Recognition of Risk - Market Analysis for Mar 31st, 2022

I feel like I am beating a dead horse with this already, but I have to say it over and over again to make sure people understand where we are in the market.

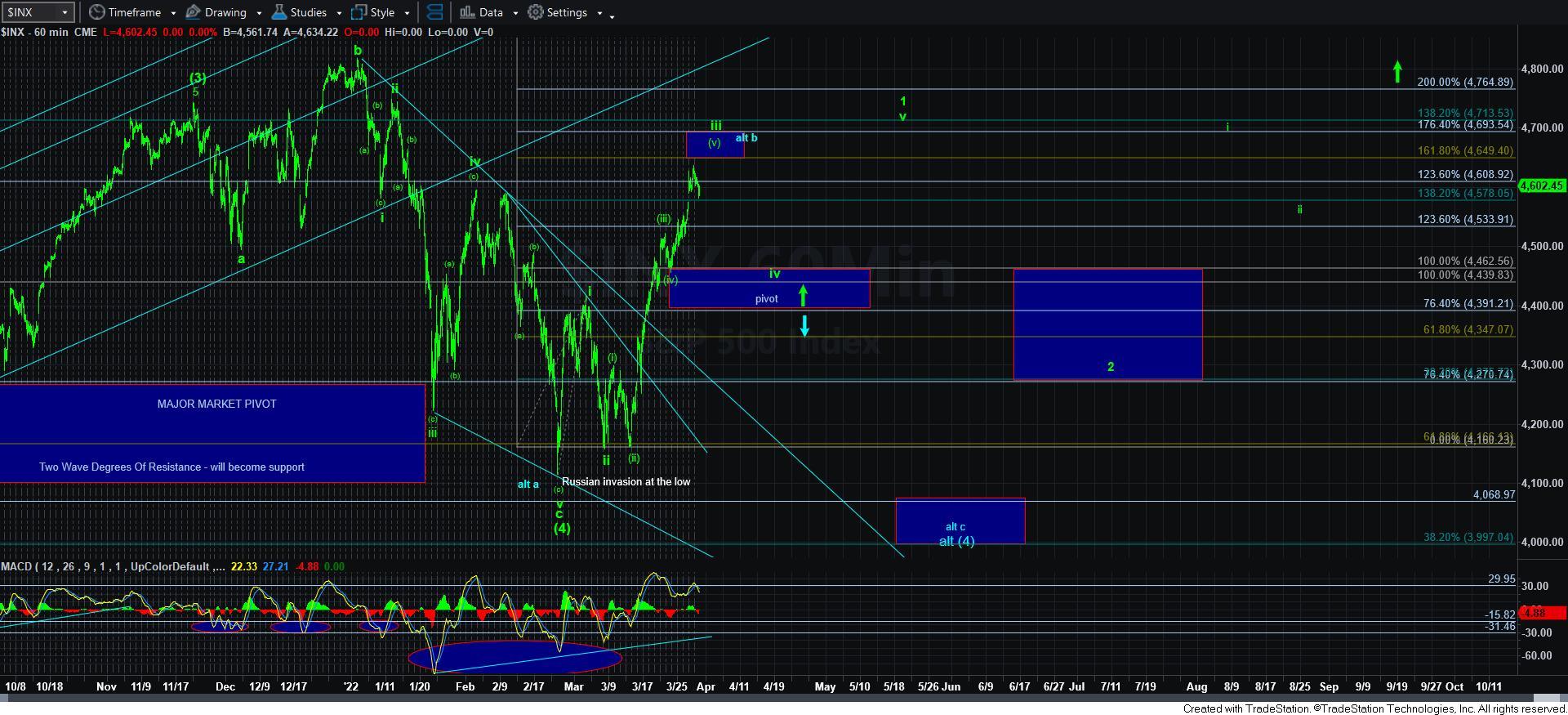

We have now traveled 500 points off the February 24th low. We have gained 10% off the lows. And, the market has been on an absolute tear.

My ideal target for this segment of the rally has been 4650SPX. We have come within spitting distance of that. Can we still extend as high as 4690SPX in this move up? Yes. But, one has to recognize where the risk/reward resides in the market.

You see, my expectation now turns towards greater downside potential than upside potential. My general target for downside in the bullish scenario is the 4460SPX region, which is the 1.00 extension of waves i-ii, and the general target for a 4th wave pullback.

Again, until we actually see a corrective pullback that holds that support, and then get a 5th wave higher high, I cannot be certain that wave [4] has completed. The main reason is that we did not get a standard 5-wave Fibonacci Pinball structure for the c-wave down, which has left me with questions. Therefore, the blue alternative still remains on the chart. But, unless we see a CLEAR 5-wave decline below 4460SPX, that is all it is . . an alternative.

But, please again recognize that if we get down there and break down, you won't have the opportunity you now have here near the highs of this rally. The opportunity I speak of is that some of you may want to reduce risk by either raising cash or hedging your positions.

The next few weeks to few months the bulls and bears are going to battle it out. Even in the most bullish case scenario I have on the 60 minute chart, we will likely see buying opportunities well below where we now reside. And, again, that is in the best case bullish scenario, as even wave 2 has potential for a very deep drop.

So, the reason I am writing this to you now is that we are still near the highs and you can make determinations now as to your own risk profile. The market is about to go to battle . . maybe you want to choose to remain outside the battle zone and simply view it as a spectator.