Setting Up The Next Breakout

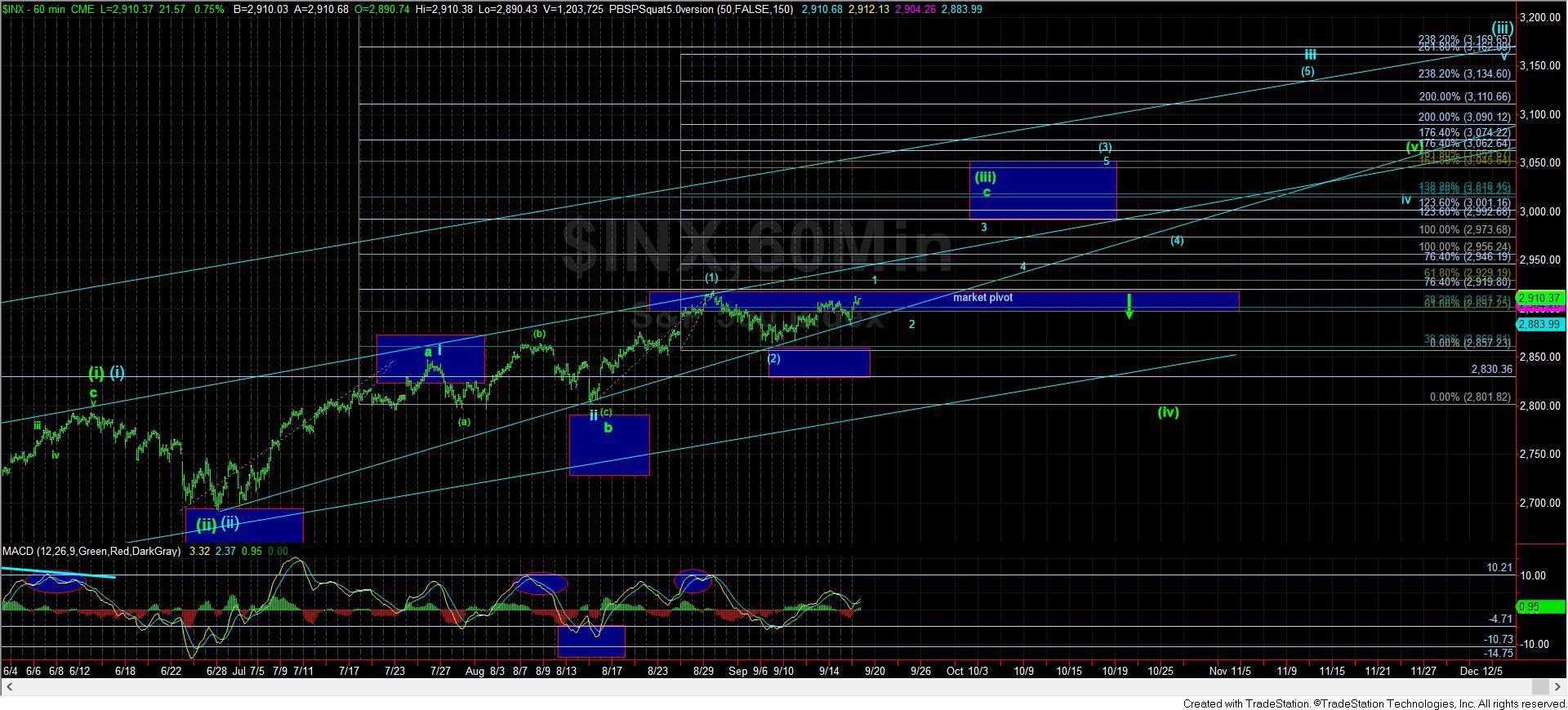

After I posted the daily market update yesterday afternoon, the market indeed dropped lower and, overnight, tested the 2880 region on the S&P 500 (SPX). Thus far, that support has held, and as I noted over the weekend, if we are able to hold that level, then we are setting up to rally to 2980.

As you can see from the attached 5-minute chart, it still seems to be completing the leading diagonal for wave 1 of (3), with yesterday’s pullback best counting as wave iv in wave 1. What we need to see is the market testing the prior highs, or even exceeding it a bit to complete wave 1 of (3). I would then like to see a pullback down towards the wave (2) support box before we break out towards the 2980 SPX region in the heart of wave (3).

One thing you should take note of is that at this point in time, we can move support up to the 2880 region. At this point in time, I would not want to see us breaking below the 2880 support, even for wave (2).

So, as I posted in an update during the day, 2880 on the SPX is now our upper support, with 2830 as our lower support. Our resistance is 2922-2930, which should contain price for wave 1 and keep pressure down for a wave 2 retracement, which should be relatively shallow. The next time we break out through 2930, support is moved up to 2922, and we should be on our way to 2980.