Quick Pre-Weekend Update

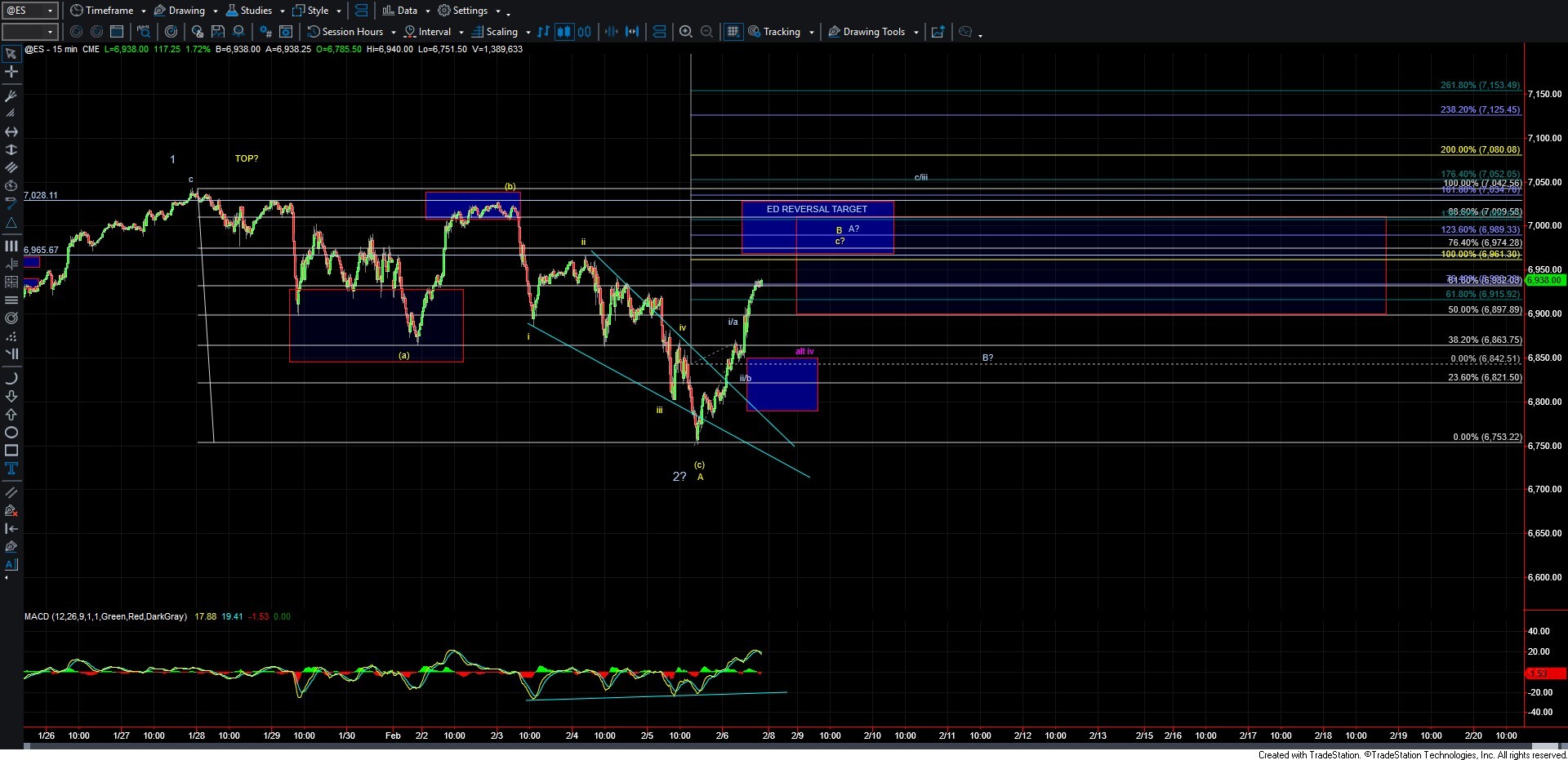

We are approaching the lower end of the Ending Diagonal reversal target zone at 6961–7028 and are now up more than 2.5% off the overnight low. As we move into this key target and resistance area, it would be reasonable to expect at least a local top to form.

Although ES did break the 6767 level, that break occurred outside of regular market hours when volume was low, and the cash SPX did not break the corresponding low. While not ideal, this does still allow the white wave 2 bottoming scenario to remain valid. With that in mind, the structure of the next move lower following a local top remains very important in determining whether we are following the yellow B-wave topping count or if the market is still attempting to push to new all-time highs.

If the pullback is corrective in nature, it would suggest the market remains on a path toward new highs. If, however, the decline begins with five waves down, it would open the door to a top being in place in the yellow wave B. Additional confirmation would still be required—specifically a break of support—which we can define once a top is clearly established. That said, a five-wave decline would be the first step toward confirming the yellow B-wave top scenario.

At this point, I am personally not leaning heavily toward either count, as I view them as fairly equal in probability. I will let the structure of the next pullback provide the guidance needed to determine which path the market is ultimately following.