Quick Update - Market Analysis for Sep 19th, 2024

I wanted to post an update this morning, as I clearly did not expect a direct break out as my primary count in the SPX. Rather, I expected more of a 2nd wave pullback first. But, as I outlined late in the afternoon, there was "potential" for this to occur, but it was not my primary count.

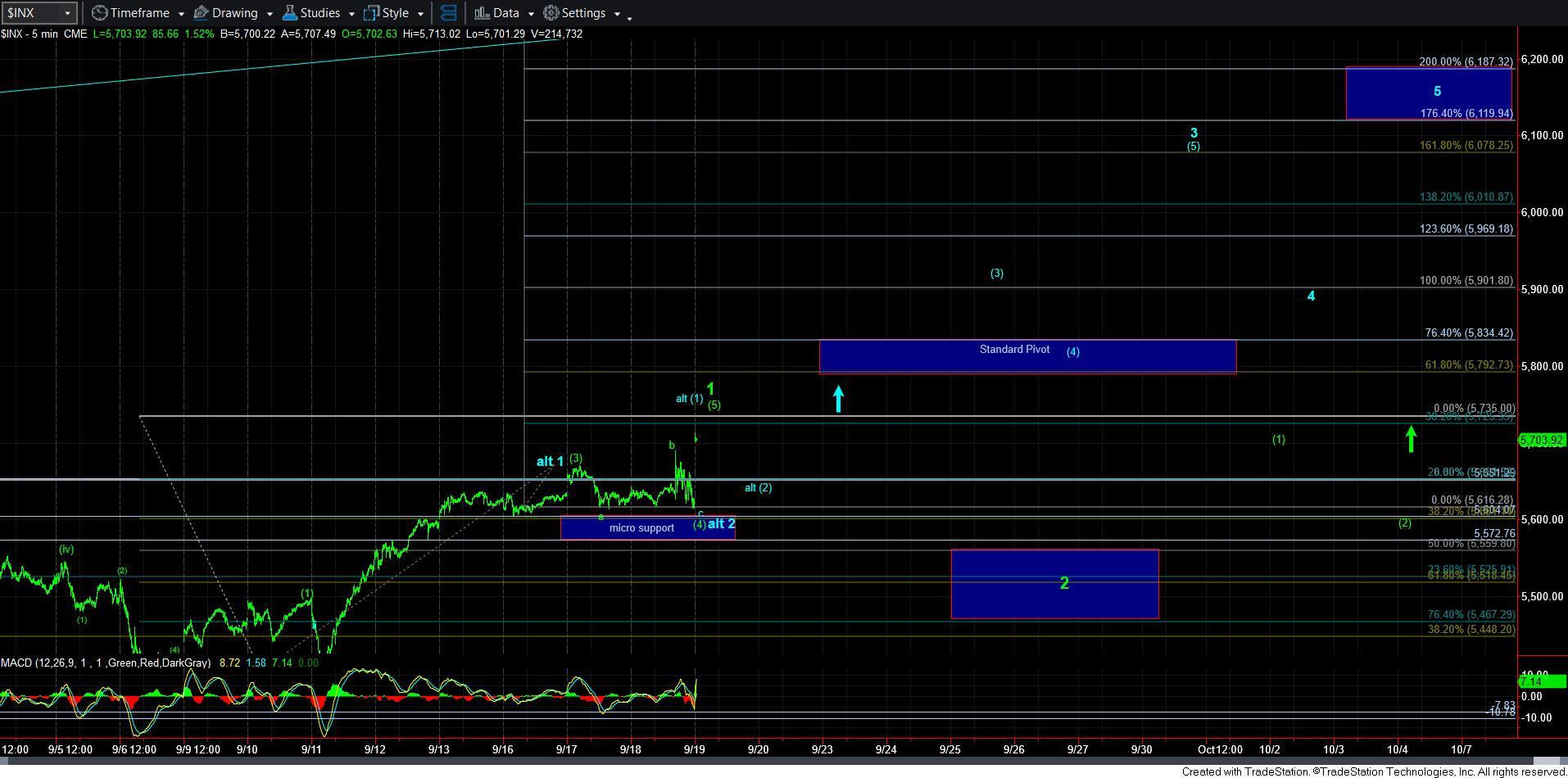

The action we have seen over the micro support was an a-b-c corrective structure, which, again, I posted about towards the end of the day. Now that we have broken over yesterday's high, I am going to be tracking two bullish counts.

The first is going to be the standard 1-2, which presents the a-b-c corrective structure over the micro support as a wave [4], with this being a wave [5] to complete the bigger wave 1. (And, yes, we still have that potential risk I mentioned about before about it being a bigger top, but I am not placing such a potential on the chart until I see other evidence).

The alternative count is more immediately bullish. That would suggest that the a-b-c is a corrective wave 2, but VERY VERY shallow for such a wave. That is the main reason it is my alternative.

Of course, the next pullback will tell the story. IF the next pullback is corrective and shallow, and we then rally back over the high we strike in this move off yesterday's low, then the market will force my hand in adopting the alternative in blue. I have added the path in blue overhead, if it should play out. It would mean that a (1)(2), followed by a break out over (1) would be projecting us to the 1.764-2.00 extension of waves 1-2 in the 6119-6187SPX region for this 5th wave.

However, if the market continues lower correctively into next week, then we simply have a much larger 1-2 structure developing, which will also likely project just north of the 6000SPX mark. Again, I am leaving this as my primary expectation for the simple reason that the alt 2 was just unusually shallow for a standard 2nd wave.

My apologies for not foreseeing this extension higher, but I do have to abide by standards, which did not point to this break out today.