Several Paths to 4400SPX

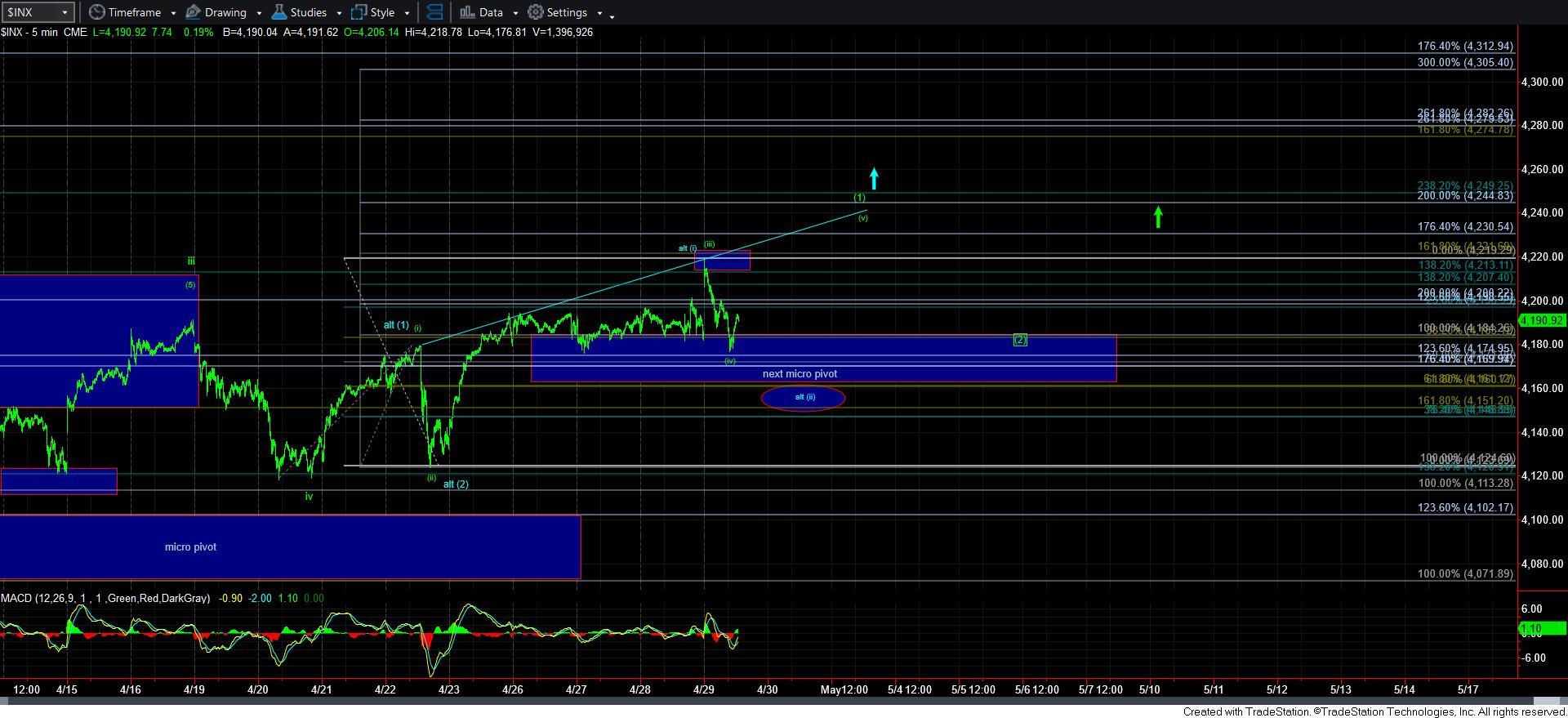

Today started out rather well, with the market gapping up exactly to our next target for wave [iii] of [1], within wave v of 3. However, the decline off that target dropped a bit further than I wanted to see in the ideal structure. After completing wave [iii], we really should have held the 4185SPX region for wave [iv] in a standard Fibonacci Pinball structure. But, since we did not form that structure, we have to ask ourselves what the market is trying to do in here?

Let me start by again referencing that this is a bull market and our glasses should be bullishly biased when we view the market structure. Therefore, I have two patterns I am tracking which point us to the 4400SPX region.

In the primary count in green, I am viewing this wave [1] as a leading diagonal. While I do not like leading diagonals as trading cues, it does make sense in this instance. But, I am still going to need it to prove itself to me with a completion of wave (1) in the 4230-50SPX region, followed by a corrective wave [2], which should hold our micro pivot, followed by an impulsive rally through 4250SPX. That will strongly suggest to me we are in the next melt-up phase within this wave 3, which would be pointing us towards the 4400SPX region.

The alternative on our chart is presented in blue, and that would suggest that we are developing a [1][2][i][ii] structure for wave v of 3. And, should we see a direct break out through 4250, then this would be the operative count pointing us to 4400SPX region sooner rather than later. But, take note that there is potential this alternative can point down as low as the 4145-60 region.

Lastly, if we should see a break below 4140SPX, then I would have no choice but to go back to the alternative in yellow, presented on the 60-minute chart. But, I want to make it clear that this is still an alternative to an alternative, and not anywhere near my primary expectation. Yet, I am keeping this in the back of my mind for now.

In summary, until the market sees a break out through 4250SPX now, I think we can still see more whipsaw action. The manner in which the market reacts between here and 4250SPX will provide us with a much clearer picture of the path to 4400SPX. My preference for now is still green, but the break of 4185SPX has certainly shaken my confidence in that potential, as it is now only a leading diagonal set up.

Under all circumstances, we should always focus on the fact that this is a bull market with much higher levels still likely to be seen in 2021, with a minimum target of 4600SPX within my expectations.