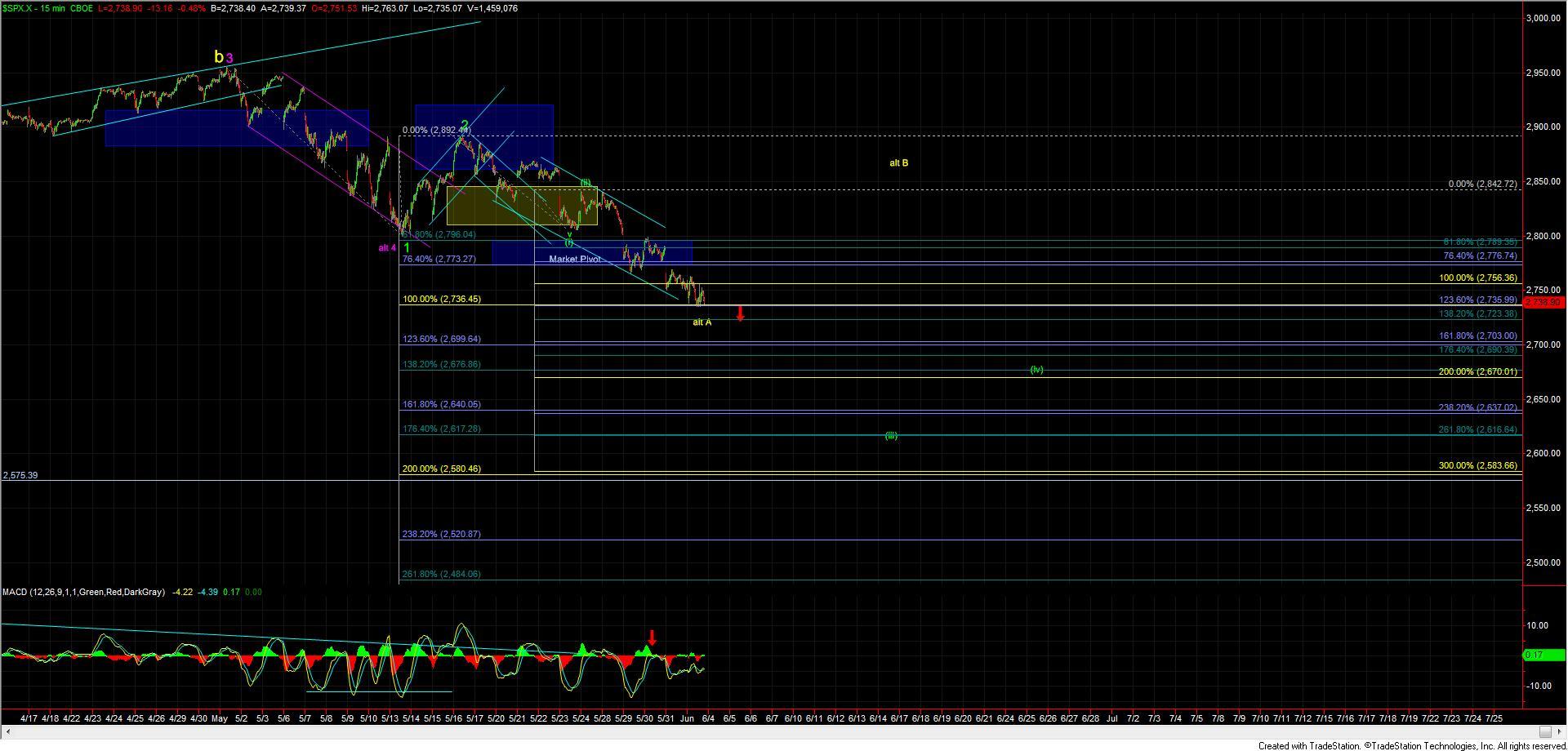

SPX Testing Key Support

After seeing downside action in the overnight futures market, the SPX opened relatively flat and tried to break higher in the early part of the morning session. This break higher was short-lived, however, and within the first hour of trading, the SPX had moved lower making a local bottom just over the 2735 support level that we have been watching for the past several weeks. The first attempt to crack this support level failed, and the SPX bounced higher only to be sold off again just before lunch. We hit that 2735 level again several times during the lunch hour and just after but as of this writing have yet to make a sustained break of that level. The continued probing of this level today is telling us that we have been tracking the correct Fibonacci levels and gives further confidence in the importance of this level.

So as of the time of this writing, we still have both the green and the yellow paths in play, and we will continue to watch that 2735 level as a key pivot to the downside. Should we break through that level then I would want to see further confirmation that we are indeed following through under the most immediately bearish green path with a break of the 2723 level. If the market is unable to see a sustained break of these levels to the downside and alternative moves back up through the 2776-2789 zone it would signal that we are not following through on the green path and are likely going to see that more complex pattern to the downside develop.