SPX Makes a New High but Fades Quickly

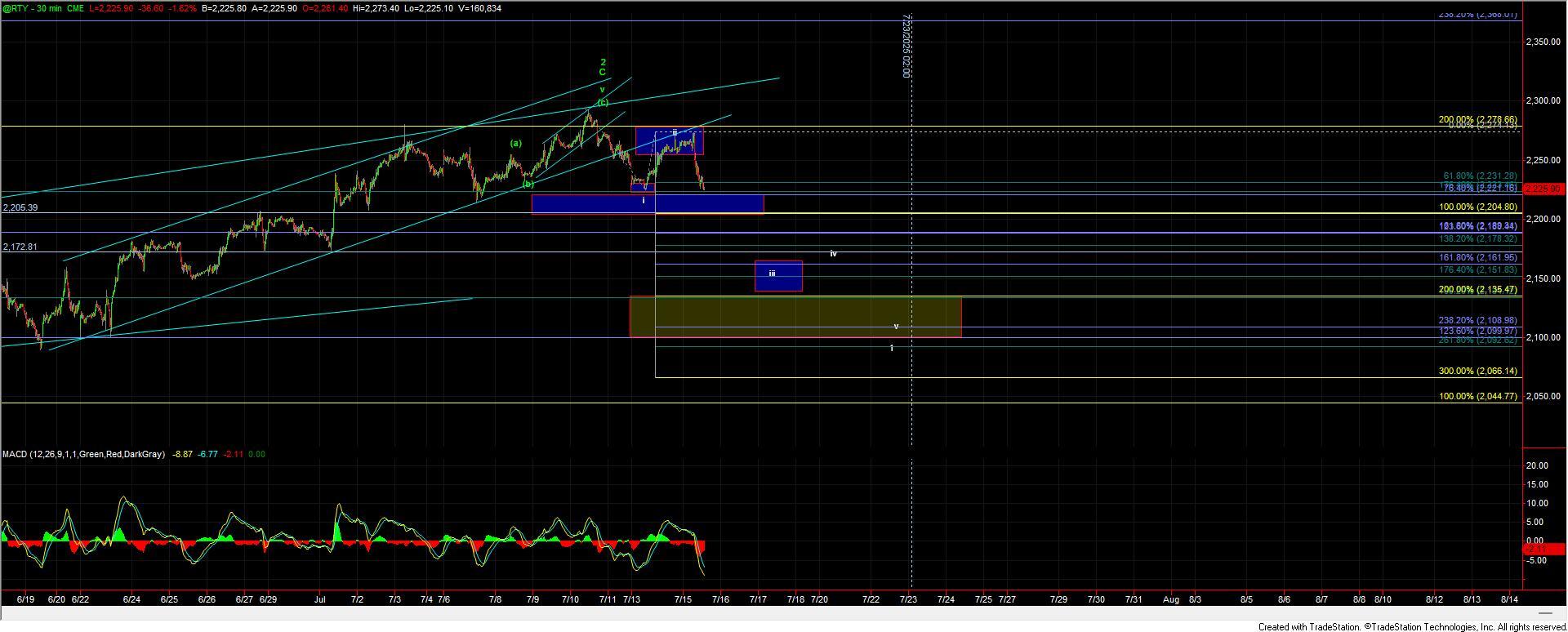

This morning, both the SPX and NDX pushed to new highs, only to fade lower rather quickly. That new high provides the potential for a more fully extended count, continuing to stretch this market to increasingly extreme levels. Meanwhile, the Russell 2000 has already started to break down, dropping sharply below the lower trend channel I’ve been monitoring. That break offers an early indication that at least a local top may be in place.

That said, both the SPX and NDX remain above key upper support, and until those levels are broken, we cannot confirm that a top has been struck.

From a wave structure and support perspective, not much has changed. I’m now watching the 6260 level on the ES as an early indication of a possible local top, with the 6185–6135 zone below continuing to serve as key support. Should those levels give way, my focus will shift to the broader SPX support zone at 6064–5929.

So, while we’re seeing early warning signs of a possible top, I still need to see confirmation via support breaks, particularly on the SPX chart, before making any definitive calls. Until then, caution remains warranted in this region, but we must respect the potential for further upside extensions as long as key support holds.