Pullbacks Have Been Outlawed

Amazingly, the market is now pushing up into the market pivot’s that we have been tracking of late, and have not approached anything resembling a pullback. And, as I have been outlining, if the market continues through that 3400SPX region, then we will likely be well on our way to the 3455-80 region over the coming week or two.

To be honest, I really would still prefer a real pullback of note, yet the move through the 3385/88 resistance region is lower the probability for that potential. And, should we continue over 3400SPX strongly, then we have completed all the pullback we will get in these 2nd waves we have been tracking. At this point in time, we would need to break below yesterday’s low to provide evidence that a bigger pullback is still in the cards.

For now, I am leaving the primary count as is, but will clearly adjust it should we see that break out through 3400SPX.

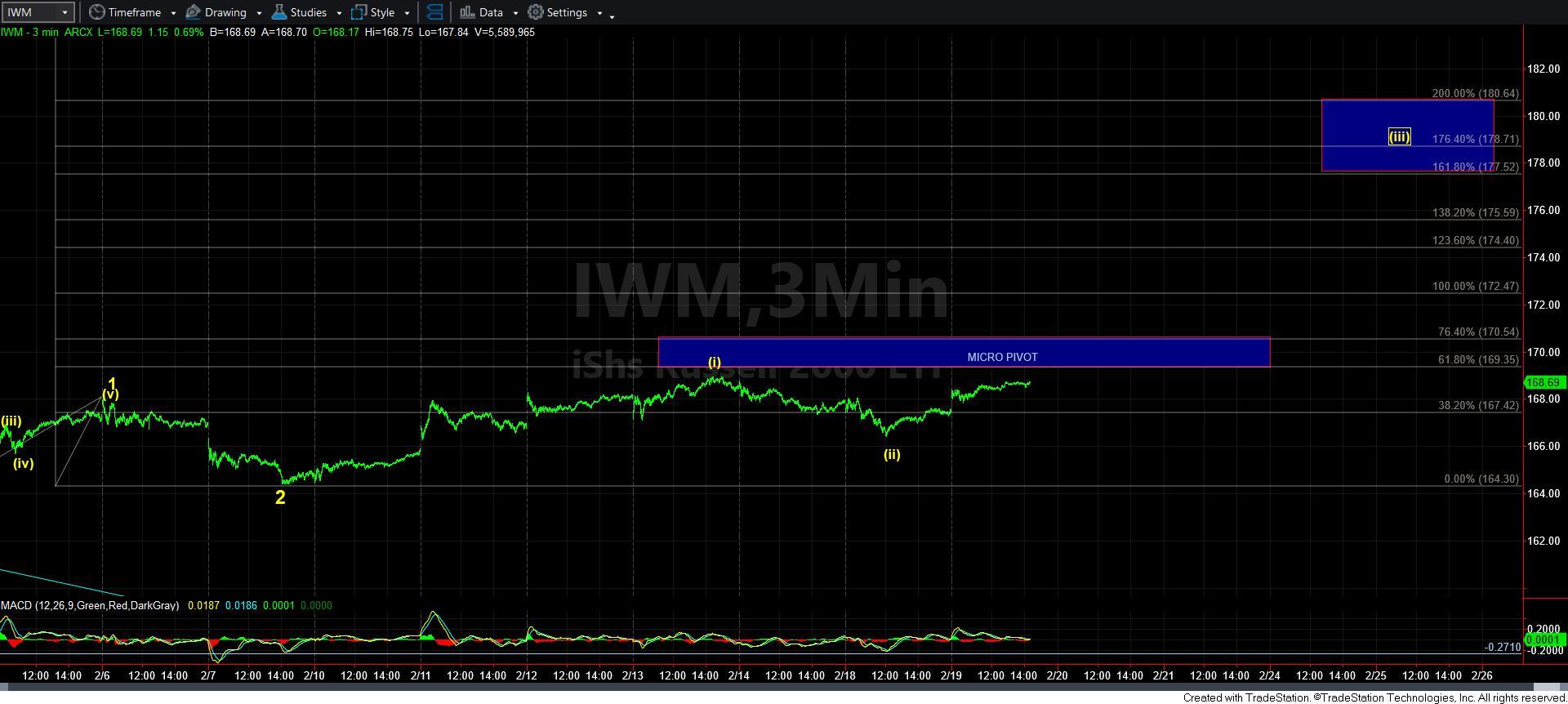

As I explained again in the live video this morning, if the SPX should break out, the chart we really need to watch is the IWM. If the IWM is going to “catch-up,” this is the time it is going to have to prove that. And, it means that we need to outperform the SPX over the coming weeks, and ideally target the 178 region rather quickly.

However, if the IWM is unable to provide us with that “catch-up” move, then it will be warning us that the b-wave we have been tracking on that chart, and the purple count I have recently added to my SPX charts may take the market by surprise.

At the end of last year, I noted that the first quarter of 2020 will not only provide us with guidance for the rest of 2020, but it can provide us guidance well beyond 2020. As we look towards the last half of this first quarter in 2020, it is even more true today.