Setting Up A C-wave Down

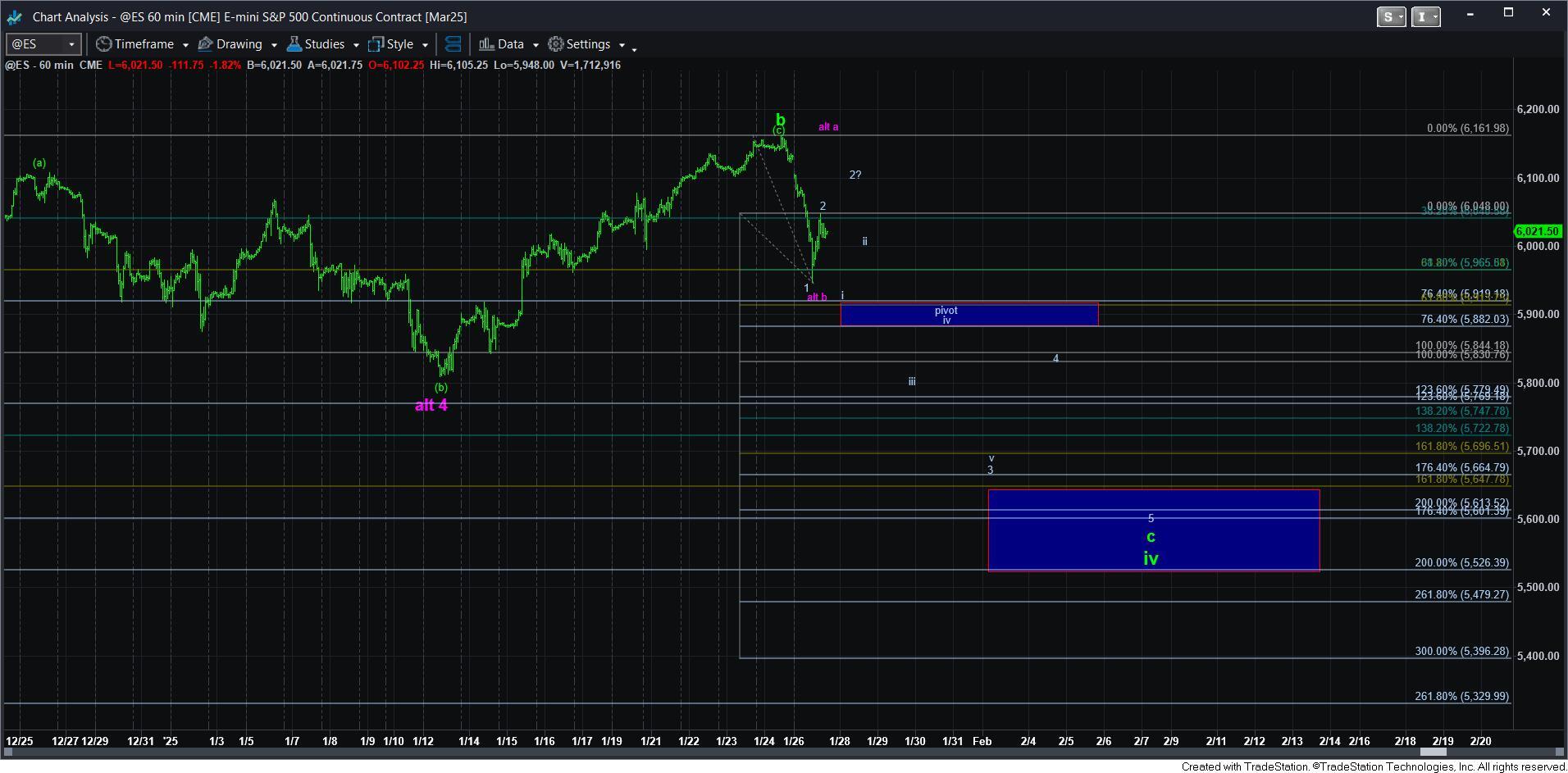

As we have been trying to follow a primary wave count which suggests that a wave iv in an ending diagonal is taking shape, we were missing a c-wave down to complete that structure. With today’s drop, the market may be providing us with a 1-2 set up to point us down to our wave iv support box below.

But, in order to make this a much higher probability set up, I would suggest waiting for the 1-2, i-ii set up, which I have outlined on the attached 60-minute ES chart.

As it stands now, the market MAY have the 1-2 in place already. Keep in mind that the wave 2 may even attempt to push higher one more time. But, what we want to see is wave i of 3 taking us back down towards the overnight lows in a 5-wave structure. Should this be seen in the coming day or so, then we would have a nice 1-2, i-ii structure taking shape, for which some of you may choose to short the wave ii bounce, with a stop at the wave 2 high. This is a lower-risk, higher probability set up for a decline to the support box set up below the market.

But, again, I want to remind you that if we see this 5-wave decline for the c-wave of wave iv, it would be a lower risk long opportunity. Our primary count is pointing towards one more rally in 2025, specifically because we have not seen the standard signal most often seen after an ending diagonal completes. Therefore, I have surmised that the ending diagonal has not actually completed yet, and one more rally can be seen.

For now, I am going to patiently wait to see if the market will provide us with this 1-2, i-ii downside set up. And, if we do follow through below the pivot, that pivot will then become our resistance on the wave iv of 3 bounce I would expect to see after we break down below the pivot. Otherwise, we will have to take the purple path into greater consideration.