Slight Change In Plans

With the market just spilling its guts into the close, I thought it would be appropriate if I wrote an update this evening.

To be honest, this looks and smells like the alternative count I have in blue on the SPX. Clearly, this was not my preference, but it certainly has some benefits if this does play out in the coming days.

First, I am probably going to adopt the blue alternative as my primary count by tomorrow morning IF, again, IF the ES does not provide us with a rally off the low we just struck, rather than a corrective "bounce.".

Second, in the event we do have to head back down to the 4120-50SPX region for an expanded wave iv, the further market weakness would provide for some VERY nice re-alignment between the SPX and IWM

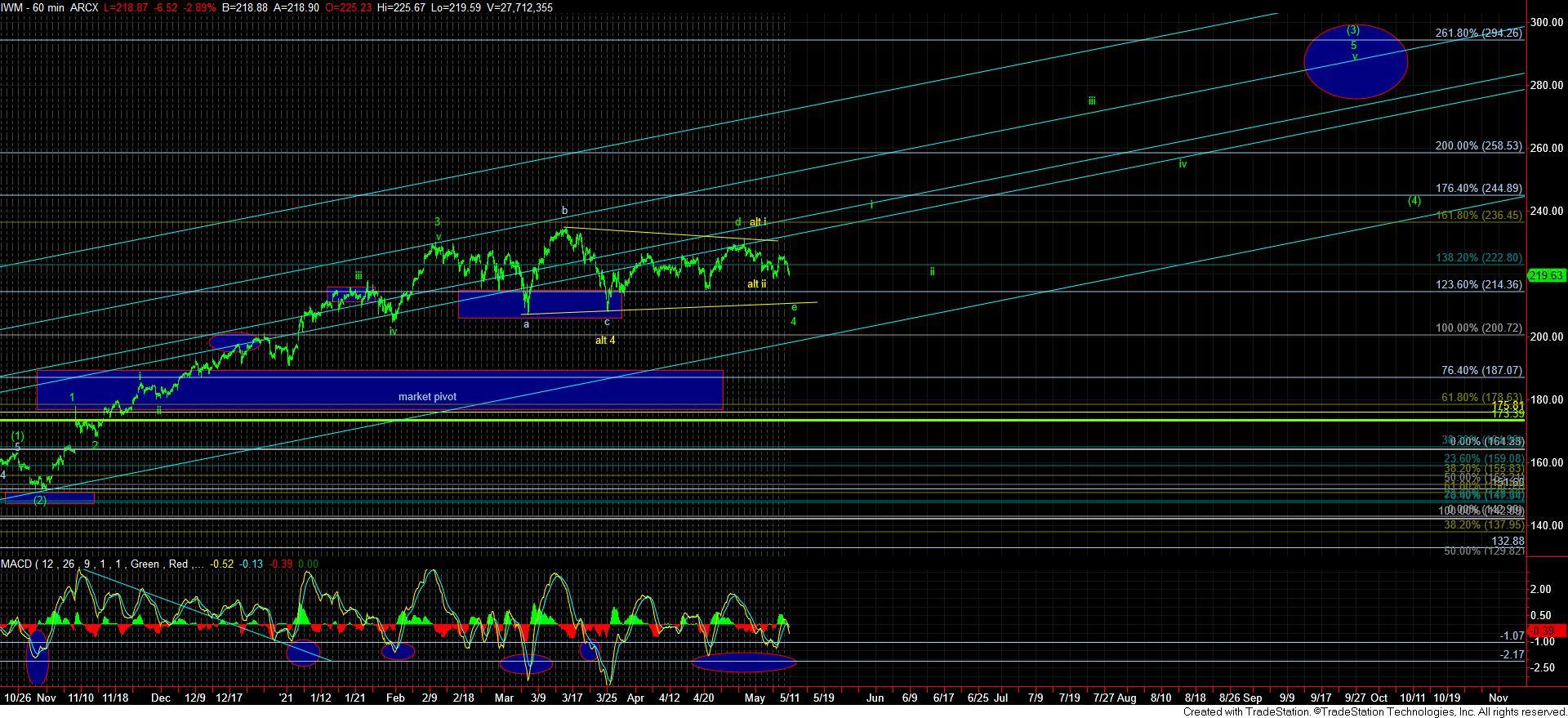

Back in February, I began warning those willing to listen that the IWM would likely begin to lag and the SPX would “catch up” in its wave count. You see, the IWM had already completed its wave 3 of [3], whereas the SPX had not even come close. So, it was reasonable to expect the IWM to lag, while the SPX catches up in its wave count. That is what we have been seeing over the last month or so.

But, if tomorrow brings further market weakness, then we have a strong probability that the two charts will move into re-alignment as we move into the summer. Let me explain.

Assuming the IWM is going to break below 214 in the coming days, then it would be completing the e-wave of wave 4 of wave [3]. That means the IWM will still be a bit ahead of the SPX in its wave count, as the SPX would only be completing wave iv of wave 3 of [3].

However, as the SPX rallies off its wave iv support to complete wave 3, I am expecting the IWM to rally alongside the SPX to complete its wave i of wave 5 of [3]. While the IWM will still technically be ahead of the SPX even at this time, at least the two indices will likely be moving in lockstep and the IWM will begin to rally again rather than simply move sideways.

So while the SPX will complete its wave 3 in the next rally phase, and the IWM would complete wave i of 5 of [3], both would then pullback with the SPX pulling back in its wave 4 of [3], and the IWM pulling back in its wave ii of 5 of [3]. What that likely means is that when the SPX begins its wave 5 of [3], the IWM will have begun its wave iii of 5 of [3]. You really will need to look at the charts side by side to understand what I mean.

What I can glean from this information, should the wave structures align in this manner, is that the IWM will likely see a more protracted, and potentially deeper, wave ii of 5 of [3], as the SPX will likely be pulling it down during its wave 4. However, it also would suggest that the SPX will not likely see much of a wave ii of 5 of [3] itself, as the IWM will likely be within the heart of its wave iii of 5 of [3], and likely be pulling the SPX up along with it. So, again, whereas it would suggest that the wave ii of 5 of [3] in the IWM may be large and deep (to coincide with the SPX wave 4 of [3]), it is likely that the SPX wave ii of 5 of [3] may be rather small and potentially relatively non-existent as the IWM will likely be pulling it higher..

The other alternative I am tracking in the back of my mind is that the SPX completes wave v of 3 as an ending diagonal, and this pullback is a 2nd wave in that ending diagonal. I really do not want to entertain this potential until I am absolutely forced to do so, but I want to at last bring it to your attention. (No, it is not on the chart just yet as there are even two ways the ending diagonal can take shape, and it would be much too confusing to try to add it into the chart right now).

Under either scenarios, I am still expecting the SPX to rally over 4300 (with an ideal target in the 4440SPX region) for wave v of 3. And, in either of the two scenarios I mention above, I think it gives us a much better chance at getting to the ideal target in the 4400SPX region in the coming weeks without the need to larger extensions, as I have been noting of late.

So, I think we will likely have our answer tomorrow as to how the SPX and IWM will finally re-align, which means there is plenty of opportunity left for us over the last half of 2021. And, please remember that this is a bull market, and as long as we hold over the 4095SPX bigger degree support, that is how I am treating it.