Setting Up For More Upside

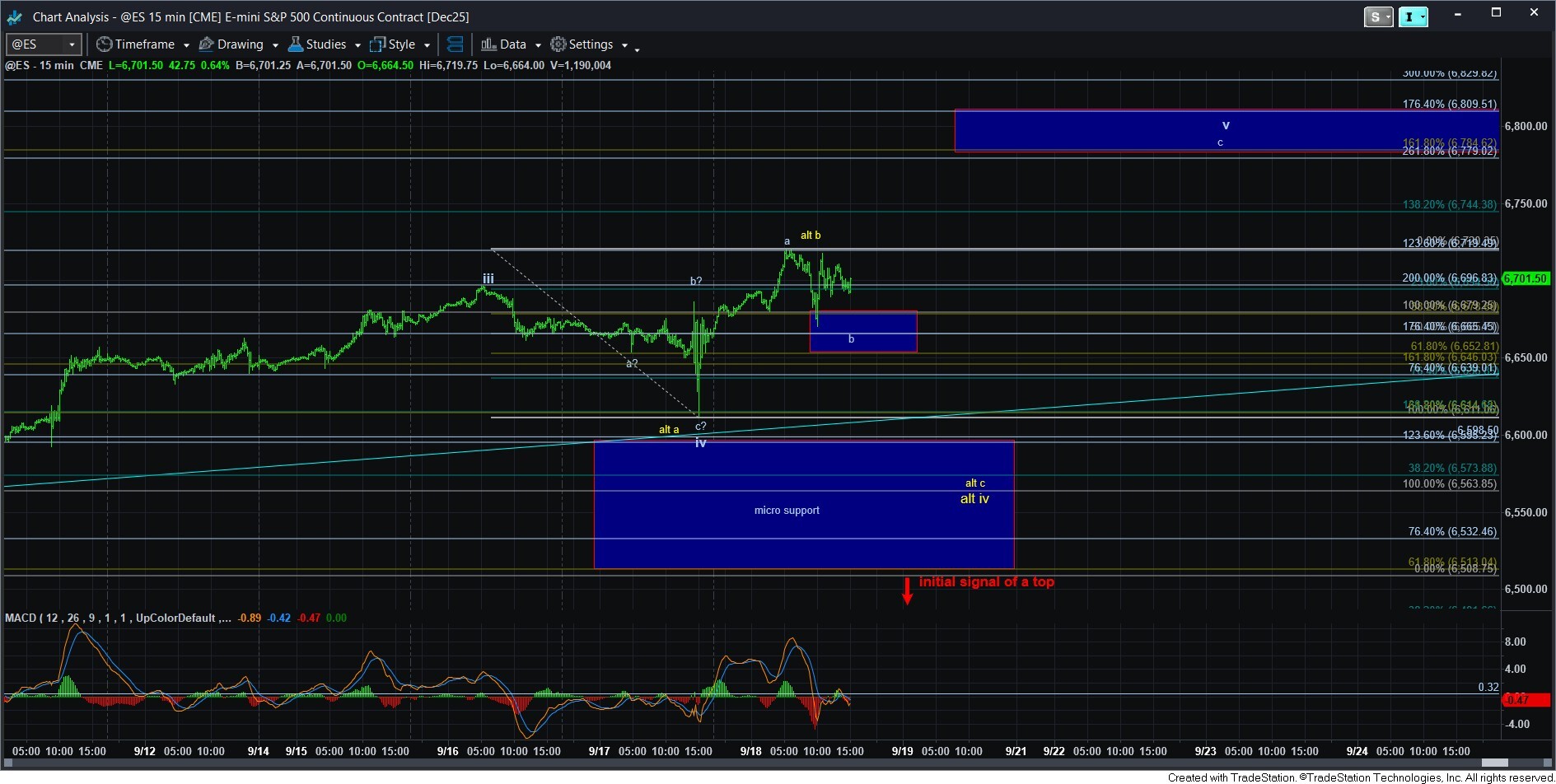

With the market holding over support yesterday, it did disappoint me in that it did not provide us with the typical overlap of waves i and iv within a diagonal, as it came up a few points short of the support box (which begins at the top of wave i). So, this provided a teachable moment for me today, as I outlined the following:

“I have added some "color" to the chart for the alternative. When a main wave - such as wave iii in this case - does not reach its ideal target, sometimes we see the corrective b-wave in the ensuing correction strike the target that was missed. That is my alternative. But, should we break the b-wave support box, it increases in probability.”

So, the analysis is quite simple. As long as the b-wave support box holds, and we then rally over the overnight high, we should be on our way to our next target overhead. But, should that box break, then I have to assume that we are seeing that expanded flat for wave iv, which will then set us up to begin wave v.