SPX Played Catch Up Today

Yesterday afternoon, I closed my analysis with the following:

So, we will need a bit more patience, as the market may still attempt to extend a bit more before we begin wave (4). While we certainly can count enough waves in place if the market chooses to break down sooner rather than later, I think patience is going to be the key right now, as we allow the market to signal to us that it has exhausted itself to the upside . . .

While the IWM gave us that push up in its wave (5) of iii, and rallied approximately .6% today, the SPX clearly outperformed the IWM for the first time in weeks, where it rallied 1% today. I know it may “feel” like more than that, but all we saw today was a 1% rally in the SPX, so please make sure you place this move for the SPX in its appropriate context. Moreover, the IWM has still rallied approximately 7% off its mid-November lows, whereas the SPX has now taken itself up almost 4% off its November lows.

Yet, clearly, I did not expect the SPX to provide us with this extension today, but, it made a statement that it wants to catch up and provide its own 5th wave extension.

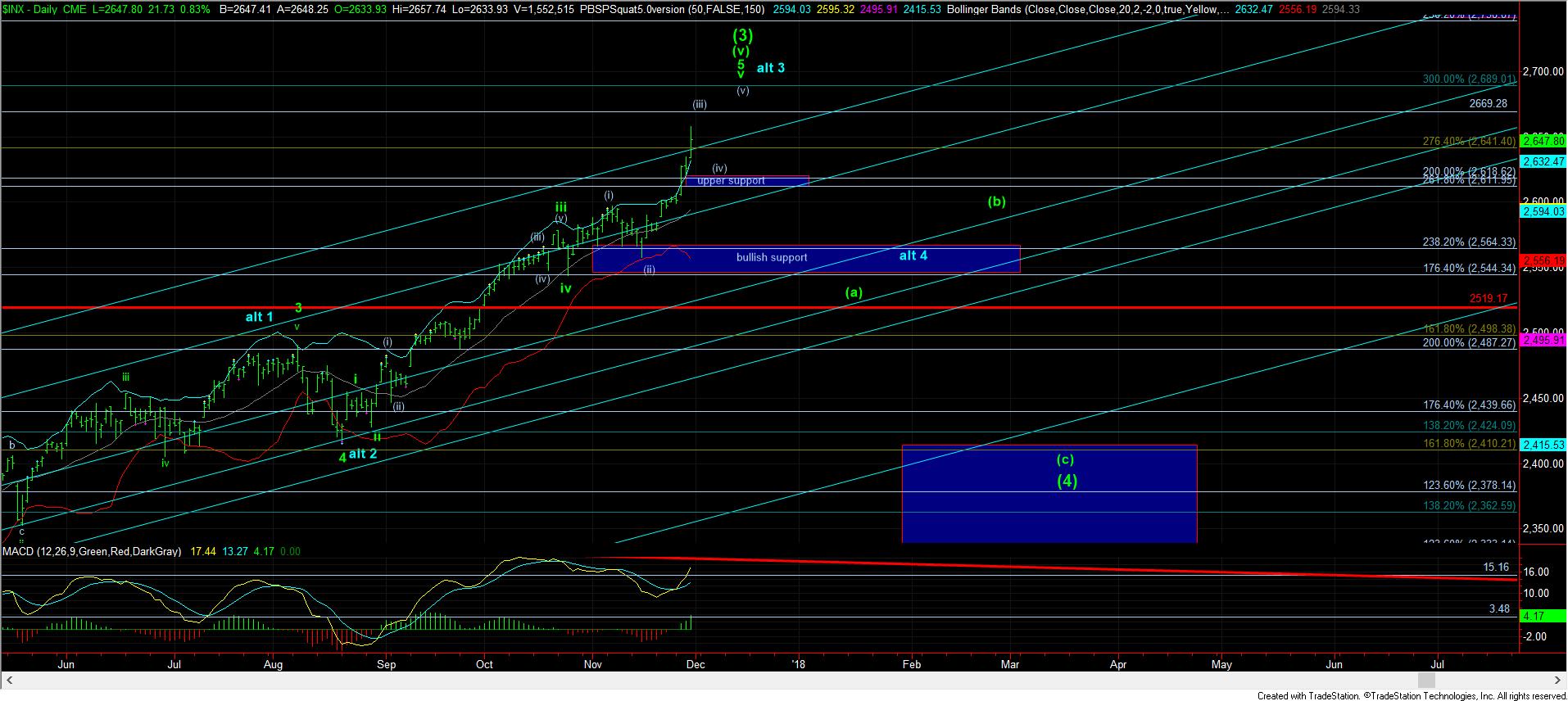

In fact, the market has now extended beyond my expectations for wave (3) which I set in 2015, which topped out at 2611SPX. And, this is where a certain amount of euphoria takes the stock market beyond extensions we normally see in these types of 3rd waves, as we have now extended approximately 2% of a 48% move beyond the target we expected back in February 2016.

Moreover, this is why I ALWAYS caution about shorting ANY market that is within a confirmed 3rd wave up, as extensions can often be seen beyond what we expect from standard expectations. This is why I ALWAYS provide support levels which provide signals that the current rally has likely run its course. And, until such time, it is hard to look down aggressively in a strong bull market.

But, simply because the market has extended a bit beyond where our standard expectations suggested back in 2015 does not mean that the entire structure is to be ignored within its usual progression. In other words, simply because wave (3) has extended does not mean we will not see a wave (4). The last time I checked the numeric order I learned as a child, 4 follows 3. But, as I noted, we have to be patient as to where 3 completes. And, as I have been saying for weeks, I will not be able to consider any form of top in the market until the IWM completes its 5 waves off the mid-November pullback low of 144.50.

So, in following the IWM, we will need to see a strong break below 153 in the IWM to suggest that we are in wave iv. But, until we are able to break that level, we have a micro structure that is still pointing up towards the 156 region sooner rather than later. Remember, this is still a bull market, and bull market rules should still apply.

In the SPX, as long as we remain over the 2620SPX level, we can also see a (iv) (v) similar to the IWM, as noted on my modified daily chart.

Lastly, as I have noted many times in the past, once wave iv does begin, as long as we hold the 150 region in the IWM for wave iv, I still have to expect a 5th wave rally before we complete all 5 waves off the mid-November lows in the IWM. So, it is quite possible this market attempts to extend further towards the end of December before we complete this 5th wave of (3).

Moreover, it would also suggest that the market could be setting up in a similar manner in which we saw back in late 2015 into early 2016, which set up a global melt up in many assets (including emerging markets and metals), for a significant portion of 2018.