Quick Update - Market Analysis for Feb 25th, 2025

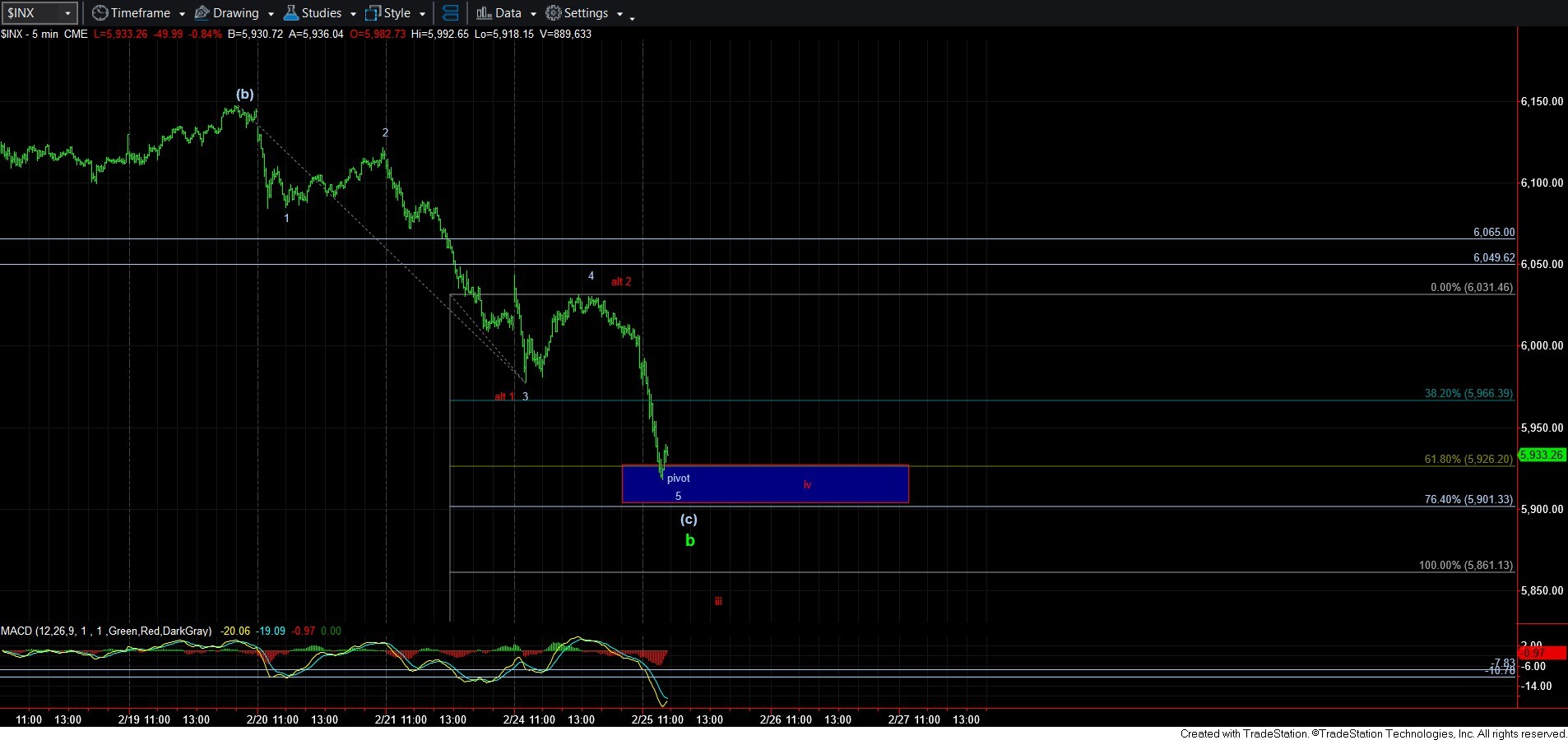

The market is now hovering around the main support in the 5923SPX region. So, I wanted to send out an update to everyone.

As it stands now, I cannot say that I am confident we are about to break down in a direct fashion. First, the ES is showing positive divergence. The SPX 60-minute chart MACD is coming into prior support. And, I can count this as a 5th wave of a (c) wave in the wider b-wave I mentioned as an alternative yesterday.

I also posted this as an alert in the full service not too long ago:

"We are at key support right now for this pullback. Take note that the micro structure presents us with a pivot that SHOULD hold if this is a b-wave bottoming. However, if we get past the pivot - which represents the 5th wave being .618-.764 the size of waves 1-3 and a maximum standard expectation for a 5th wave), then it suggests we could be breaking down in a bigger move - at least as long as the pivot then holds as resistance. . . .

While I still prefer the (c) wave 5-wave structure I am presenting here . . . it only holds true if the pivot holds. But, if the pivot breaks, there is enough extension down to consider an alternative wave 1 in red. And, then a break of the pivot would be a wave iii of 3, and as long as the pivot holds on the bounce thereafter, then it is viewed as a wave iv in red, with expectation that we continue much lower.

Overall, this pivot will be rather important over the coming day or so."

So, for now, we are holding support as long as this pivot holds on the 5-minute chart. A break down of that would open a bigger decline scenario. Try not to get whipsawed, as the 3-wave moves we have seen cause much greater volatility, variability, and uncertainty, of which I have been warning for some time.

Lastly, for as long as the market continues to remain over the bigger support box on the 60-minute chart, I have to give the bulls the benefit of the doubt due to lacking the clear indication that this larger ending diagonal has come to conclusion.