SPX Extending Higher & Still Trading Over Support

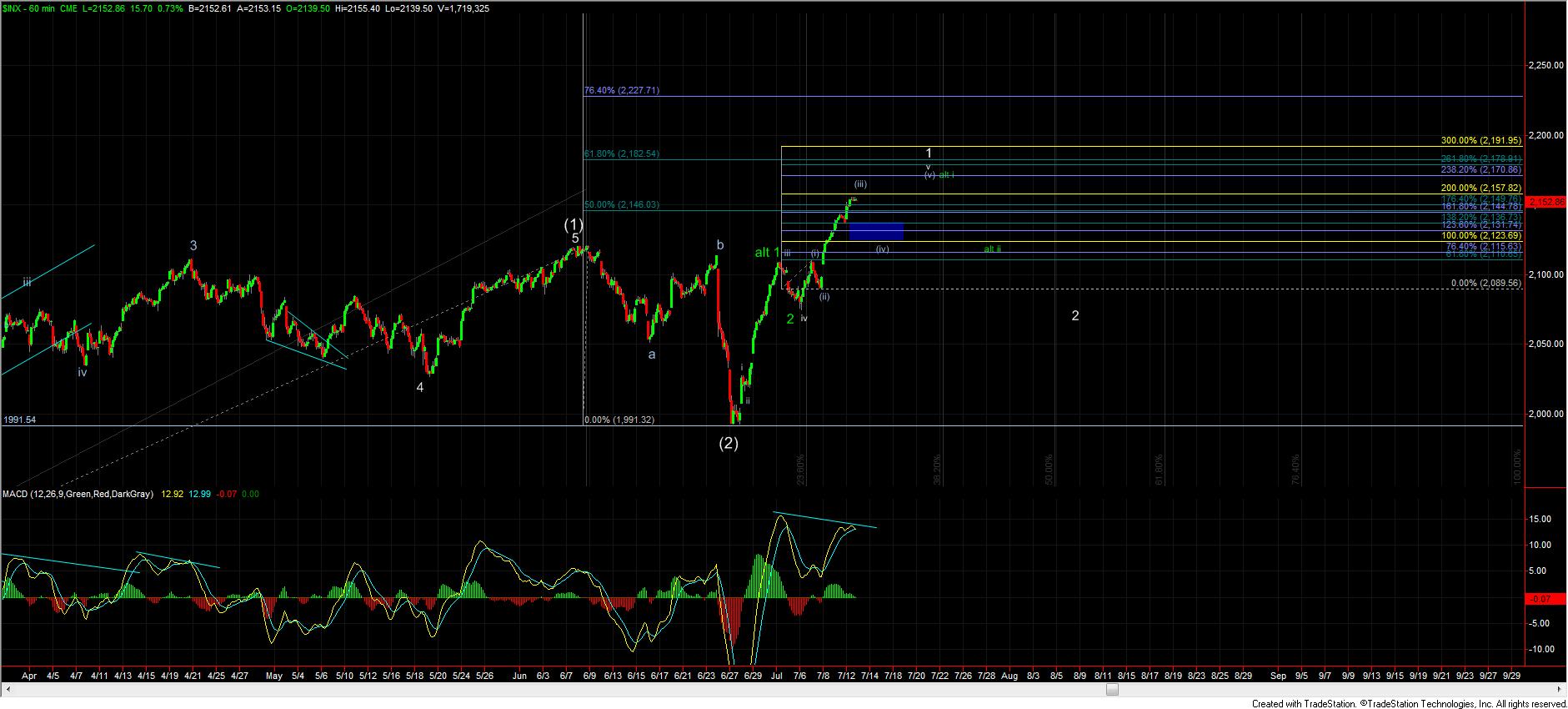

Today we saw a continued move higher of what I am still preferring to count as an extended wave (iii) of v up off of the 1991 low. This leaves the analysts as posted at the close yesterday relatively unchanged with the exception that I am moving the support level up for wave (iv) which now comes in at the 2136-2123 range.

So with that my base case remains that this move off of that 7/6 low as part of wave v of 1 which is shown in white. Under this case we still do not have confirmation that we have indeed topped for wave (iii) of that wave v and are now closing in on the 200 extension of that move up off of the 7/6 low at 2157. Current support for wave (iv) of v under this impulsive case comes in at the 2136-2123 range and as long as we are over this support zone we should still should ideally see another move higher finish off wave (v) of v of 1 up. A break of this support zone would be the initial signal that we have indeed topped with further confirmation coming with a break back under the 2110 level.

Now should should we complete a full 5 wave impulsive move up off of the 7/6 low as described above it would certainly be possible to consider this a 1-2 i-ii up off of the 1991 low as is shown in green on the chart. Under this case we would still be looking for a local top soon but would then expect to see much more shallow retrace for the minor degree wave ii vs. the larger degree wave 2 as is shown in white. This green count is not my primary count at this time however with these continued extended moves to the upside it is certainly on my radar.