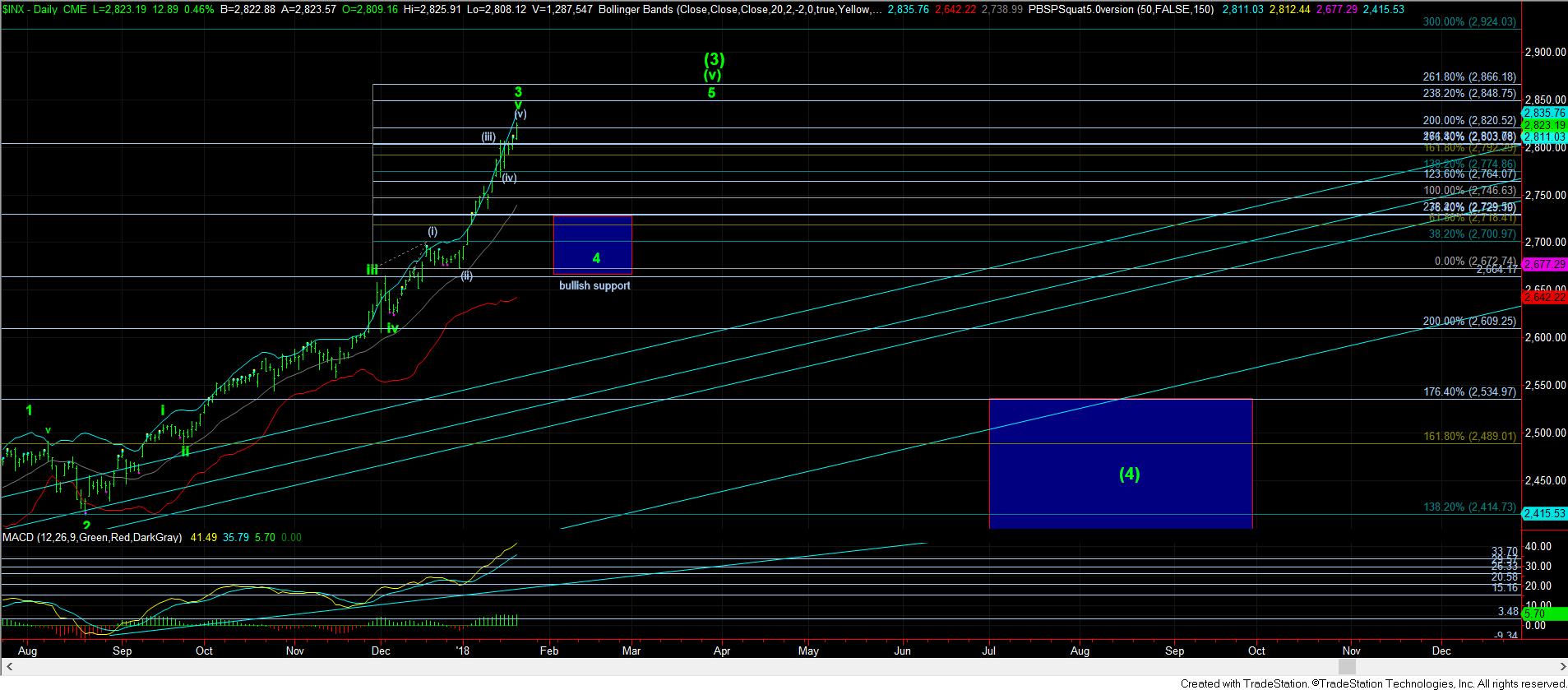

And, now that we are coming closer to the 1.00 extension in the 2850SPX region on my alternative bullish path to the 3000 region sooner rather than later, we are approaching the test of the market to provide us with insight as to whether we are completing a much larger degree wave 3 off the 2009 lows, or if we are still only completing the wave (3) of v of that 3rd wave off the 2009 lows. The answer provided by the market in the coming weeks should provide further insight as to when the next 20% correction takes hold for the larger degree wave 4 on the monthly chart, or if we will still see a wave (4)(5) within this wave v of 3 on that monthly chart.