Risk Management Reminder - Market Analysis for Nov 30th, 2022

I have made it no surprise or secret that I have a problem with the market having completed its top at the end of last year. I have reiterated many times that the structure of the rally into that high did not seem complete to me, and I still stand here today with the same issue.

However, I also noted that if the market did not provide to us a CLEAR 5-wave impulsive structure off the low that adhered to standard Fibonacci Pinball structures, then I was going to have no choice but to treat the market as having topped FOR RISK MANAGEMENT PURPOSES. While I still think there is a strong potential for the market to reach a new all-time high, I cannot say so with a high degree of confidence or probability due to the lack of a standard Fibonacci Pinball 5-wave structure off the October 13 low. Of course, we may have diagonals that can take us there, but that is not reliable enough for me, so it may not be reliable enough for many of you.

To that end, I have also noted that the downside structure of the market since we topped a bit over 4800SPX has been quite overlapping and uncertain. While we have caught most of the turns, I cannot say that the pattern to the downside has been terribly clear. So, now that we are approaching our MAJOR MARKET RESISTANCE region overhead, it is again time for most who are risk averse to raise some more cash, as I outlined in my live video this morning for our entire main-room membership.

With that being said, I still think there is a strong potential that the next pullback will be corrective and will hold the support box we have noted below on the 60-minute SPX chart. And, if see a solid a-b-c corrective structure pulling back into that support box, we can always begin to redeploy the cash we raised this year, as I outlined in my live video this morning.

But, for now, we are approaching another high-risk point in the market. At this time, I have no assurance that the market will pullback correctively and hold the support box below, despite my expectations. But, what I do know is that I will not have another chance to raise cash in this region if I am wrong . . well . . not until we see a multi-year corrective rally from much lower levels. But, who wants to go through that pain? So, again, I think it may be prudent for those that are risk averse to consider raising some more cash as we approach our MAJOR MARKET RESISTANCE box.

Now, as I noted in a post I made towards the end of the day, there is an alternative path that can take us more directly to the 4300-4500SPX region. And, I have outlined that in blue on the attached 5-minute chart. It suggests that the [a][b] structure is done with a high consolidation, and that this is wave 1 of the [c] wave already. But, due to the overbought reading on the daily MACD, I cannot say that I see that path as a high probability at all at this time. So, again, I think it is prudent to consider raising some more cash. Should the market pullback correctively, and then rally back over the high we strike in the coming days, then we can always move back into the market for the rest of the [c] wave which would likely point us to the 4300SPX region.

Now, with all that being said, I want to note that I am still seeing signs of continue risk-on for this market as we look into 2023. First, as we know, we are trying to track a 5-wave initial rally completion in the metals complex. And, if that tops out over the coming days/week and completes a 5-wave structure off the low, we will be looking for a corrective retrace to set up a major metals rally into 2023.

Moreover, today I saw something quite significant in the EEM. We seem to now have a relatively clean 5-wave rally off the recent lows as well. While the 5th wave can still push a bit higher, as long as the resistance noted on the 60-minute chart is maintained, and a corrective pullback begins, we can have a 1-2 set up for a major rally in 2023 in the EEM as well.

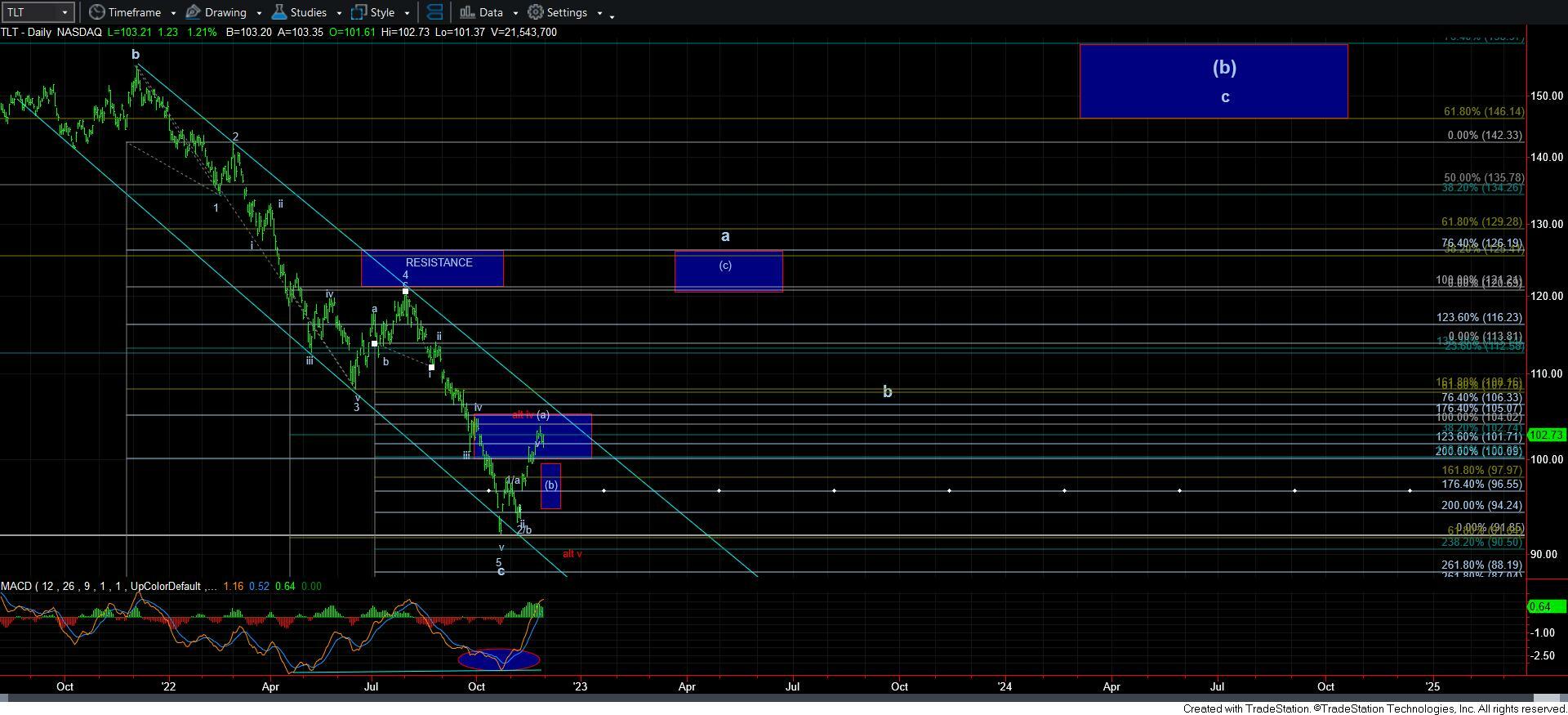

This next brings me to the TLT chart. And, as you know, we are looking for a sizeable rally in the TLT into 2023 as well, albeit as a corrective rally. But, even so, that corrective rally is potentially quite substantial.

Furthermore, I have to again note that there are so many extremely oversold stocks, many of which are in the tech sector. And, many of these stocks can more than double from where they currently reside, even if they only see a .382 retracement of the declines they experienced in 2022.

So, while I am trying to get you to focus on risk management as we approach our MAJOR MARKET RESISTANCE, if the market provides us with a corrective pullback in the coming weeks/months, then we can always redeploy that cash for the potential risk-on signals that we may seeing across many markets. But, my point is that, at least for now, risk has risen.